Prior to the pandemic, most consumers didn’t pay much attention to the names of big pharmaceutical companies. But now that public health has been on the forefront of our minds for more than a year and a half, we’ve moved from indifferent to engaged.

Pharmaceutical companies are highly regulated but that didn’t stop them from spending $6.58 billion on advertising last year across B2B and B2C sectors.

Here’s a check-in of the latest trends and spending taking place in the pharmaceutical category.

Where are Pharma Budgets Going?

1. Search Dominates Digital Channels

As we’ll see in the data below, print is still a big channel for pharma companies, but even the most regulated of industries needs to spend big on digital.

Google receives about 1 billion health-related searches daily, about 7% of its searches. With this massive amount of intent data, it only makes sense that pharmaceutical companies invest heavily in programmatic ads using Google and Bing.

When comparing digital channels, more pharmaceutical advertisers bought Google SEM than any other social, display or programmatic network in the second half of 2020.

Though Google currently has the most advertisers, social channels are growing quicker.

2. Pharmaceutical Companies Become More Social

Advertisers at large are expected to spend $15 billion on influencer marketing by 2022—and pharmaceutical companies will play a big part in that.

Though they have to be more careful than the latest retail brand, influencers will be able to offer that ‘peer-to-peer’ advice that traditional pharma ads don’t convey.

In the last six months of 2020, eight new large pharma companies transformed their social strategy by placing both branded and unbranded Facebook and Instagram Stories ads. Companies like Novartis, AstraZeneca and Merck are expanding beyond conventional buys in order to reach younger generations where they are at.

Jessica Botting, director of social media at leading life sciences marketing agency Klick Health told AdAge, “The most important thing is understanding patients’ journeys to their core, and evaluating how your brand can make meaningful connections at each stage of the journey.”

It’s not just where the ads are being placed—the creative is changing too. Pharmaceutical companies are taking on a much more “familiar” or “human” tone in the pandemic.

The pandemic has brought on a huge potential for rebranding or building new campaigns for many, with a focus on how science can help people in their health journeys. (See Bristol Myers Squibb’s new ‘transformation’ campaign.)

3. DOOH

Out-of-home advertising is having a comeback with digital options now available.

According to Ciara Dundon, Associate Media Director at Greater Than One, consumer healthcare OOH advertising increased 777% between 2016 and 2018, and that number is only likely to rise as digital options become more advanced.

DOOH allows pharmaceutical companies to target buyers based on demographics, behavior and intent. Digital billboards grab more attention as they change regularly and allow for a creative range of content.

4. Consumer marketing outpaces B2B

According to MediaRadar data, there have been 2.2 thousand pharmaceutical companies advertising in B2B publications across print and digital formats, spending $693mm this year so far.

Comparatively, in the consumer market, 3.9 thousand companies have spent $3.2 billion across print and digital formats.

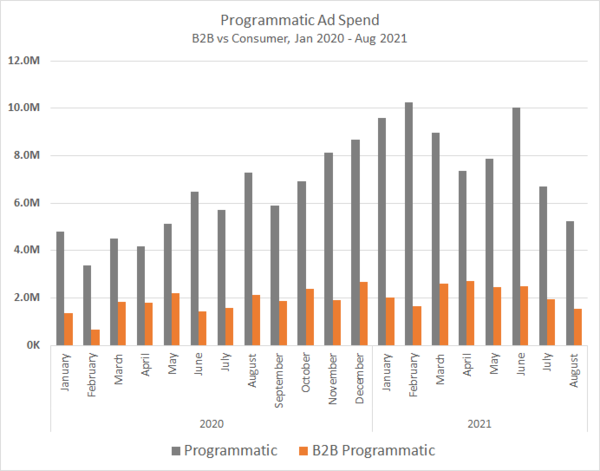

With Search and Social being two of the biggest channels, we analyzed programmatic ad spend across B2B and B2C.

Including Facebook, programmatic ad spend in the consumer pharmaceutical space adds up to $564.6mm (from January 2020 – August 2021.)

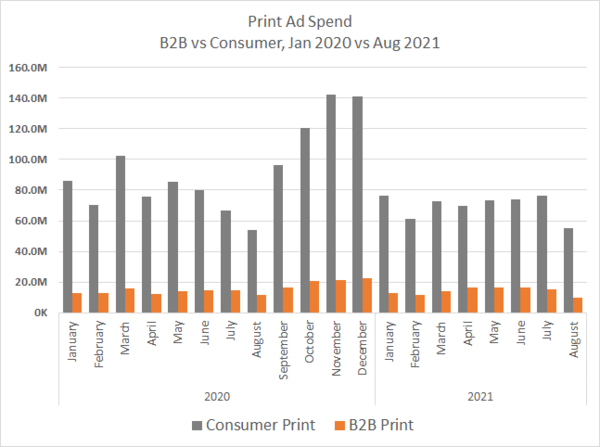

Even though digital is huge for pharmaceutical companies, print is still a huge investment.

Pharmaceutical companies spent $1.6 billion in print advertising from January 2020 – August 2021. Only $300 million of this was in the B2B space.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.