Note: This mall index focuses on 100 top tier malls and 100 outdoor centers across the country to understand the nature of the retail recovery.

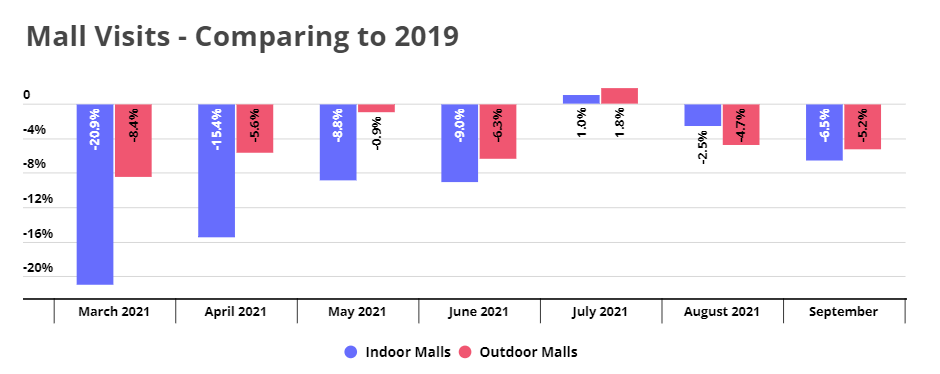

Top tier malls across the country had been experiencing a steady recovery since the start of 2021. This recovery culminated in July when visits to indoor malls rose 1.0% above the same month in 2019, with outdoor mall visits rising 1.8%. Pent-up demand, a lack of travel, general excitement around the retail reopening and more all combined with the Back-to-School retail season to drive an impressive month.

Yet, when we last looked at the Mall Index, visits had fallen off of their impressive growth pace with August returning to declines of -2.5% for indoor malls and -4.7% for outdoor when compared to August 2019. Rising COVID cases, a comparison to an early Labor Day weekend in 2019 and a return to school all contributed to limit the recovery and reestablish the visit gap.

But what did September bring?

Declines Continue

Looking at the Mall Index through September showed a further expansion of the visit gap, with indoor malls down -6.5% compared to September 2019 and outdoor malls down -5.2%. Rising COVID cases and the end of the unique confluence of factors that drove the summer visit surge all came together to expand the visit gap.

Yet, there are still very real reasons for optimism. The summer in general and July in particular benefited from a very unique mix of factors that boosted mall visits in the short term. The end of that unique mix was inevitable and the resulting decline in visits therefore something that could be expected. This ‘artificial’ July boost was clearly beneficial to retail, even if it made the sector appear somewhat ahead of where it really was.

In addition, while visit gaps returned in August and September, they were still smaller than those seen in May and June, indicating that the wider retail situation is still in strong shape relative to where it was just a few months ago. And all this in the face of the Delta variant, a continued lack of business travel and ongoing visit declines in major urban areas.

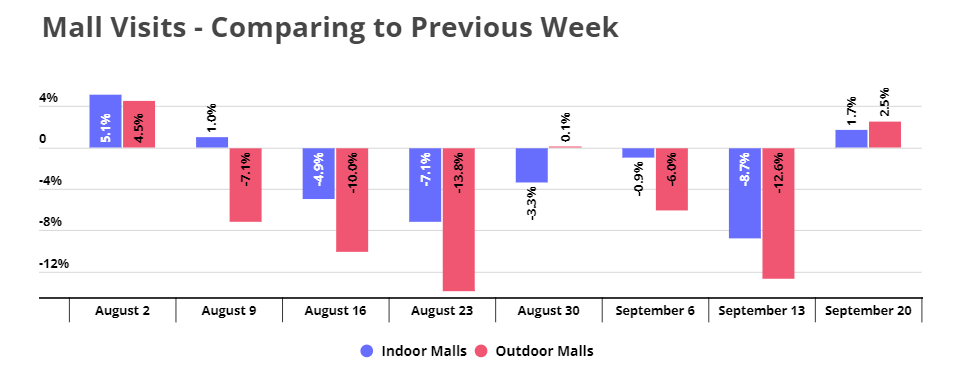

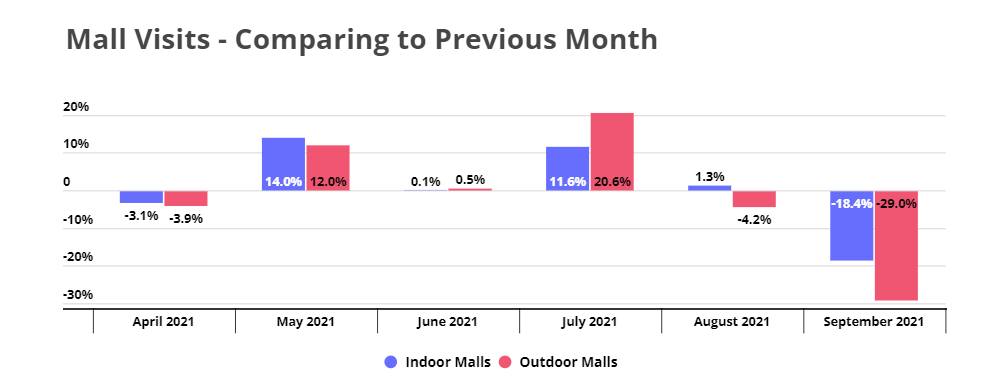

There is also a natural seasonality to retail visits, with Back to School driving a surge that leads into a quieter autumn period right before the holiday season. And the data does show the presence of that cycle, with visits declining week over week into late September and month over month as well.

And the ongoing presence of this normal seasonality could bode well for an exceptional end of year retail season. The Back-to-School surge combined with the decline that followed shows that traditional retail patterns are holding. So, while October may not see a significant change, the holiday shopping period could jolt visits back to growth or near-growth levels – especially if COVID cases decrease into that time.

Even the declines demand perspective in that they remain fairly limited – indicating that top tier malls and retail experiences have retained much of their allure even during the extended COVID period.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.