As the wider retail recovery continues, one sector that seems particularly well aligned with current trends is the pharmacy space. An increased focus on health and wellness alongside the ability to distribute COVID vaccines and administer tests has positioned leaders in the space particularly well.

The Steady Rise, The Slight Dip

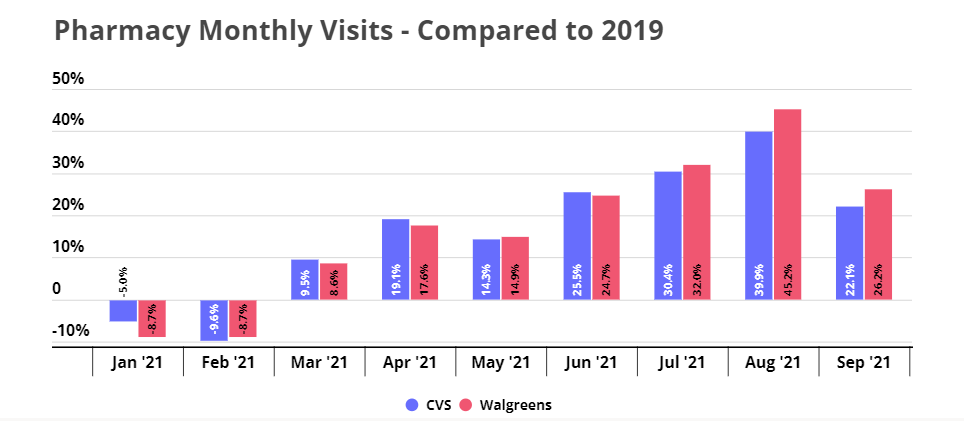

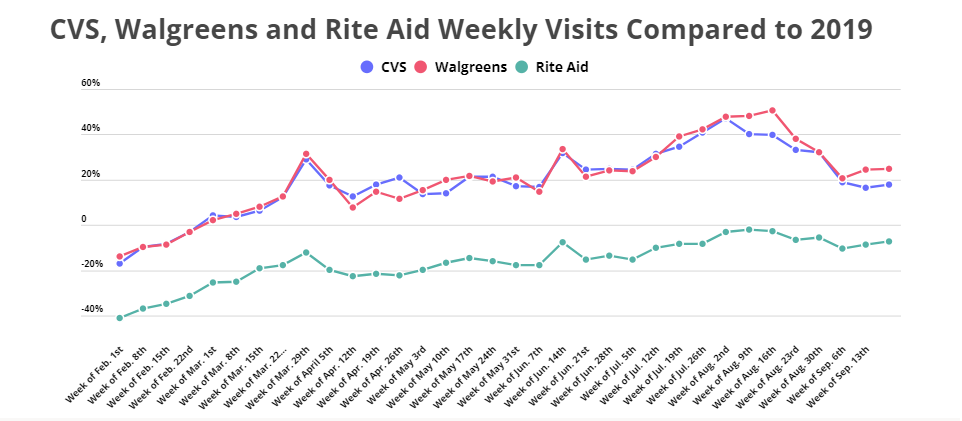

CVS and Walgreens returned to year-over-two-year growth by March 2021 with both brands maintaining the success throughout the summer. August marked a high point, with CVS and Walgreens seeing visit growth of 39.9% and 45.2%, respectively. And while COVID vaccines and testing – especially amid the rising Delta variant – and a wider focus on health certainly contributed, the unique retail environment clearly played a significant role. The summer saw a major spike in visits across the board with likely contributors ranging from pent up demand for brick and mortar retail to less international travel leading to larger groups making a retail trip.

And although the return of normal school and work patterns in September had a slight impact on growth rate, foot traffic was still significantly higher than it was in 2019. Visits for CVS and Walgreens were up 22.1% and 26.2% respectively in September – still strong, but off the pace set in July and August.

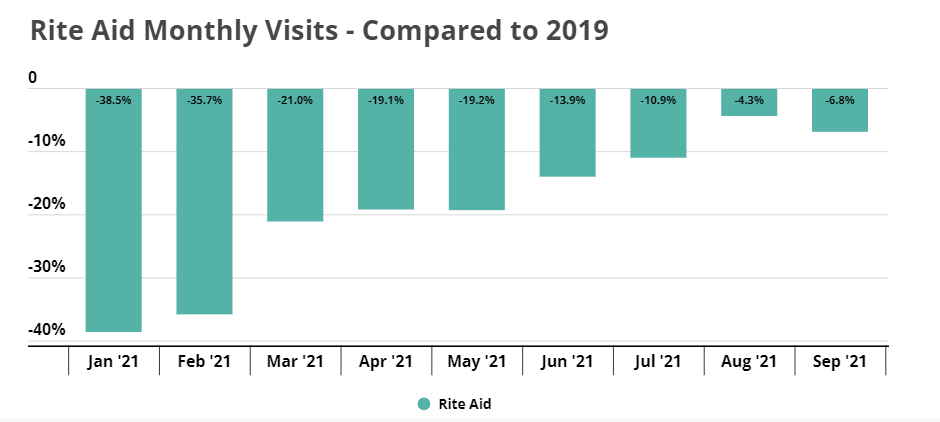

Rite Aid, a brand that had been hit harder than CVS or Walgreens, has also seen a steady recovery, with the visit gap with 2019 decreasing from over 35% in January and February to just 4.3% and 6.8% in August and September, respectively. The chain’s orientation towards major cities and large scale closures are still limiting the overall success in terms of visit growth.

Heading to ‘Normal’?

And the heights of the summer do appear to be behind these brands – though even this regression still includes significant visit increases when compared to 2019. The especially interesting case is Rite Aid, who stands to benefit most from a wider return to work and school and the boost that move would give to cities.

Yet, the bigger question may be whether the strength created can drive a longer term boon for the players in the space. COVID’s presence does not appear to be going away all that soon, and the impact this could have on continued testing and vaccinations is significant. In addition, the spectre of a pandemic does appear to drive a greater focus on health and wellness, and the brands in the space had already been pushing more clinic style options in recent years. This combination could drive a greater staying power to the visit strength.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.