The holiday season is on its way and while the last year and half provided an ongoing lesson in the challenges of ‘predicting’ during a pandemic, there is still value in attempting to highlight what the season could hold.

Clearly the ongoing presence of COVID as an actual or potential disruptor is significant, but planning must go on and accordingly we decided to provide some of the key themes we believe will impact the holiday season.

Real Reason for Optimism

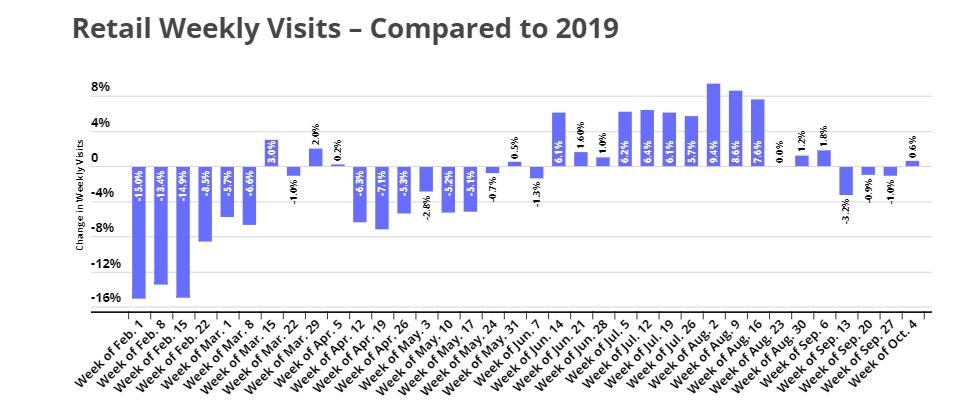

Visits hit impressive peaks during the Back-to-School season, with July and early August seeing year-over-year growth for retailers across sectors and for many malls and shopping centers. The surge was driven by a combination of factors including pent up demand, excitement around the wider reopening, and the presence of a key retail season.

And when looking at the trends coming together ahead of the holiday season, a similarly positive confluence seems to be building. The ability to finally spend the holidays with family after the mass cancellations of 2020 holiday plans may move many consumers to up the ante on gifts this year. So while retail is already open, the pent-up demand for holiday shopping could drive a similar boost as that seen during the summer.

This is further supported by the continued presence of traditional seasonality patterns where visits decline post summer into October and then rise again in November. In addition COVID cases are on the decline in the US, creating the potential for a pandemic lull as the holiday period kicks off.

In short, timing matters. And there are real signs that this could work in the favor of the holiday retail.

Extended Holiday Season

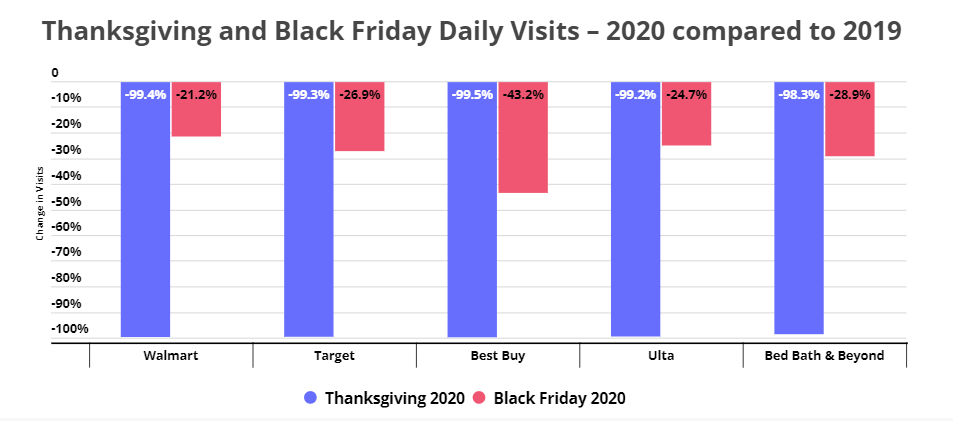

For many retailers, Thanksgiving shopping will remain a remnant of the past potentially impacting the full weight and impact of Black Friday weekend. And though Black Friday still provided peaks in 2020, the height of those surges was down significantly compared to years prior.

To combat this, many retailers are pushing holiday retail cheer throughout a more expanded period in the calendar. And this could have significant and positive ramifications for those who handle the more distributed visits well. In fact, already in 2019 chains like Walmart and Target saw similar if not greater visit peaks in the days pre-Christmas than those immediately following Thanksgiving. Should early November and late December become a bigger piece of the puzzle for a wider array of brands, the impact could be significant. This is especially true for those with strong omni channel offerings where convenience-oriented elements like Buy Online Pick-Up In Store (BOPIS) could play a bigger role.

Winter Mall Boost

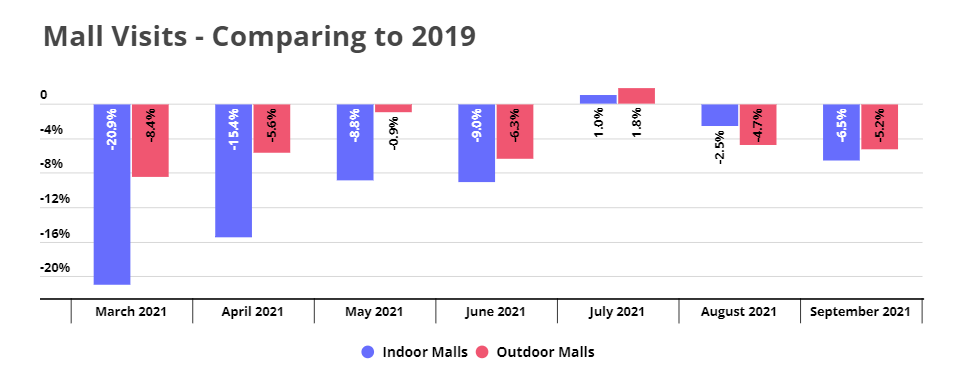

If COVID cases do continue to decline and winter brings the weather we normally associate with it, malls are going to see a boost. Yes, visit gaps did increase after July saw visits rise above 2019 levels, and the likelihood of seeing holiday retail visits hit 2019 levels is not high. But barring another COVID surge, top tier malls are positioned to see their best months since the start of the pandemic.

The aforementioned positivity around the holiday season and continued limitations on international travel alongside the unique environment that can be created by malls, offer a powerful opportunity for top tier shopping centers. And the added focus many malls have placed on emphasizing dining and entertainment options will only boost the draw they create. This is even more important in a season that will be defined at least partially by supply chain challenges, where a shopping trip without a wider experience could be less successful than in the past.

Creativity

The holiday season is going to be heavily impacted by supply chain challenges. From the likely move away from major markdown deals to the potential sparsity of key items, a big focus for retailers will be finding ways to generate urgency and excitement without the traditional levers to pull.

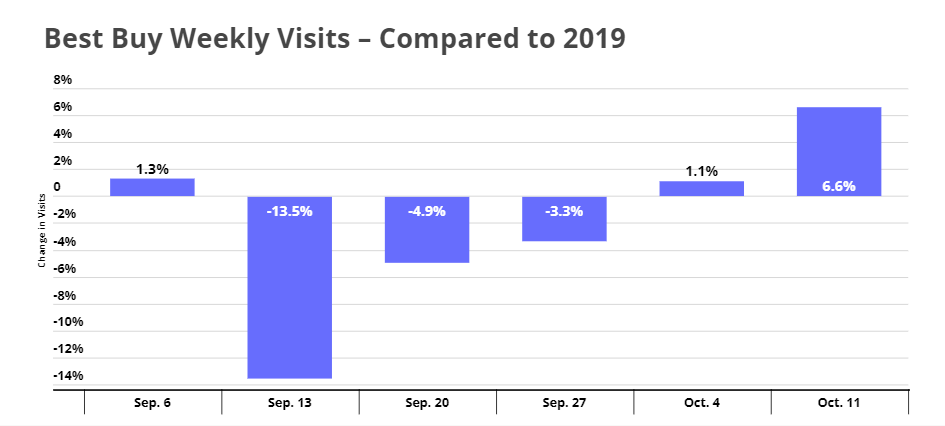

Luckily for retailers, and if early foot traffic data is any indicator, customers may be feeling the sense of urgency all on their own. Although Best Buy has announced early Black Friday deals beginning October 19th, it seems that some customers have already begun their holiday shopping even earlier. Visits the weeks of October 4th were up 1.1% compared to 2019 – almost as big a jump as the Labor Day boost. Visits the following week were up 6.6% – also a major jump. And all this before the launch of “Member Mondays,” a special sales event which launches October 18th for members of Best Buy’s new loyalty program Totaltech.

But even if the extension of the holiday season doesn’t solve the problem – which it certainly won’t completely – the focus will need to shift to the creative approaches brands can deploy to manufacture excitement. Whether it be leveraging loyalty programs to incentivize shopping via product access, the impact of Buy Now, Pay Later options or any array of new ideas, retailers will be challenged to utilize different tactics than those used in the past.

Which trends will prove defining features of the 2021 holiday season? Visit Placer.ai to find out.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.