In this Placer Bytes, we dive into Destination XL and The Paper Store – two brands who have made impressive comebacks in 2021 – and take the opportunity to check in with the plus size apparel sector.

Plus Size on the Rise

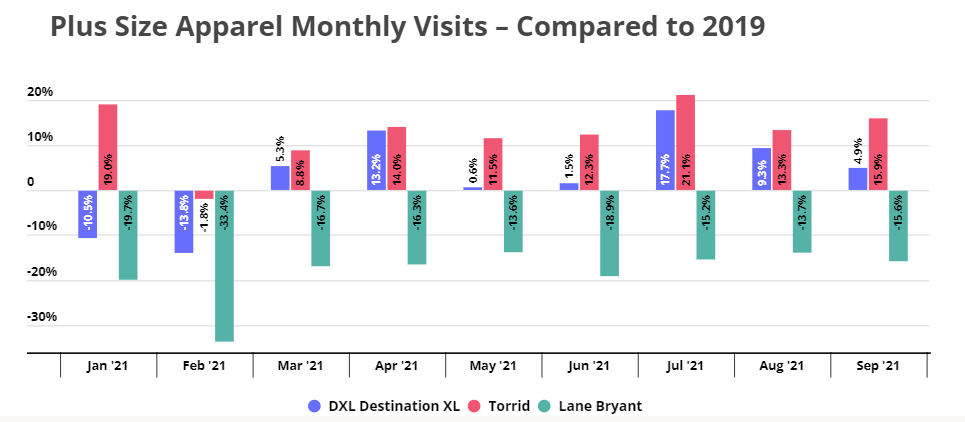

At the height of the pandemic retail crisis, Destination XL looked particularly vulnerable. But as the country opened back up and consumers headed back to stores, the big and tall leader has made an impressive recovery. Year-over-two-year visits have been up since March with no sign of slowing down: While overall retail visits were down for much of September due to normal seasonality and renewed COVID concerns, Destination XL has continued to flourish, with visits up 4.9% when compared to September 2019. Critically, Destination XL currently has no true direct competitors with the same nationwide reach, which may mean even more growth as the body positivity movement slowly begins including men in the conversation.

Torrid, the women’s plus size apparel retailer targeting women 25-40 that went public in July, has also been experiencing noteworthy growth, with year-over-two-year visits up every month this year except for February. September visits were up 15.9% compared to 2019. Meanwhile, Lane Bryant, which targets a slightly older demographic, has seen a drop in visits – but the decrease is to be expected given the brand’s massive closures of more than 150 locations last year after its parent company filed for bankruptcy.

Plus Size’s Moment

The plus size sector is likely getting a boost from the same factors contributing to the rise of athleisure – after over a year in pajamas, consumers are valuing comfort more than ever. The growing body positivity movement is also playing an important role by encouraging consumers of any size to celebrate their shape and seek out clothes that are stylish and flattering, and not just functional.

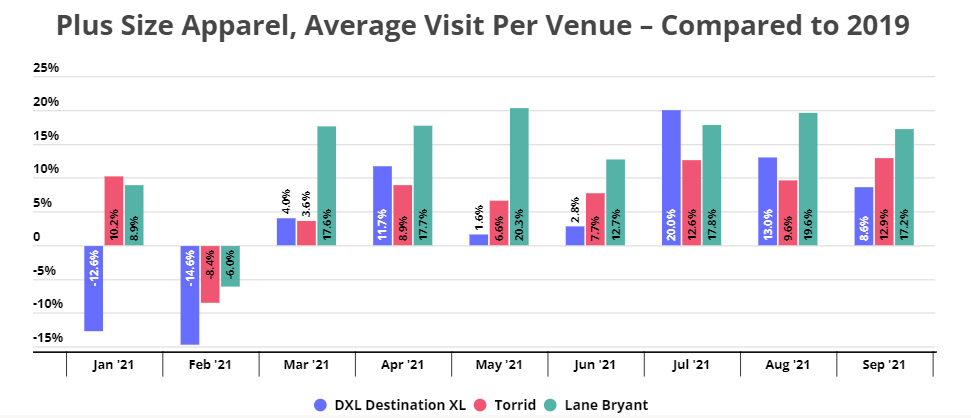

Indeed, looking at the change in average visit per venue in the last two years demonstrates the current draw of plus-size brands. Average visits per Lane Bryant location have increased by 17.8%, 19.6%, and 17.2% in July, August, and September, respectively, when compared to the equivalent months in 2019. Visits to Destination XL have increased by 20.0%, 13.0%, and 8.6%, respectively. And Torrid, whose overall foot traffic numbers got a boost from its growth in locations, has also seen a sizable increase in the average number of visits per venue.

While many brands have begun offering inclusive sizing, some consumers may still feel more comfortable shopping in plus-size-focused stores. And Destination XL, Torrid, and Lane Bryant are well positioned to benefit from the rise in consumer demand for plus-size fashion.

The Paper Store’s Remarkable Rebound

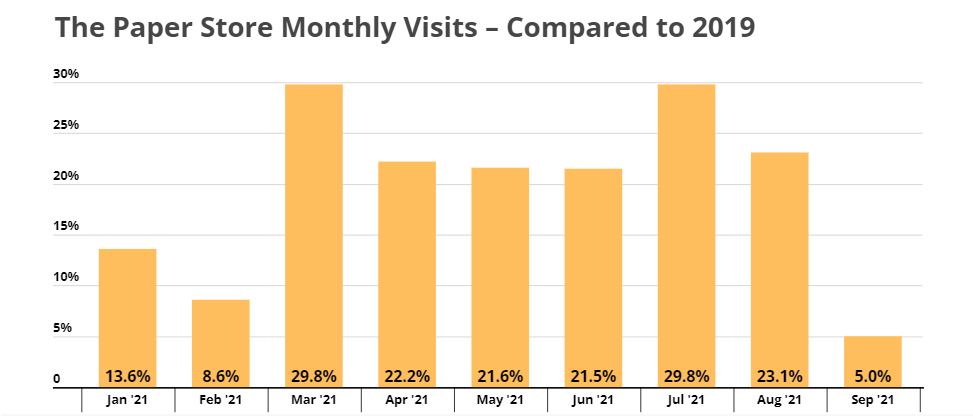

The Massachusetts-based gift and stationery retailer The Paper Store filed for bankruptcy in July 2020, and emerged in September of the same year – less than 50 days after the initial filing – following a successful sale of the brand to a group of investors led by real estate firm WS Development. Since then, The Paper Store has made a remarkable rebound.

Visits were up every single month this year when compared to 2019, with most months seeing year-over-two-year double-digit growth. Summer visits were up 21.5%, 29.8%, and 23.1% in June, July, and August, when compared to the equivalent months in 2019. September visits were up by 5.0%, but the relatively low growth in September does not mean that foot traffic to the gift retailer has peaked.

Year-over-two-year weekly visit numbers show that visits did slump slightly in September and early October, but foot traffic was back in full swing the week of October 11th. The nature of The Paper Store’s offerings – greeting cards, accessories, small gifts – lead many consumers to browse the shelves in-store, rather than shop online, and so visits may have been affected by the renewed COVID concerns. The mid-September retail slow-down that occurs every year could also have been a factor.

But the significant growth in visits mid-October indicates that the retailer may be well-positioned to benefit from the extended 2021 holiday shopping season. Consumers are beginning their holiday gift shopping early this year, and after last year’s lost holiday season, many shoppers are likely to be extra generous with presents this year. Following a strong year, The Paper Store may be gearing up to end 2021 on an exceptionally high note. `

Will Plus Size apparel brands continue their ascent? Will the holiday season bring an even larger increase in visits to The Paper Store?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.