As the pandemic’s retail effects took hold, the off-price apparel sector was put in a particularly difficult position because of their heavy dependence on brick and mortar traffic. Yet, the recovery period had been the reverse, with many of the sector’s key strengths aligning perfectly with wider trends.

The value the brands in the space provided was well suited to a period of wider economic uncertainty, while the treasure hunt experience drove interest in being back in stores. In addition, the orientation towards the suburbs and the wide geographic distribution also helped the sector ride the various waves of the recovery period.

Unsurprisingly, the sector saw tremendous results in the spring and then again in the summer Back-to-School season. But as the wider retail landscape has recovered, there is a real risk that the success may not continue – at least at the levels established in recent months.

Off Price Continues to Outperform

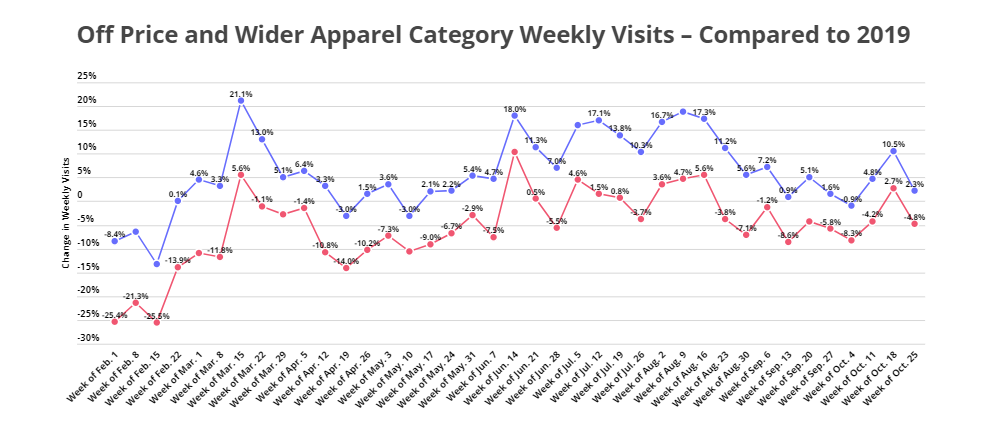

But looking at the latest data shows that the sector’s dominant position has continued. Average weekly visit comparison with 2019 for four top off-price retail brands significantly outperformed the wider apparel category.

Looking at the four weeks from October 4th through the week of October 25th shows that the wider apparel category saw an average weekly decline of 3.7% compared to the equivalent weeks in 2019. Yet, the off price average was actually up 4.2%. This is a huge swing that indicates the power the off-price retail sector has heading into a critical holiday shopping season.

The Brand Perspective

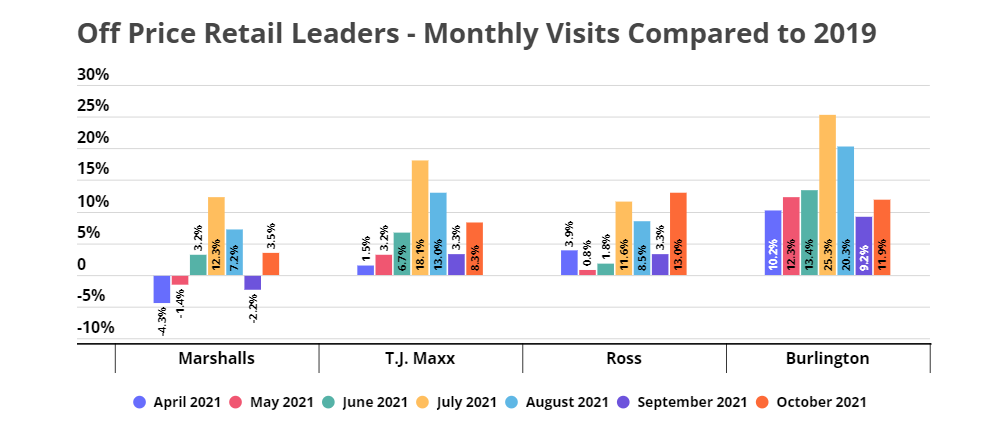

And diving deeper into the brand level shows that the strength is being seen across the board, with Marshalls, T.J. Maxx, Ross and Burlington all showed monthly visits growth in October when compared to 2019. In fact, for this group of retailers, only one month in the last five showed a visit decline when compared to two years prior.

Burlington has continued to lead the way with huge growth numbers, with a 14.7% average monthly increase in traffic compared to 2019. This is an especially important result considering the heat the brand took in early 2020 when they shut down their eCommerce offering. But the success has been felt by other leaders as well, with T.J. Maxx and Ross showed jumps of 8.3% and 13.0% respectively in October, even after an exceptional Back to School season.

This success combined with pent-up demand for the holiday retail season, lingering economic uncertainty, and the strong brand relationships these chains have developed all point to a very strong period in the months to come.

Room for More

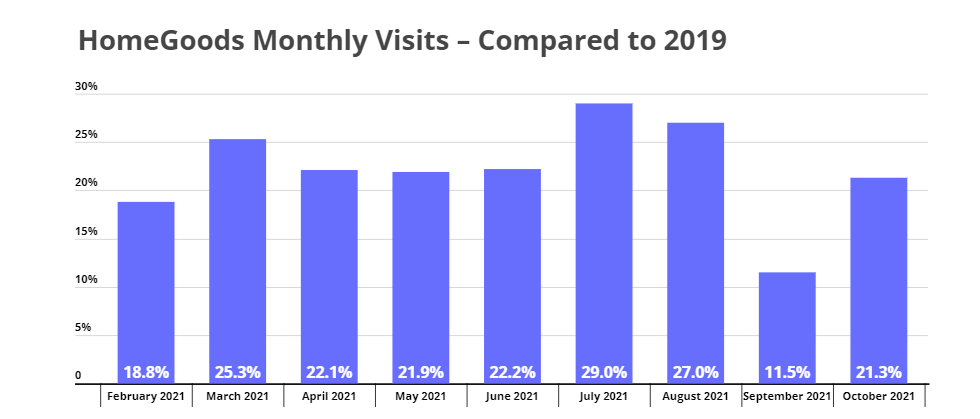

But what makes this sector even more exciting is how the approach can be expanded. TJX, which owns both Marshalls and T.J. Maxx, is also the owner of HomeGoods, an off-price home furnishings leader. The success for this chain has been equally staggering, with visits up 27.0%, 11.5%, and 21.3% the last three months when comparing to 2019 equivalents. The strength here shows that the model and perspective can have wide appeal which could push these brands to make more forays into adjacent retail spaces.

Can off price continue to dominate through the end of 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.