Bath & Body Works, Best Buy, and Dick’s Sporting Goods may operate in radically different retail categories, but these chains do have one thing in common – all three brands survived the pandemic with flying colors. We dove into the foot traffic trends to better understand where these category leaders are positioned going into 2022.

Bath & Body Works

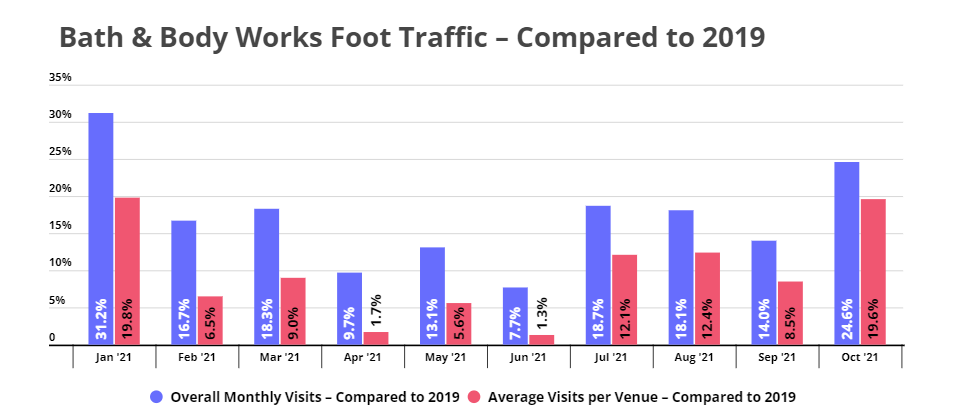

Bath & Body Works made headlines over the summer when its parent company took the Bath & Body Works name and spun off Victoria’s Secret into an independent company. There were many reasons for this split, including the difference in foot traffic trends between the two chains. Unlike the iconic lingerie brand, whose Year-over-Two-Year (Yo2Y) foot traffic has lagged as the company struggled to adapt its image and marketing to current consumer preferences, Yo2Y visits to Bath & Body Works have been soaring all year.

Q3 foot traffic was up by an average of 16.9% compared to 2019, and October visits were up by a hefty 24.6%. While some of the increase comes from new store openings, visits-per-location have also seen impressive growth, with an average visits-per-location Yo2Y increase of 13.5% in Q3 and 19.6% increase in October. With the pent-up demand expected to lead to increased gift shopping this holiday season, Bath & Body Works is on track to finish the year stronger than ever.

Best Buy

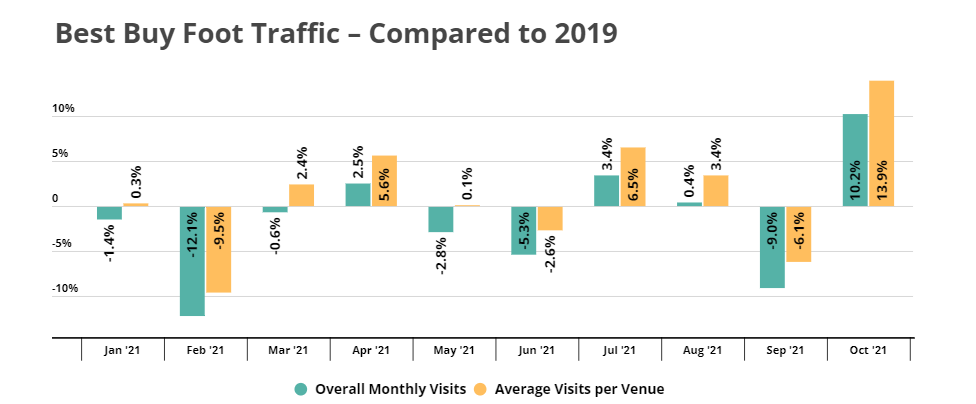

For most of 2020, Best Buy managed to maintain a relatively minimal year-over-year visit gap, and 2021 has brought visit growth for the electronics retail leader. Yo2Y were up by 3.4% and 0.4% in July and August, respectively. And October visits were up 10.2% – indicating that the brand may be particularly well positioned to benefit for 2021’s extended and amplified holiday season.

Best Buy’s growth in overall visits is all the more noteworthy given that the company is operating now with fewer locations than it had in 2019. Indeed, looking at the brand’s average visits-per-venue confirms just how strong the brand’s appeal still is, with the growth in visits-per-venue consistently outpacing overall visit growth. Yo2Y visits-per-venue were up 6.5% and 3.4% in July and August, respectively, and by 13.9% in October. With Best Buy consolidating its store fleet as it invests in its ecommerce and omnichannel capabilities, the brand’s increased visits-per-venue numbers show that a significant number of customers are still seeking out the brick and mortar retail experience.

Dick’s Sporting Goods

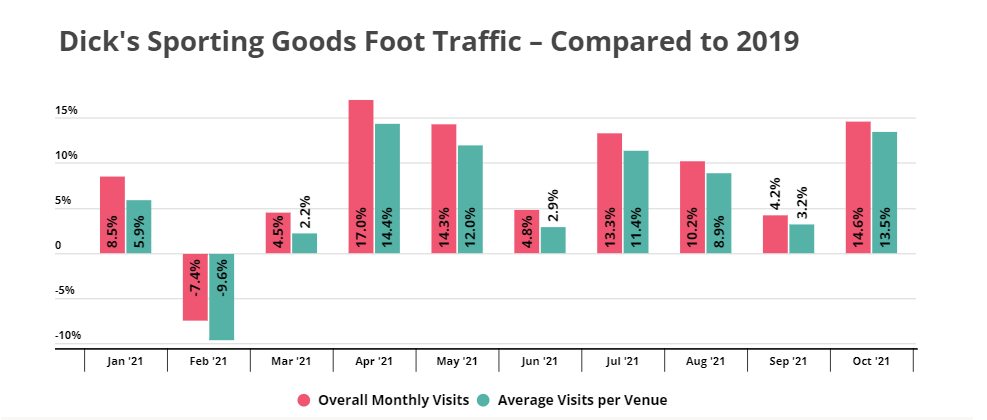

We’ve written about Dick’s Sporting Goods strength before, and the past couple of months have been no exception. Yo2Y visits have been up every month since March, with Q3 visits up by an average of 9.2% and October visits up a whopping 14.6% compared to 2019. And while Dick’s is also expanding its physical footprint, the brand’s Yo2Y visits-per-venue have also been increasing significantly, with Yo2Y average visits-per-venue up by 7.8% and October visits-per-venue up by 13.5%.

And Dick’s is not resting on its laurels. With the company’s push into experiential retail and themed shops-in-shop, the sporting and outdoor goods leader is setting itself up for an even stronger 2022.

Will Dick’s Sporting Goods Experiential expansion boost its already strong foot traffic? Will Best Buy visits continue to rise this holiday season?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.