Our latest white paper checks in with one of the pandemics major winners – the grocery sector. Following our Summer Grocery update, we dove into nationwide, regional, and brand-level visit data to understand what has changed and what has returned to pre-pandemic patterns.

Grocery Continues to Thrive

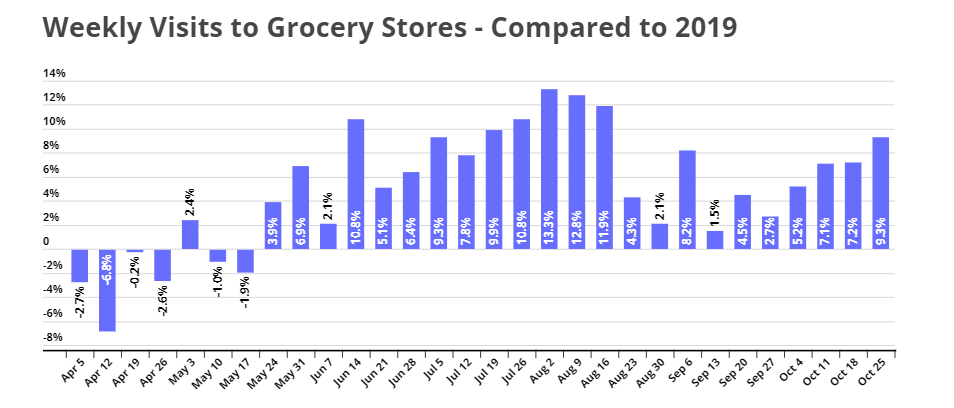

Year-over-two-year (Yo2Y) grocery visits have been consistently up nationwide in recent months, with weekly visits in October surpassing 2019 numbers by 5.2%, 7.1%, 7.2%, and 9.3% for the weeks of October 4th, 11th, 18th, and 25th, respectively. Even more significantly, Yo2Y weekly visits since April shows that the rare declines are all relatively small – never more than 3%. The Yo2Y increases, on the other hand, are quite significant, with the Yo2Y visit increase sometimes even reaching into the double digits.

This points to the success grocery leaders have had in leveraging the pandemic visit boost into long-term strength. The initial increase in grocery visits in 2020 could be largely attributed to panic buying and to the temporary closure of non-essential businesses, which drove consumers to transfer their shopping to sectors – like grocery – that continued to operate. But grocery’s strong performance in July – when consumer confidence was the highest it had been since February 2020 and before concern over the Delta variant took hold – is a testament to grocery’s improved position.

The growth in grocery visits also points to the resilience of the offline grocery market, perhaps because grocery products have some unique characteristics that might make people more reluctant to switch to grocery ecommerce channels. Many people like choosing their own fruits and vegetables, browsing the supermarket shelves for dinner inspiration, rather than scheduling their day around grocery delivery. So, while much ado was made about the rise in online grocery shopping, it seems that the brick and mortar supermarket experience still holds a wide appeal.

Grocery’s Correlation with Other Sectors

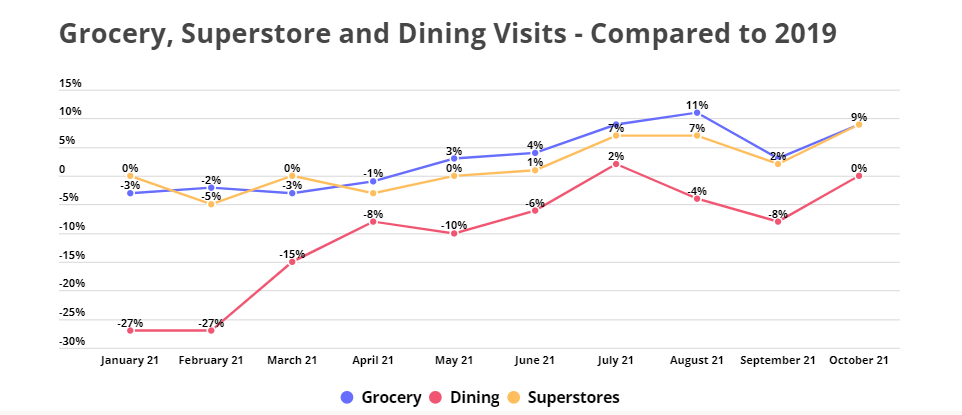

Contrary to a popular narrative that held that grocery store foot traffic increased in large part due to the drop in dining visits, dining and grocery visits actually often moved in the same direction for much of 2021. This means that the Yo2Y rise in grocery visits is not just a product of specific pandemic conditions. Instead, the data shows that more consumers are visiting grocery stores even as dining visits increase, which is another indication of the grocery sector’s improved strength going into 2022.

Yo2Y grocery visits also showed a very tight correlation with superstore foot traffic, with Yo2Y visits to these categories generally rising and falling together at comparable rates throughout 2021. It’s important to note, however, that the two sectors were not identical – the increase in grocery foot traffic surpassed the growth in superstore visits most months. So despite the convenience of buying groceries alongside beauty and home goods products at “one-stop-shops,” it seems that many consumers are still ready to make multiple visits in order to address their full grocery needs.

Regional Differences

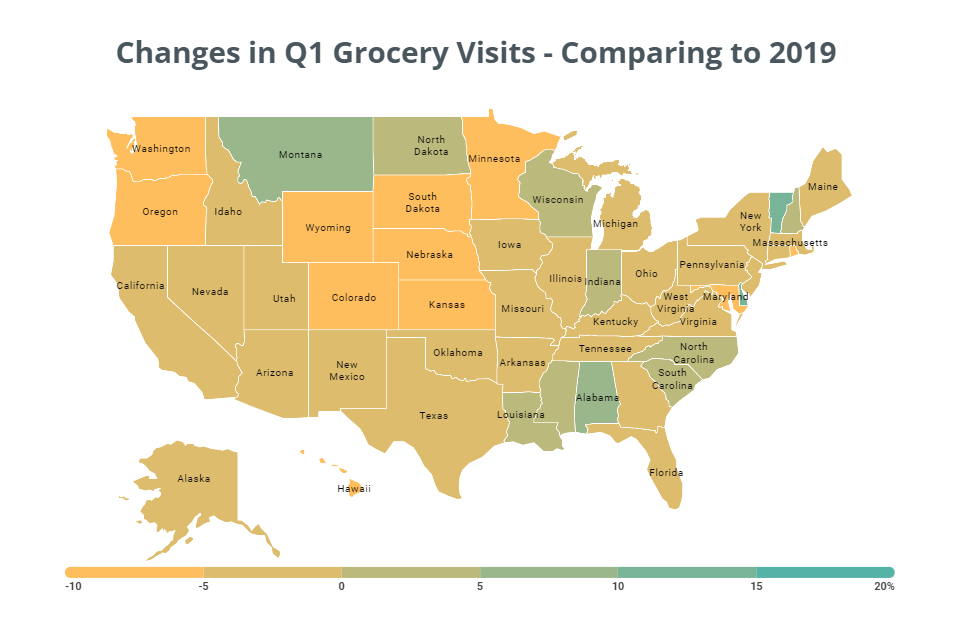

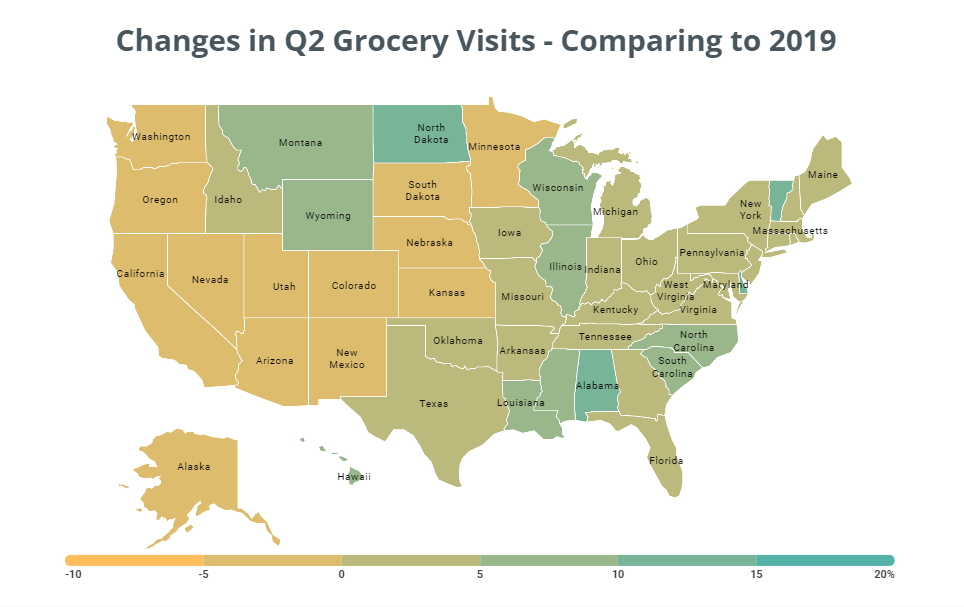

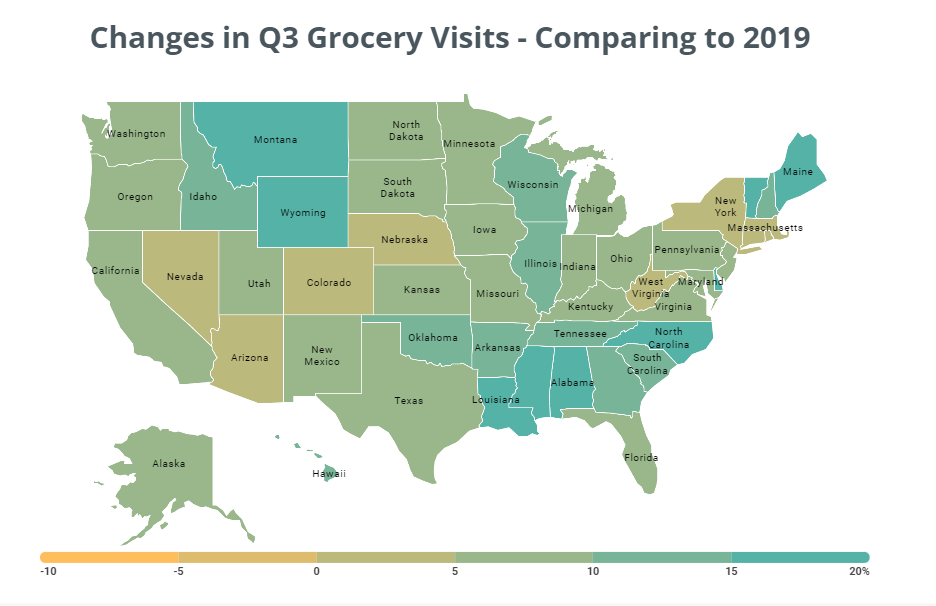

Although almost all states saw a Yo2Y increase in visits in each of the first three quarters of 2021, some regions saw more grocery growth than others. The northwest, southeast, and northeast all saw a significant rise in grocery visits, while the southwest, midwest, and mid-Atlantic saw a more moderate increase.

In the northwest, grocery visits to Montana, Wyoming, and Idaho rose by 21.9%, 16.2%, and 11.8%, respectively, between Q3 2019 and Q3 2021. Year-over-two-year grocery visits in the Southeast also increased, with Louisiana, Mississippi, Alabama, and North Carolina seeing respective Q3 visit hikes of 18.6%, 15.8%, 22.8%, and 15.3%. Finally, the northeastern states of Maine, New Hampshire, and Vermont saw their respective Q3 grocery foot traffic increase by 15.9%, 12.2%, and 18.7% when compared to Q3 2019. Meanwhile, in California, Texas, Florida, and New York, grocery visits rose by 5.2%, 5.8%, 7.4%, and 4.8% between Q3 2019 and Q3 2021.

Since the grocery market is so regionally fragmented, understanding how grocery visits are changing in different parts of the country can help explain performance differences between various grocery chains. Regional-level insights into the grocery market can also help product companies prioritize their product placements, plan product pilot launches, and generally drive a far more efficient and successful operation.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.