The great aviation recovery is underway, or more precisely - airline capacity is rebuilding in many parts of the world, airline schedules are more stable than they have been all year, and if you are double vaccinated (and able to work out the paper trail of requirements) you can travel freely to most parts of the world. However, you are still unable to travel everywhere and, in a throwback to the mid-nineteenth century, there are markets that remain firmly shut for nearly all international travel and that is not good news for the airline industry. For most airlines, it is generally accepted that international services are more profitable than short-haul domestic services; indeed, some airlines with major hubs happily operate some domestic flights as “loss leaders” to feed their international networks.

Top of the Wrong League Table

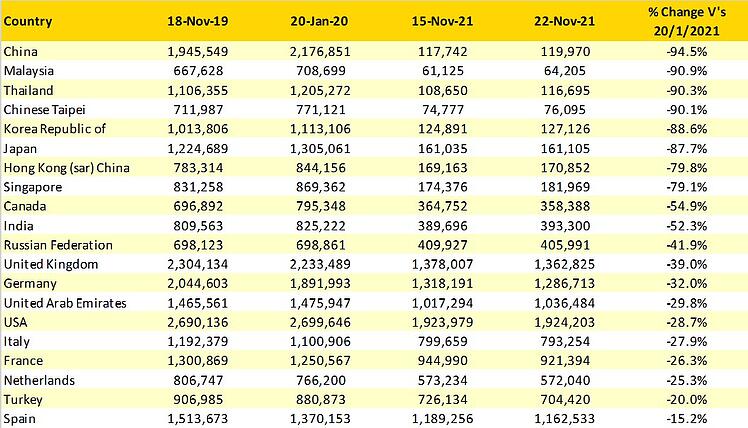

The pandemic has created lots of new and interesting data points, many of which are presented as tables of information, and we have finally produced the table of international airline capacity that you would expect no country to want to feature in. The table below contains the top twenty international markets at the beginning of the pandemic and then compares them to their current levels of capacity and sadly the percentage reductions in many of those markets remain very high.

Table 1 - Top 20 International Country Markets, 20th January 2020

There are four major international markets where international airline capacity currently remains at less than 10% of pre-pandemic levels and eight countries where less than a quarter of normal capacity will be operated this week. Even more interestingly there is a very stark geographic “divide” at a regional level with international capacity still at a near lockdown with airline capacity between these major markets in virtual lockdown as the matrix below illustrates.

China’s US$20.2 Billion International Lockdown

The interdependency between all eight Asian markets essentially means that until all markets are fully reopened then the impact for airlines and airports in the region will threaten any market recovery. China is clearly key to any recovery, pre-pandemic there was around 1.35 million seats to the other seven international markets; this week that number is just 61,000, a weekly reduction of some 1.3 million seats in each direction! Assume a conservative load factor of 75% across all those seats and typically that would equate to around 1.95 million passengers in both directions and then apply a cautious US$200 yield per passenger and that suddenly stretches out to US$390 of lost revenue a week across those markets. In a year that reaches an incredible US$20.2 billion of revenue that airlines in the region desperately need.

Table 2 - Top Asian Markets Interconnectivity

No Sudden Changes Expected

Despite the creation of numerous Virtual Travel Lanes (VTLs) to and from Singapore, Cambodia reopening, Malaysia announcing a phased international reopening and Thailand having already established a series of protocols for international arrivals - the collective impact of all these actions in the context of a US$20 Billion revenue gap are but drops in the ocean. So, when will things change?

In the case of China there is clearly no urgency to re-open international borders ahead of the Winter Olympics scheduled for February 2022 and recent interviews with leaders of the aviation industry in China suggest that the lockdowns could continue into the third quarter of next year. The financial impact for many carriers in the region will be devastating with millions of dollars lost revenue if China’s lockdown does stretch into the second half of next year. China may be the main blockage point now, but Japan is equally struggling to cope with accepting international arrivals.

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.