While most of the retail world looked anxiously towards Black Friday preparations and results, the grocery sector knows that a far more important day comes before – Turkey Wednesday. Turkey Wednesday marks the day before Thanksgiving when grocers around the country see a powerful visit surge – for some, the pinnacle of their annual visits.

How did this key supermarket holiday play out in 2021, and which other sectors benefited?

Turkey Wednesday Visits Surge

In a year where visits have been up for grocery across the board, there was a real question of whether Turkey Wednesday would drive its traditional surge. At the same time, the pent-up demand for a holiday filled with family and, perhaps more importantly, food held out the potential to drive traffic that would surpass even the heights set this year. And the latter proved to be true.

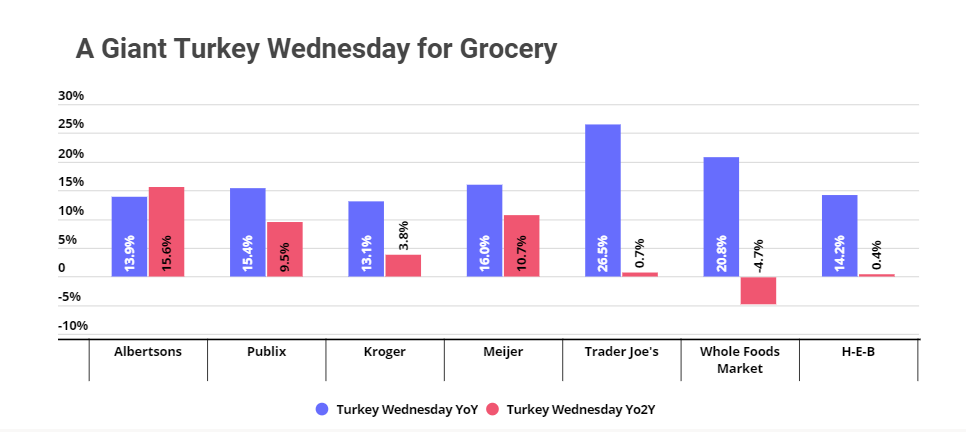

Looking at seven top grocers across the country showed Turkey Wednesday visits jumped 17.1% year over year, and even more impressively, 5.1% compared to a ‘normal’ 2019. The result gave further weight to the huge role that pent-up demand is playing in key retail seasons in the recently reopened 2021 retail environment.

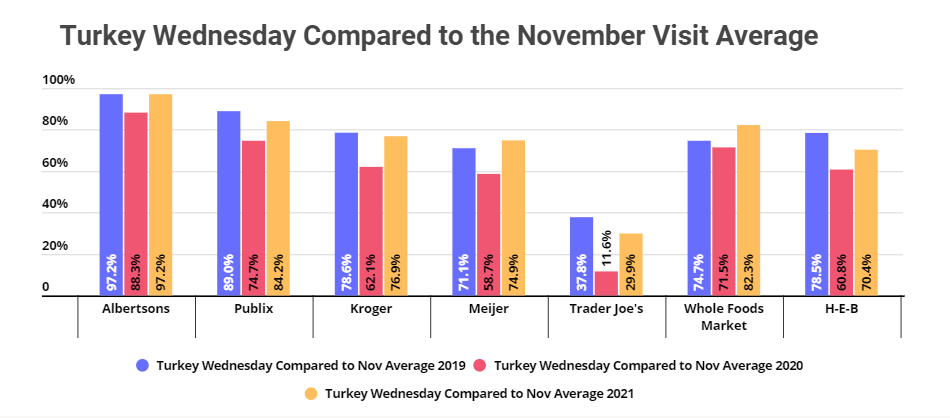

And it wasn’t just compared to past heights that visits surged. Looking at the peaks reached on Turkey Wednesday compared to average daily November visits prior to the day over the last three years shows the powerful pull Turkey Wednesday sustained in 2021. The chains analyzed all saw the 2020 declines rise back to 2019 levels this year, reestablishing the importance of the last-minute shop.

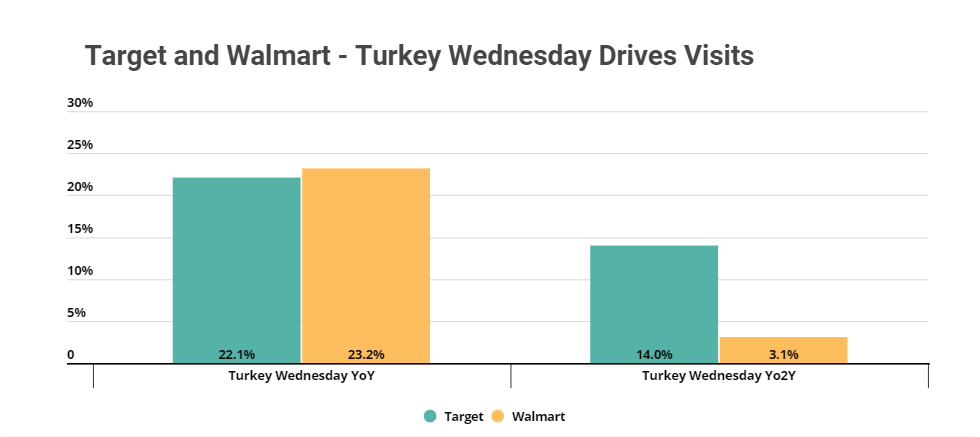

And this increase in visits – whether driven by panic or plan – also drove a huge boost to grocery adjacent brands. Target and Walmart both saw huge surges in Turkey Wednesday traffic compared to both 2020 and 2019. The retail implications here are significant. Not only do these chains benefit from the key retail holidays of the season like Black Friday, but they are exceptionally well positioned due to the wide reach of products they offer. The ability to drive a visit the day before Thanksgiving or Christmas doesn’t just lead to a few missing Thanksgiving ingredients in a cart, but also a likely upsell to other items – especially during a holiday season defined by extended deal time frames.

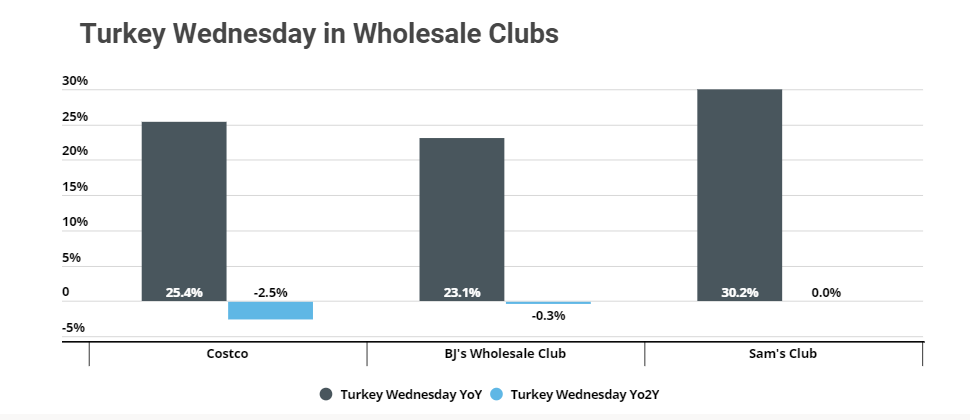

The only grocery related sector that didn’t see a significant bump was within the wholesale club space. The orientation of these brands towards planned, bulk buys likely made them less enticing for the last minute shop. Yet, even here, visits were up significantly year over year and essentially flat with 2019.

Will Turkey Wednesday success prove a precursor of grocery impact in the months to come?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.