Supply chain issues. Material shortages. Inflation. Across most industries, these are the words dominating executive meetings.

And the footwear industry is no exception.

Prices for shoes were up 6.5% in September, compared to a year ago. This spike in prices is due to a shortage of rubber and plastic, factory shutdowns in the summer and the shipping crisis at ports.

But increased prices don’t necessarily mean less sales.

Shoe companies, like Skechers, that had been investing in eCommerce and were well-positioned for pandemic-related trends (e.g. comfortability as a top priority), saw a sales boom.

“Consumers are embracing a more relaxed lifestyle and want to incorporate comfort into their work and weekend wear,” said Skechers, which ran an effective new marketing campaign this year.

The footwear market is expected to grow 16.2% in 2022 in terms of volume. Which companies should you reach out to?

MediaRadar Insights

Overall Spending and Breakdown Across Formats

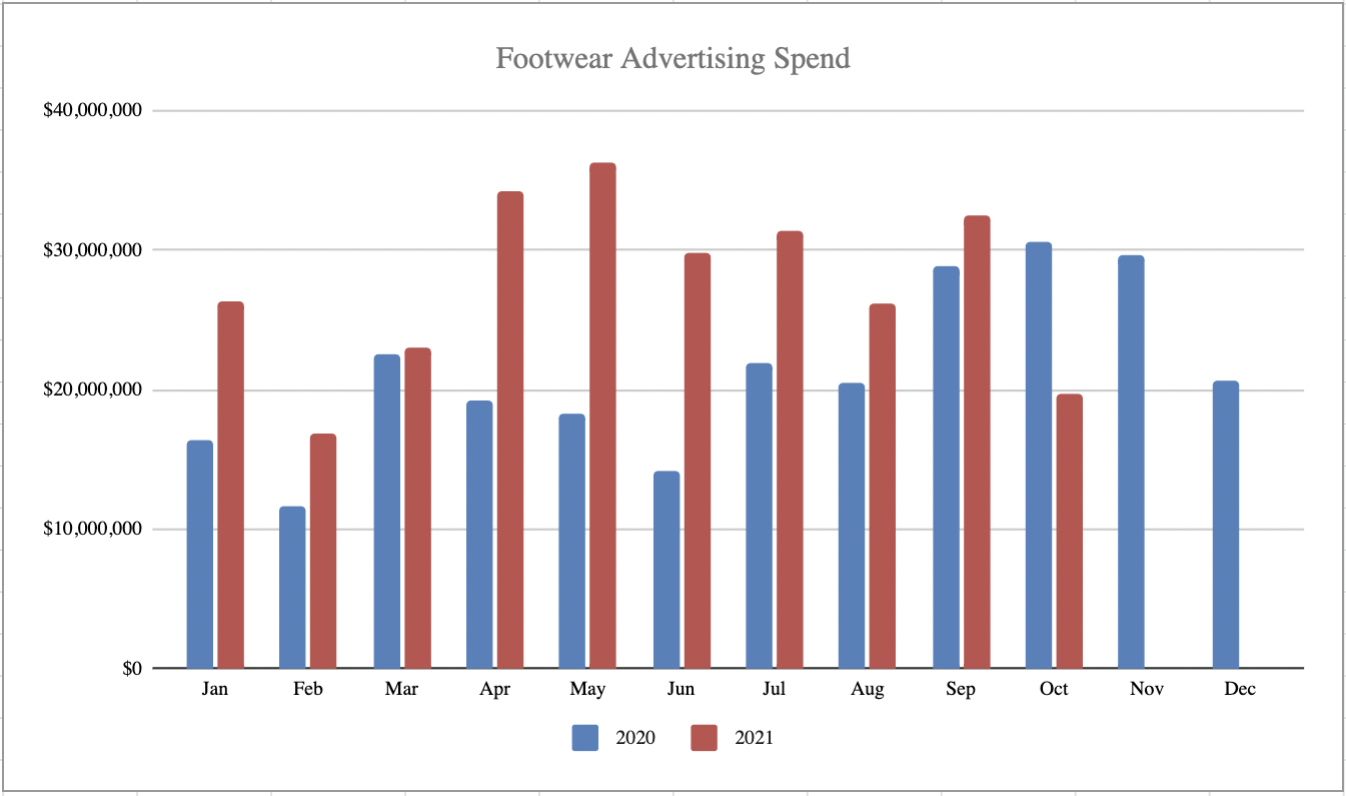

Overall, shoe companies spent $276.2 million in 2021, a 36% increase from the year prior (through October.)

More than $101 million of this spending was across digital, which is up 26% from last year.

The second largest format advertisers spend on was print, in which they spent $89.2 million this year. This is an increase of 11% year-over-year.

Footwear advertisers spend the least on TV—however, spending was up a significant 101%. Spending totaled $85.5 million on TV through October this year.

Number of Advertisers

Just over one thousand advertisers spent $276.2 million in 2021 compared to 948 advertisers spending $203.8 million in 2020.

Advertiser Retention

In the overall category, advertisers had a 58% retention rate between 2020 and 2021 (January – October).

5 Top Advertisers – Which Advertisers Spent the Most in 2021?

1. Skechers U.S.A., Inc.

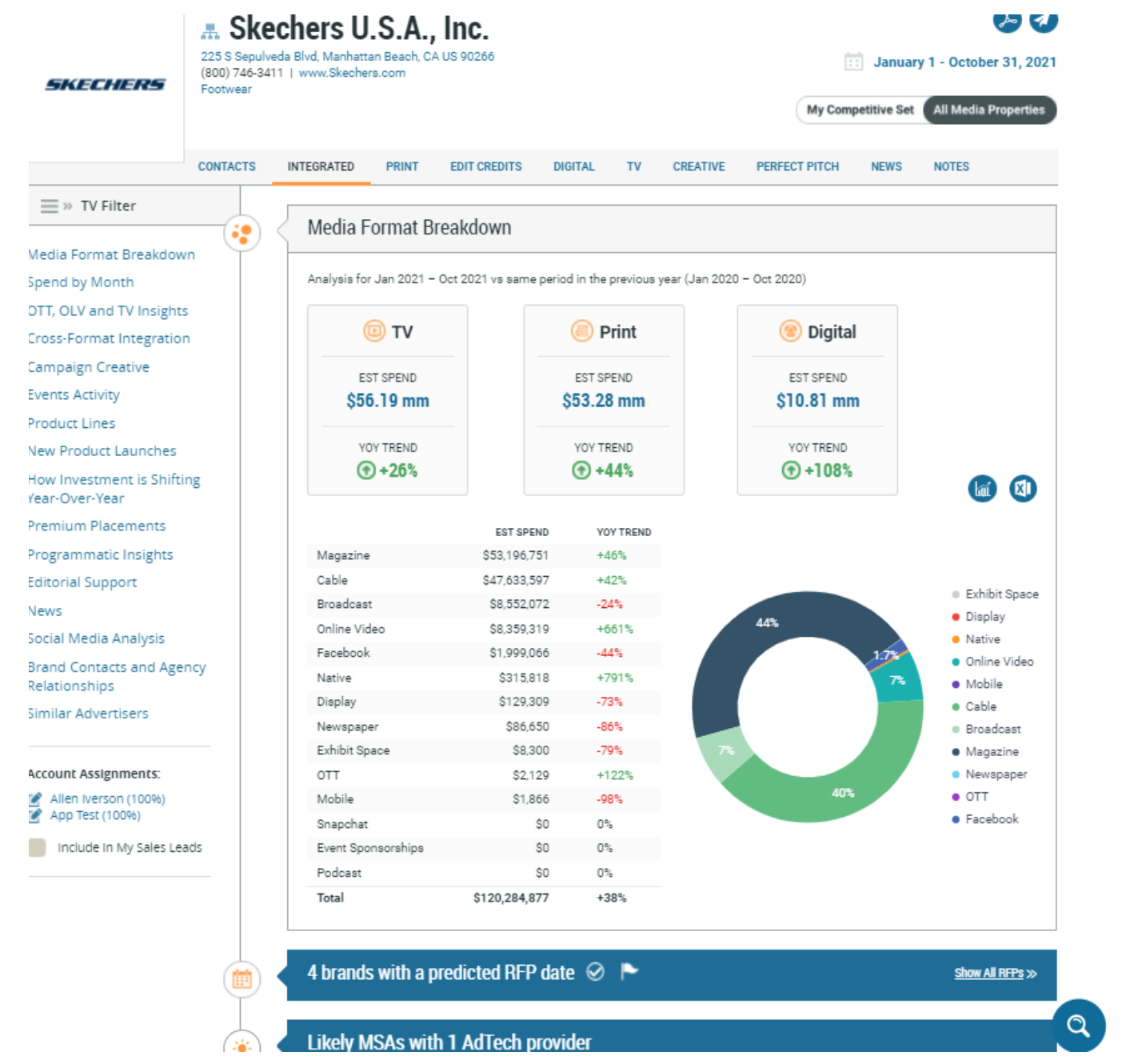

Skechers U.S.A., Inc is the top advertiser in the footwear category, with 96% of their overall budget on ads promoting their footwear brands. Their ad spend is up 38% since last year.

Skechers’ digital spending is up 108% year-over-year, with significant investments in native and online video advertising, in which their spending has gone up over 791% and 661% respectively.

$53 million, 44% of Skechers’ ad spend, is spent towards magazine ads. Another 40% of the ad spend ($47 million) is allocated to cable ads.

Below is a breakdown of Skechers U.S.A., Inc’s ad spend thus far in 2021. We predict they will likely have 4 upcoming RFPs issued. MediaRadar can help you connect with 7 key contacts at Skechers U.S.A., Inc.

2. Allbirds, Inc.

Allbirds, Inc. is also a top spender in footwear advertising, with 60% of their overall budget on ads promoting their footwear brands, spending a total of over $19 million.

Their investment in print ads has gone up over 1000%, and they began running TV advertisements this year, with $26 million (82% of their total ad spend) going towards cable ads.

Below is a breakdown of Allbirds, Inc’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 4 key contacts at Allbirds, Inc.

3. Alexander Innovation Wizard

Alexander Innovation Wizard is another top advertiser in footwear, with 100% of their overall budget on ads promoting their footwear brand, spending a total of over $9.5 million.

The majority of Alexander Innovation Wizard’s advertising budget is allocated towards print ads, with $8.3 million (87% of the total spend) going towards magazine advertisements and $809,795 towards newspaper ads.

Their investment in digital advertising has gone up 195%, and Alexander Innovation Wizard began investing in TV advertisements this year. They’ve increased investments in native advertising over 1000% and increased their spending on display ads by 167%.

Below is a breakdown of Alexander Innovation Wizard’s ad spend thus far in 2021. We predict they will likely have an upcoming RFP issued. MediaRadar can help you connect with 2 key contacts at Alexander Innovation Wizard.

4. CABH Holdings, LLC

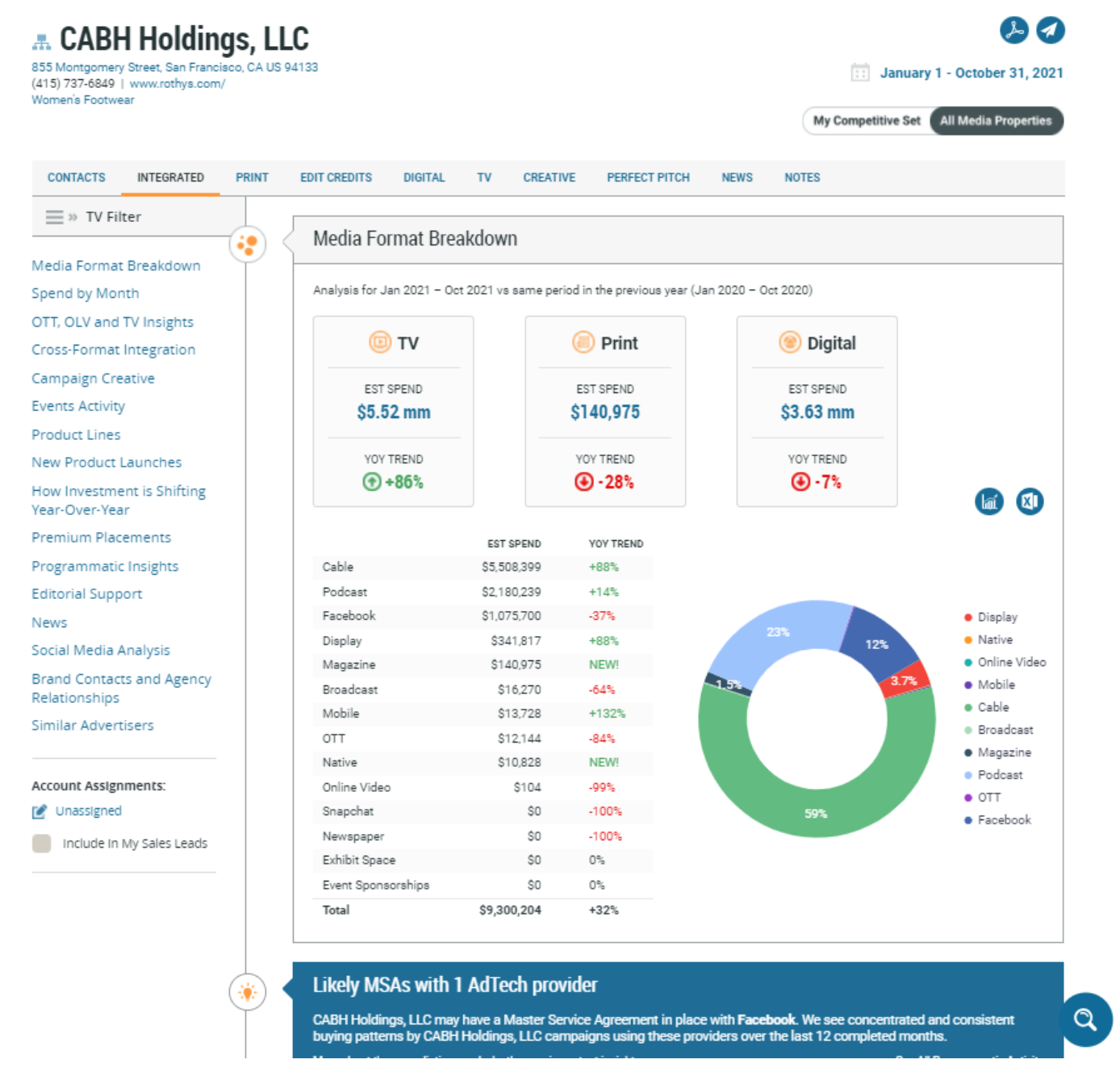

CABH Holdings, LLC is also a major advertiser in the footwear industry, with 97% of their overall budget promoting their footwear brands. In 2021, they’ve spent $9.3 million on advertising, increasing their spend 32% since last year.

They’ve invested heavily in TV ads, increasing spending by 86% with $5.5 million, the majority of which goes into cable ads. They also began running magazine and native advertisements this year, and increased their spend on mobile ads by 132%.

Below is a breakdown of CABH Holdings, LLC ad spend thus far in 2021. MediaRadar can help you connect with 3 key contacts at CABH Holdings, LLC.

5. OluKai, LLC

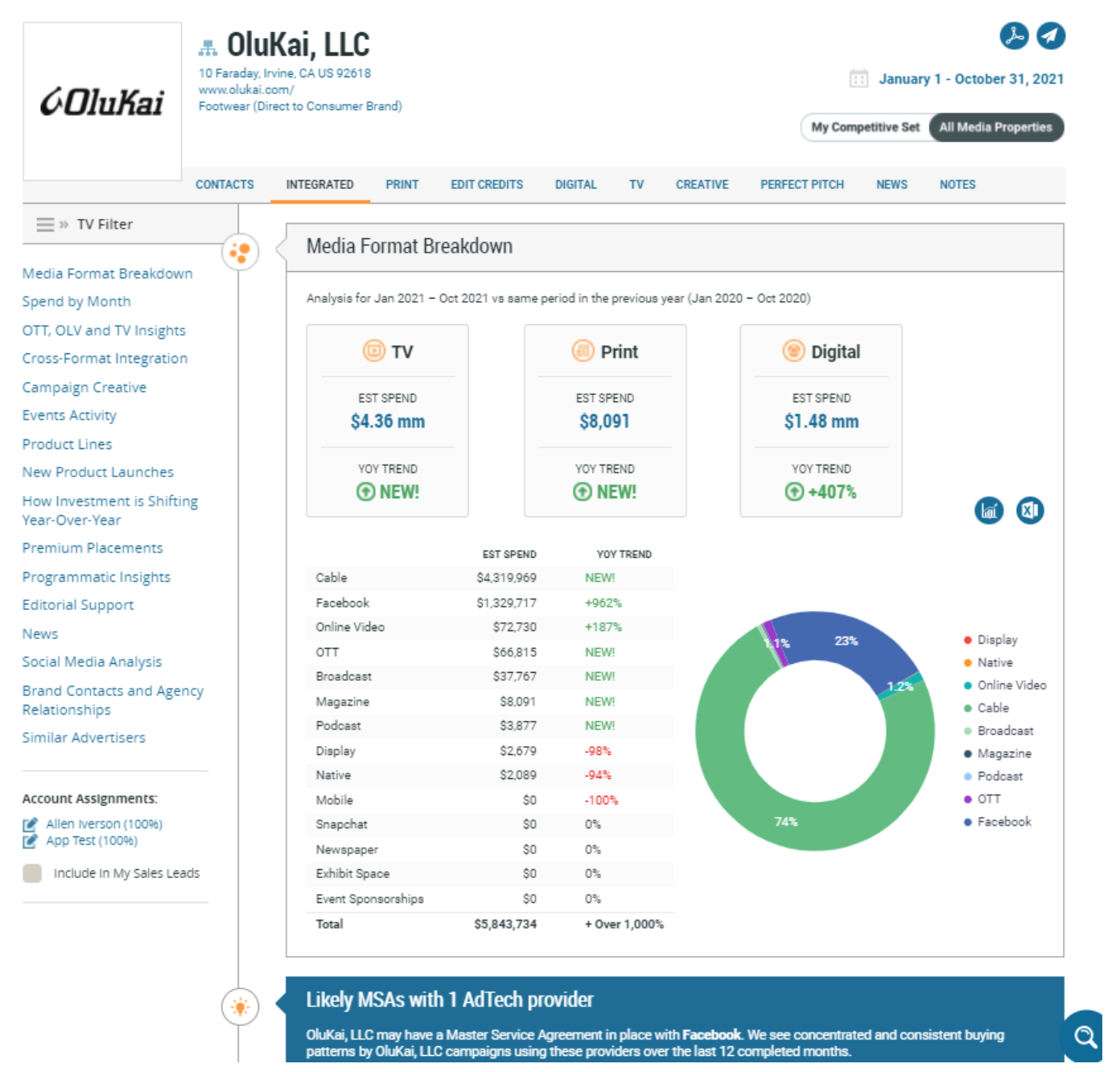

OluKai, LLC is a top advertiser in the footwear category, with 99% of their overall budget going to promoting their footwear brand. They’ve increased their ad spending by over 1000% this year, with new investments in both TV and print advertisements.

Digital advertisements saw an increase in spending by 407%. They spent $1.3 million on Facebook, an increase of 962% since last year.

With their new TV campaign, 74% of OluKai’s total ad spending went to cable ads, a spend of $4.3 million.

Below is a breakdown of OluKai, LLC ad spend thus far in 2021. MediaRadar can help you connect with 2 key contacts at the company.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.