When analyzing leading wholesale clubs in the spring, there was a clear sense that the sector was in the midst of a clear and significant recovery. Visits had surged back to growth compared to 2019, and there were real signs that these jumps in traffic could last deeper into the year. A look at these same retailers in the summer only confirmed that assumption.

So, as the end of 2021 approaches, we dove back in to see how the sector has performed and what this could mean for the prospects of leading chains in 2022.

The Growth Continues

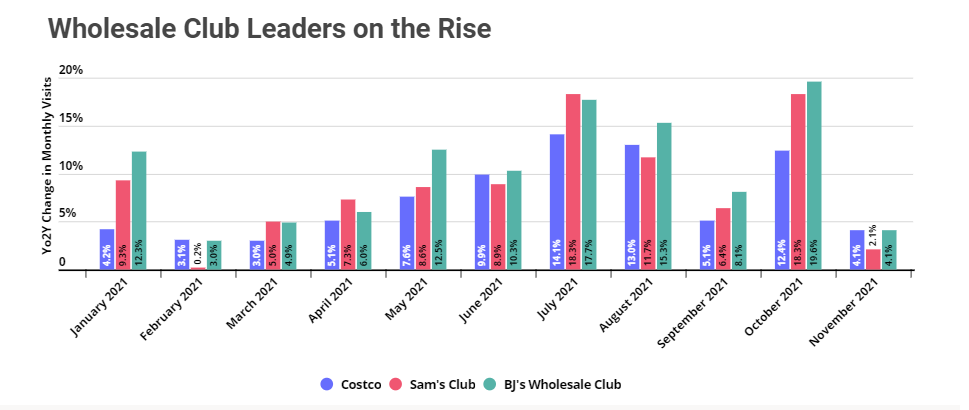

Wholesale club leaders like Costco, Sam’s Club and BJ’s didn’t just see nice performances in 2021 – they saw huge visit increases. Costco saw monthly visits up an average of 7.4% through the first 11 months of the year compared to 2019, while Sam’s Club and BJ’s saw jumps of 8.7% and 10.3%, respectively. This number is especially impressive for Costco who was already among one of the strongest retailers in the country in 2019.

So what happened? The likeliest explanation is that the initial wave of stock up buying in the early days of the pandemic highlighted the unique benefits of the wholesale club model. Then, as mission-driven shopping continued to be a major retail trend, customers found wholesale clubs ideally suited for minimal visits with larger baskets. Existing members found chains like Costco and BJ’s to be even more valuable, while newer members had gotten the needed push from the pandemic to sign up.

And this is the unique magic of the wholesale club model. Once someone buys into the concept, the stickiness of the membership club model keeps them coming back. So while many sectors and retailers saw short term bumps that regressed to the norm, wholesale club leaders are seeing a far more extended surge – one that is only buoyed further by the wider strength seen in grocery.

Changes to the Competitive Landscape?

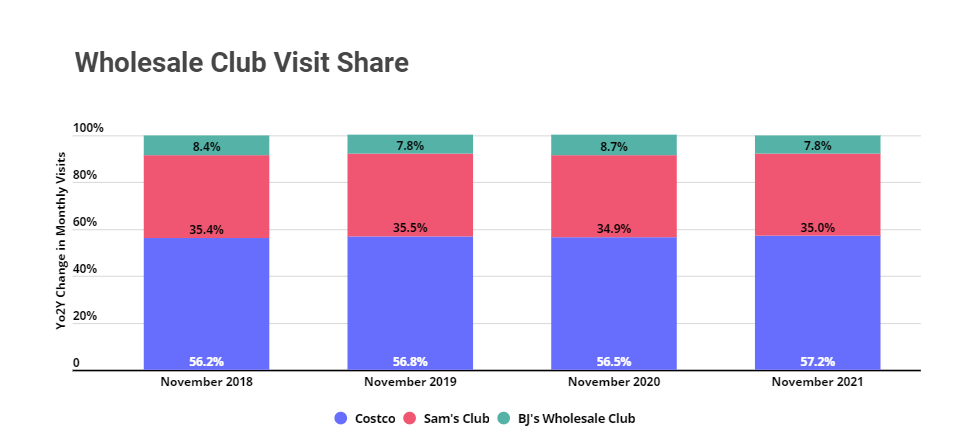

And interestingly, the rising tide does appear to have lifted all boats. The jumps for brands like BJ’s and Sam’s Club – while more significant than the one seen by Costco – did not significantly shift the visit share among them. Costco went from a 56.2% visit share percentage in November 2018 to 57.2% in November 2021, while both Sam’s Club and BJ’s saw equally minor shifts.

The clear takeaway? The wider wholesale club sector was a winner in the last year and a half, with the model they utilize proving to be a powerful asset.

A Big Ending for 2021?

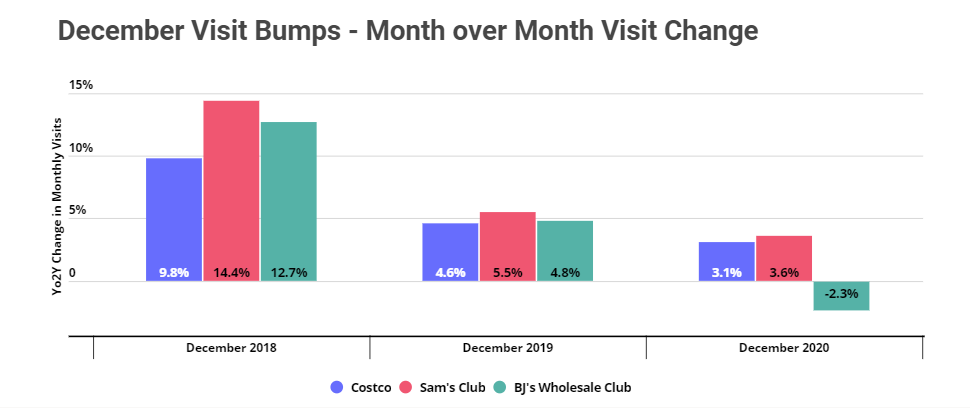

It also appears that the best may still be yet to come for the sector in 2021. While November marks a consistently strong month for the space, December is consistently the strongest month for wholesale club visits with family holiday visits driving an added need for bulk buys.

In 2019, Costco, Sam’s Club and BJ’s saw jumps of 4.6%, 5.5% and 4.8%, respectively, in visits between November and December. Should this pattern hold in 2021, the chains could see a powerful end to what has already been an especially strong year.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.