The holiday season was impacted by declines in Black Friday visits and a push for an extended holiday retail season. Yet, with Omicron raging, it was difficult to understand which declines were defined by potentially permanent shifts to holiday shopping behavior and which were a direct result of COVID.

While the role of rapidly rising cases is critical to understanding retail performance over recent months, the extended season concept indicates that we might see stronger visit metrics in the post-holiday period than we would normally expect.

And, indeed, visits have been better.

Retail Performance Post-Christmas

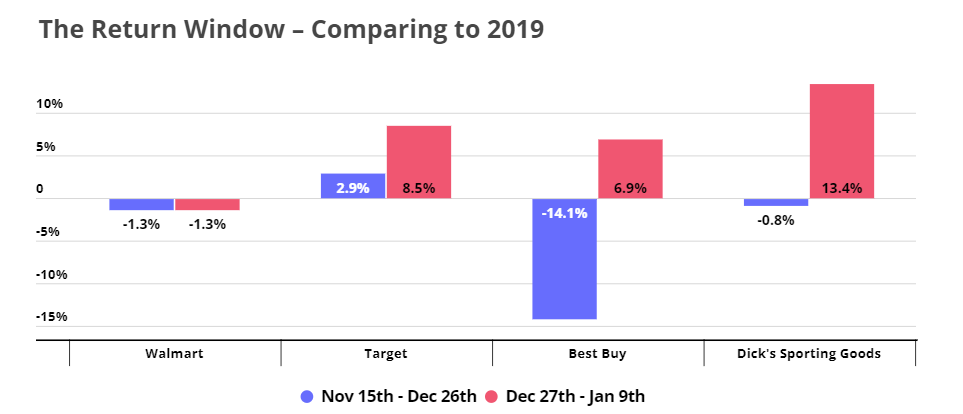

Looking at the average weekly visits compared to the equivalent weeks in 2019 and 2020 shows that the last two weeks performed far better than the six weeks prior. While Walmart visits were almost directly in line when comparing the two periods, Target saw a significantly better performance.

However, two bigger standouts were Best Buy and Dick’s Sporting Goods. In the last two weeks Best Buy saw visits up 6.9% compared to the same weeks in 2019 and 2020, while visits were down just over 14% in the 6 weeks prior. For Dick’s Sporting Goods, the shift was from down 0.8% to up over 13%. While the effects of COVID could still be playing a significant role, the takeaway is clear. The shift in behaviors during the holiday season seem to have given an added boost to post-holiday shopping, with a likely heavy influence from returned items.

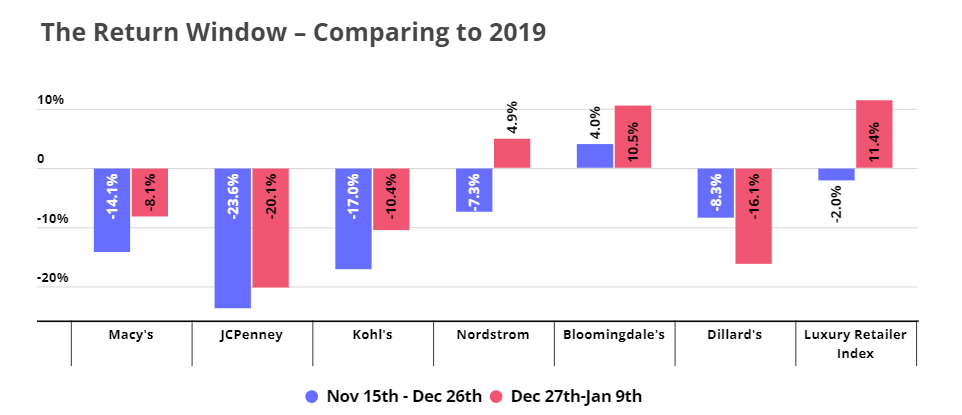

And it wasn’t just these major retailers that saw the shift. Kohl’s and Macy’s saw their visit gaps shrink by nearly 7% and 6% respectively, while Nordstrom, Bloomingdale’s and our Luxury Index, which tracks over 100 luxury retail stores throughout the United States, all saw significant gains compared to the same period in 2019/20.

Why Does This Matter?

The impact of the extended holiday season was the single most important takeaway from retail’s final months of 2021. Retailers were able to effectively communicate a challenge and incentivize visits to help overcome a significant array of obstacles including supply chain issues, labor shortages, and COVID. The result was a far better brick and mortar performance for many retailers than might have been otherwise expected.

Critically, these shifts in behavior appear to have long lasting ramifications. The return period is giving retailers a boost to kick off the year, offering an opportunity to further offset any challenges faced during the pandemic. However, the bigger lesson centers around the ability to engage with customers to drive visits during off-peak periods. The more retailers embrace this approach, the more they will be able to offset challenges – COVID related or not.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.