Barnes & Noble is making a comeback. Foot traffic to existing locations is booming, and the company has even opened several new stores in recent months to keep up with demand.

How did Barnes & Noble do it? We dove into the location analytics to find out.

Transforming a Challenge into an Opportunity

Before COVID took center stage in every discussion on the future of retail, some legacy brands were already struggling to adapt to the millennial shifts in consumer behavior. One of the chains that had the most trouble finding its place in the new increasingly digital retail environment was Barnes & Noble. In 2008, the bookseller started steadily closing stores, and foot traffic continued to fall between 2017 to 2019, even after the pace of store closures slowed down.

In June 2019, the company went private following its sale to a fund run by private equity firm Elliott Management – the same fund that had bought British bookseller Waterstones the previous year. Elliot Management appointed James Daunt, the legendary CEO who successfully nursed Waterstones back to health, as the new CEO of Barnes & Noble, and Daunt was tasked with the formidable job of turning America’s largest brick-and-mortar bookseller around.

Then COVID hit, and all non-essential shut down. But what could have been a fatal blow proved to be a major opportunity. With customers hunkered down at home, Barnes & Noble employees moved fixtures and changed their displays. Local management made major merchandising changes that were better suited to their customers’ tastes and interests, as part of a larger vision of providing local store managers with the autonomy they need to best run their branches.

Barnes & Nobles Visits on the Rise

As the pandemic stretched on into 2021, it was hard to tell whether Barnes & Noble’s refreshed and more locally-embedded stores would be successful in reviving the brand. But since the wider reopening of retail, foot traffic and sales data seems unequivocal – Barnes & Nobles has officially made a comeback.

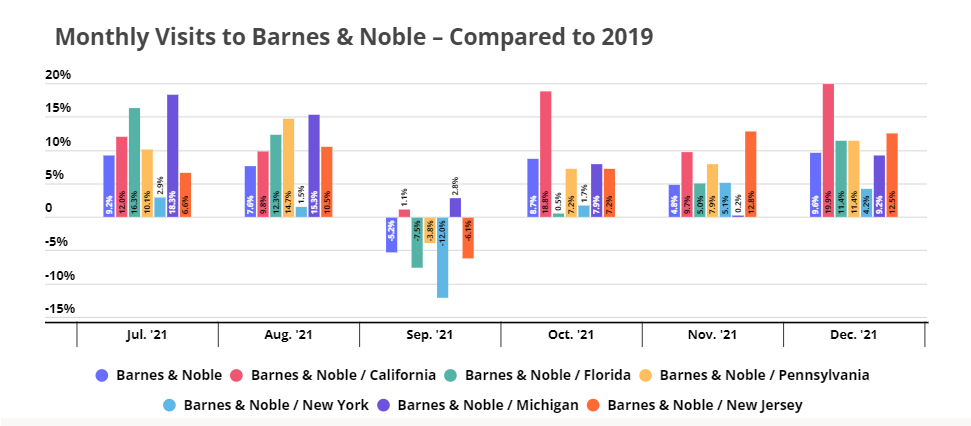

Since July, visits to the bookseller have been up almost every month when compared to 2019, with the exception of September (at the height of the Delta wave). And even then, visits to Barnes & Nobles in California and Michigan remained strong – a testament to the success the local store managers in these states have had in identifying, and providing, exactly what their customers want.

Pandemic Reinvigorated Demand for Books

While Daunt’s strategy has been instrumental in turning the brand around, it is likely that the unique circumstances of 2020 and 2021 have also contributed to the brand’s resurgence. There are only so many movies and tv shows to be watched, and so all the time spent at home has led customers to diversify their entertainment options by adding more old-fashioned types of contents to the mix.

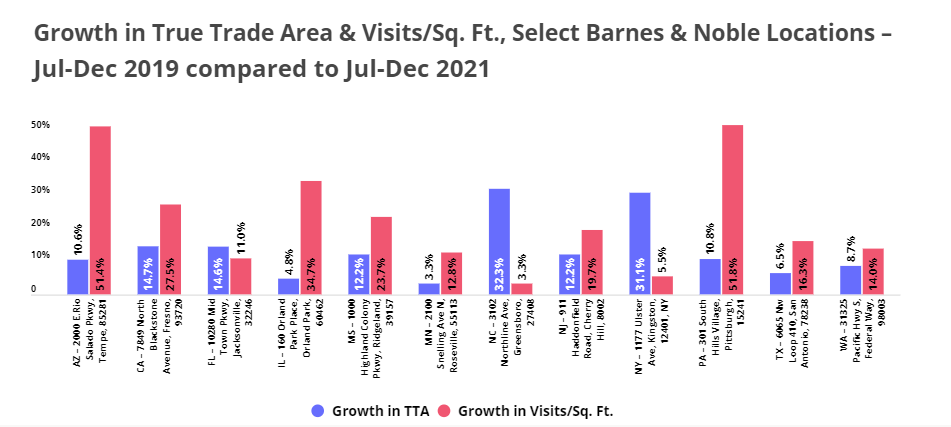

And to satisfy this renewed craving for the printed word, customers have been flocking to their local Barnes & Noble. Foot traffic from select locations throughout the United States showed that these stores did not just see a rise in overall visits – they also saw an increase in True Trade Area, meaning that customers were travelling to the store from further away. It looks like prioritizing catering to local tastes over keeping uniformity of decor and merchandise throughout the chain has paid off.

How Has Customer Behavior Changed Since 2019?

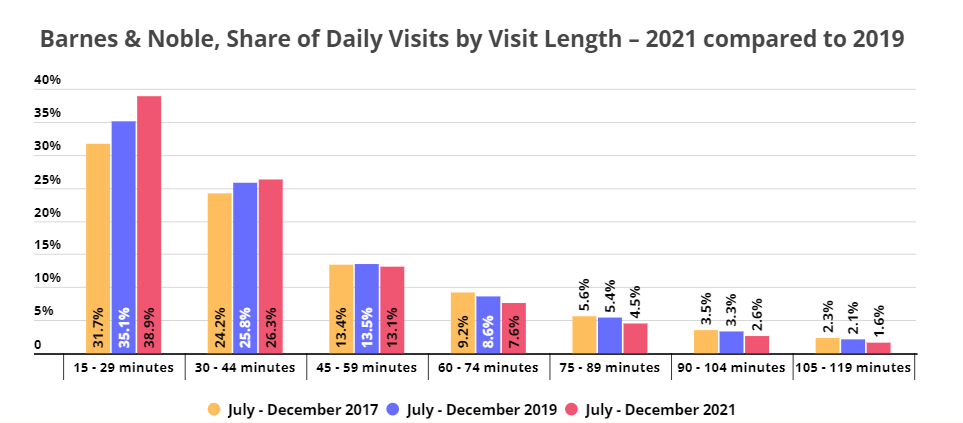

But just because customers are returning to Barnes & Noble does not mean that they are looking for the same experience as they did in 2019. Those old enough to have patronized Barnes & Noble in the ‘90s and early 2000s might remember treating the bookseller a bit like a library. One could spend an afternoon – or a whole day – curled up in overstuffed armchairs with a book picked off the shelf.

Over the years, however, the share of short visits has been increasing, while the share of long visits has gone down. Specifically, the share of 15 to 29 minute visits has increased from 31.7% in 2017 to 38.9% in 2021, while the share of visits lasting 1 to 2 hours dropped from 20.6% in 2017 to 16.3% of all visits in 2021. The drop in visit time is not necessarily negative – it may well mean that Barnes & Noble’s current customers are coming with a much more clear intent to buy, and don’t need to spend as much time browsing in store before deciding to purchase. It also reflects the fact that today’s customers are more savvy across the board and spend more time researching products before stepping into brick and mortar stores – and this likely applies to books just as much as it does to blenders or backpacks or bathing suits.

Still, the fact that Barnes & Noble visits have become shorter does mean that customers may not be getting to all parts of the store or seeing all the displays on every trip – so store managers need to be especially deliberate in choosing what merchandise to exhibit at strategic points, such as near the entrance or registers.

COVID-specific Shifts

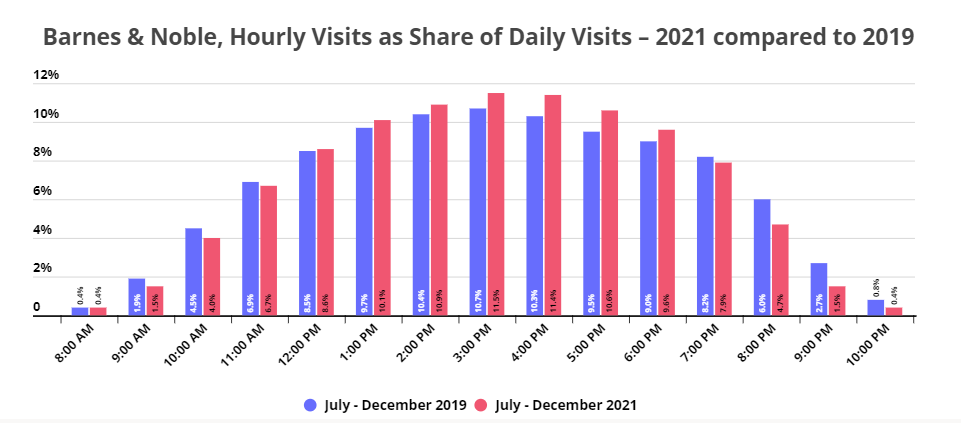

While some changes have been brewing for a while, some behavioral shifts are most specific to the current COVID circumstances. In 2017 and 2019, hourly visits remained similarly distributed throughout the day, with midday visits between the hours of 12 and 6 PM representing on average 67.0% and 68.2%, respectively, of total daily visits. But in 2021, with so many people working from home, the share of mid-day visits climbed to 72.8%.

These numbers mean that at least some of Barnes & Noble’s current visit boost is coming from customers who are taking advantage of their newly flexible schedules to visit bookstores midday. If and when people return to their regular routines, the bookseller will need to find ways to keep those customers coming even after people’s mid-day time slots fill back up.

What’s Next For Barnes & Noble?

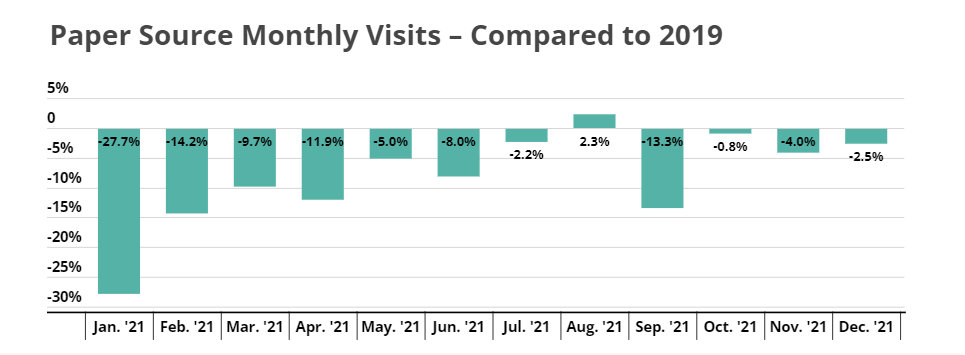

Chicago-based stationery retailer Paper Source filed for bankruptcy in March 2021, and was bought two months later by Elliott Management – the same firm that purchased Barnes & Noble in 2019 and James Daunt has once again been tapped with reviving a chain. While both brands continued operating independently, the potential for deeper collaborations between the bookseller and stationary store was clear.

And indeed, in late November 2021, Paper Source opened shops-in-shops in two Barnes & Noble locations as a pilot, “with plans to scale and localize across their shared 700 plus national retail footprint.” Already, Paper Source’s seasonal items are sold in more than 100 Barnes & Noble stores throughout the country. It seems that Elliott Management and Daunt are out to prove that, despite the rise of smartphones and social media, there is still plenty of room for books and greeting cards in 2022 and beyond.

So far, the foot traffic data seems to be proving them right.

Will Barnes & Noble continue its ascent? Will Paper Source follow in the bookseller’s footsteps?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.