Source: https://www.placer.ai/blog/placer-spotlight-how-the-pandemic-affected-mcdonalds-consumer-behavior/

McDonald’s foot traffic is now on par with pre-pandemic visit levels, but that doesn’t mean that consumer habits have returned to where they were in 2019. We dove into the latest data to find out how McDonald’s consumer behavior has changed since the pandemic.

McDonald’s 2021 Recovery

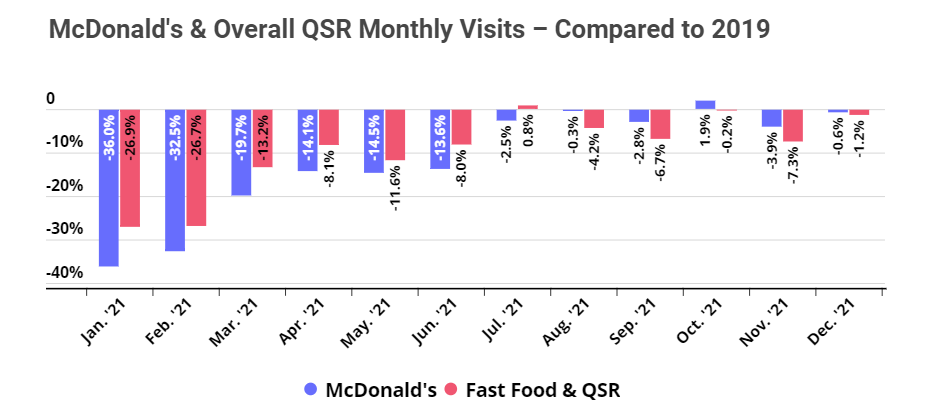

McDonald’s started out 2021 with a larger Yo2Y visit gap than the nationwide category average and remained behind the wider QSR sector throughout the first half of the year. But in July, as the wider dining recovery accelerated, the visit gap to McDonald’s also narrowed significantly. Visit numbers to McDonald’s stayed essentially equivalent to 2019 levels until the end of the year; in December ‘21, McDonald’s Yo2Y visit gap narrowed to only -0.6%. During that time, McDonald’s also remained the dominant QSR player in the United States, enjoying a 46% to 49% monthly visit share of overall burger brands nationwide foot traffic.

Rough Start, Strong Finish for Q1 2022

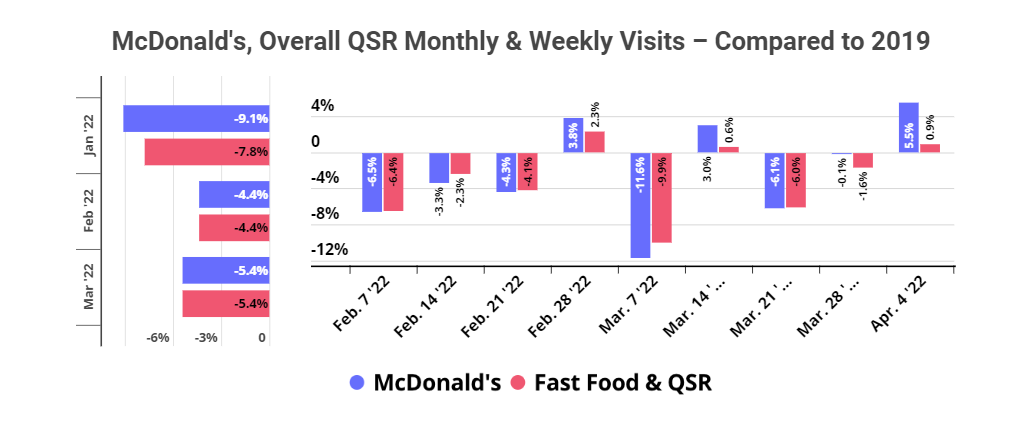

The Omicron wave that set the nationwide dining recovery back also impacted McDonald’s foot traffic. Visits in January and early February were significantly below 2019 levels, and the COVID surge pushed McDonald’s foot traffic back behind the wider fast food sector. But foot traffic to the QSR leader picked up again mid-February, with visits the week of February 28th up 3.8% compared to the equivalent week in 2019. And even though McDonald’s Yo3Y visit gap lingered in February and March, the foot traffic deficit still narrowed by half – and recent data indicates that the fast food leader is on its way to another recovery. Visits for the first full week of April were 5.5% higher than the equivalent week in 2019.

The narrowing of the visit gap in February and March indicates that McDonald’s foot traffic is likely more sensitive to COVID surges than it is to inflation, since visits moved in a positive direction throughout Q1 despite the rising prices. Of course, it is important to note that this data only reflects offline foot traffic and does not take into account delivery or online takeaway orders.

Many McDonald’s patrons likely prefer to get delivery or to pick up their food and eat elsewhere during Coronavirus outbreaks, and the low visit numbers in early 2021 reflect that. Still, the fact that since 2021, nationwide McDonald’s visit numbers have quickly shot back up every time there is a COVID lull points to the enduring demand for on-premise meal ordering, pick-up, and/or consumption – despite the availability of digital channels.

Changes to McDonald’s Consumer Habits

The many shifts in consumer behavior seen in 2020 were actually in the making for some time prior to the pandemic. But other changes are directly related to wider transformations to daily life brought about by the events of the past two years. The shift in dining hours appears to belong in the latter category.

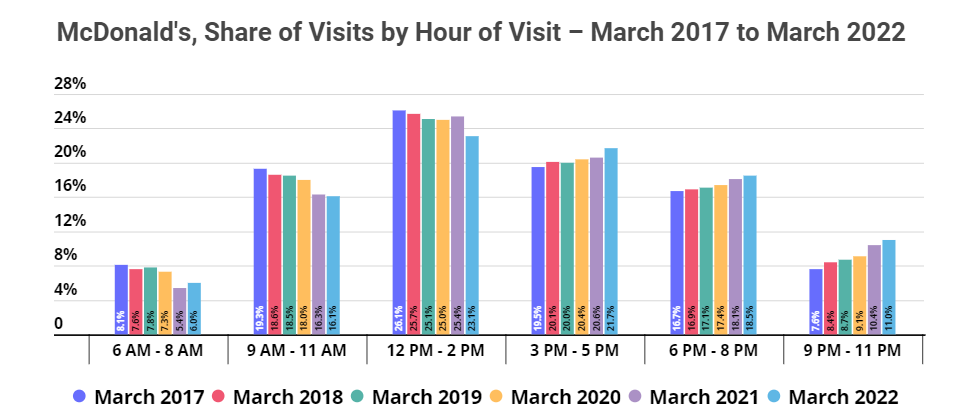

The chart below, which presents McDonald’s share of visits by hour in March between 2017 and 2022, shows that evening foot traffic was somewhat on the rise and morning visits slightly declined between March 2017 and March 2020. Still – especially with regards to the declining proportion of morning visits between 6 and 11 AM – the year-to-year change in foot traffic prior to the pandemic was relatively minute.

But visits plummeted in March 2021 relative to the period between March 2017 and 2020, and they were still low in March 2022. March 2022 also saw a decrease of lunchtime visits (between the hours of 12 and 2 PM) and an increase in later afternoon and evening visits, relative to both pre-pandemic and also March 2021.

The lasting change in visiting hours to McDonald’s is likely due to the dramatic transformation in working patterns since the onset of the pandemic. With so many people still working from home full-or part-time, the demand for breakfast or lunch on-the-go has fallen.

In a survey we conducted in March 2022, 45% of respondents stated that the change in dining visiting hours since the pandemic has impacted their product selection. Some dining brands that previously relied heavily on breakfast foot traffic – such as Dunkin’ – have already adjusted its menu to include more offerings that could attract consumers later in the day.

So while McDonald’s has invested heavily in its breakfast selection in the past, now may be time to diversify its snack and late afternoon menu.

Continued Drop in Returning Monthly Visitors

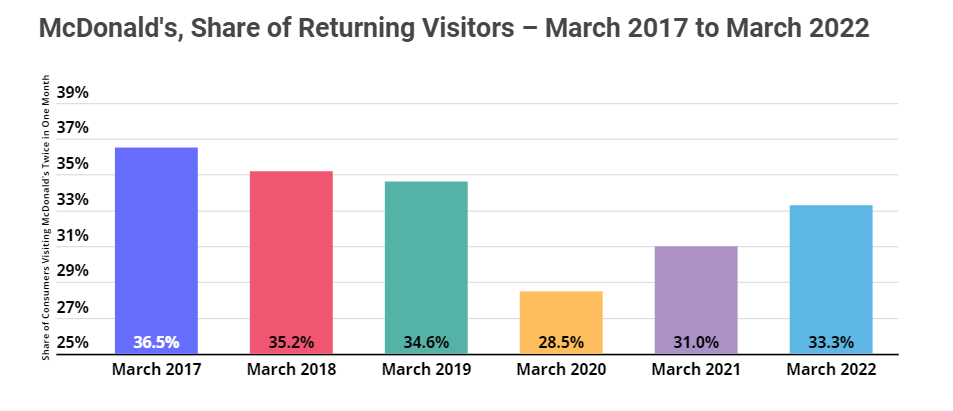

The decrease in morning McDonald’s visits may be primarily driven by new pandemic-induced lifestyle shifts, but the drop in returning monthly visitors seems to continue pre-pandemic trends. The share of returning monthly visitors in March has been dropping steadily since 2017, going from 36.5% in March 2017 to 35.2% in March 2018 to 34.6% in March 2019. After reaching the record low of 28.5% in March 2020, the share of returning visitors climbed back up to 31.0% in March 2021 and then to 33.3% in March 2022, but still remained slightly below 2019 levels.

The consistent decrease in returning visitors may reflect the interest in health and wellness that was on the rise already prior to the pandemic (although the pandemic undoubtedly amplified demand). Perhaps consumers who used to incorporate McDonald’s into their regular meal rotation now view Big Macs as more of a treat.

McDonald’s has been aware of the increasing focus on health for over two decades. Following the short-lived salad shakers in 2000 and introduction of its premium salad line in 2003, McDonald’s stepped up its offering of healthier options across the menu in 2013. But recent attempts at winning over health-conscious consumers, such as adding the McPlant to its line of burgers, has seen mixed results. And due to the drop in traffic over COVID, many of these healthier items disappeared from the menu altogether.

Now, almost two years after the menu contraction, McDonald’s seems ready to gradually add salads back into its product rotation, which could ultimately boost the share of returning visitors.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.