About the Office Building Indexes: These indexes analyze foot traffic data from nearly 200 office buildings (53 in San Francisco, 72 in Manhattan, and 70 in Chicago). They only include commercial office buildings and commercial office buildings on the first floor (like an office building that might include a national coffee chain on the ground floor). They do NOT include mixed-use buildings that are both residential and commercial.

Office Recovery – May 2021 to May 2022

Even as pandemic restrictions eased, the prevailing culture around coming into the office seems to have changed for good. In a recent article, 65% of workers said they would not return to full-time in-office work, and companies are adjusting their expectations accordingly, allowing for a more hybrid work model.

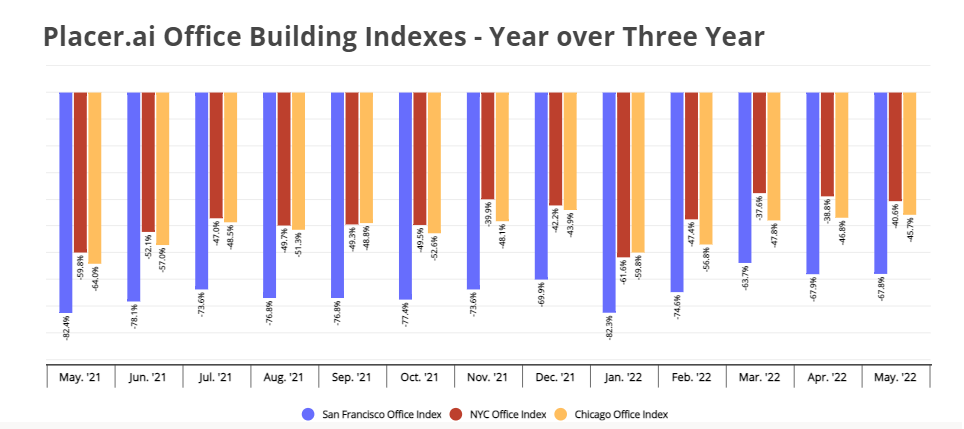

A look at our most recent foot traffic data confirms these trends. Visits to office buildings in San Francisco, New York City, and Chicago are still significantly lower than they were three years ago. But while visit gaps have narrowed as we continue to move further into the “post pandemic” environment, the workplace recovery has not been consistent across cities. In May 2022, year-over-three year visits to office buildings in San Francisco were down by -67.8%, while the office foot traffic gap in New York and Chicago stood at a less dramatic 40.6% and 45.7%, respectively.

Diving into each individual city’s data tells a story about the city itself. Like many major cities, San Francisco experienced a decrease in its population over the past few years, and this may be impacting a slower office recovery. Meanwhile, foot traffic to New York and Chicago office buildings seems to be slowly but surely bouncing back – and major companies are betting that offices in the city will continue their comeback. Google and Facebook just snatched up more office space in NYC, while in Chicago, Google is ready to finalize a massive office expansion project.

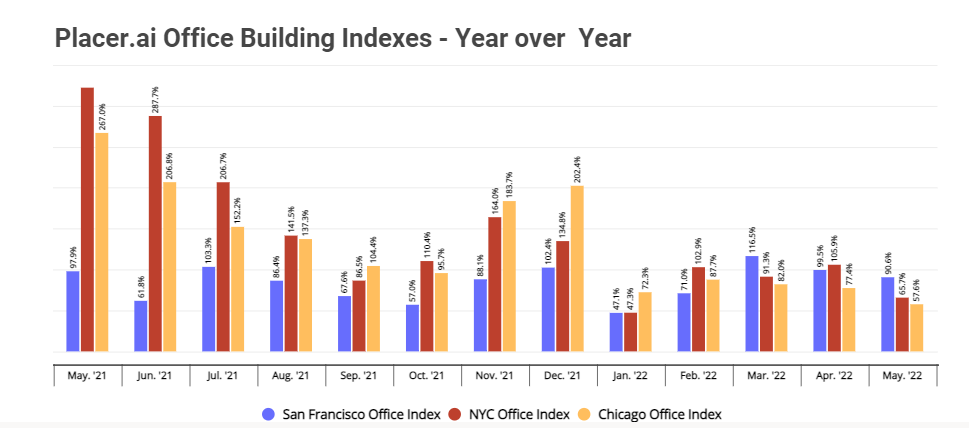

Year over Year Continuing to Improve

While office foot traffic is still lower than it was three years ago, year-over-year (YoY) trends are strong, with May 2022 office visits to San Francisco, New York City, and Chicago up by 90.6%, 65.7%, and 57.6%, respectively. This shows that while the traditional, 9-to-5, five days a week office model may not be returning in the near future, workers haven’t fully abandoned office life. Businesses are also investing in bringing their employees back to their desks – many companies are offering incentives for workers who come into the office a few times a week. And

managers are not the only ones in favor of (at least partial) office attendance. Younger workers, in particular, see the value of being able to collaborate with their coworkers, get face time with higher-ups, and learn and onboard in the tried-and-true ways.

YoY data also highlights the correlation between office foot traffic patterns and overall COVID spikes. January and February 2022 saw overall lower traffic than November and December 2021, which is in line with the Omicron spike that hammered the country earlier this year. And in 2021, YoY office visits fell in September and October, around the time of the Delta surge.

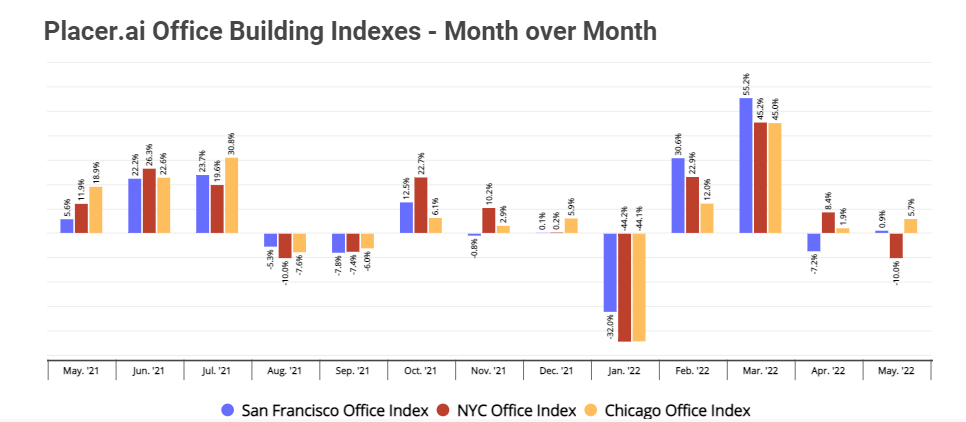

Month-over-Month Visits are Trending Up

Month-over-month (MoM) office traffic indicates that, despite the persistent Yo3Y gaps, office occupancy is trending up. In San Francisco, New York, and Chicago, MoM office foot traffic was up seven, eight, and ten out of the past 13 months, respectively.

Although January 2022 did see a significant decrease in office visits – likely due to the spread of the Omicron variant – visits jumped up again in February, an impressive feat considering the lack of business days. And MoM office traffic in New York and Chicago was up again in April 2022, despite the month having less days than March and even though holidays may have kept office visits artificially low. So, while the popularity of hybrid work may be preventing office buildings from reaching their full pre-pandemic occupancy rates, foot traffic data indicates that a partial return to the office is definitely underway.

With many major companies continuing to offer work from home options for the near future, it may be quite a few years before visits catch up to pre-pandemic levels. However, as COVID concerns continue to wane, a ‘new office normal’ may soon find its equilibrium.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.