Source: https://www.placer.ai/blog/visits-to-bevalc-retailers-remain-higher-than-pre-pandemic%ef%bf%bc/

We looked at year-over-year (YoY) and year-over-three-year (Yo3Y) visits to BevMo!, Total Wine & More, and ABC Fine Wine & Spirits to understand where BevAlc (Beverage Alcohol) visitation patterns stand as we head towards the second half of 2022.

Liquor Store Visits Begin to Normalize

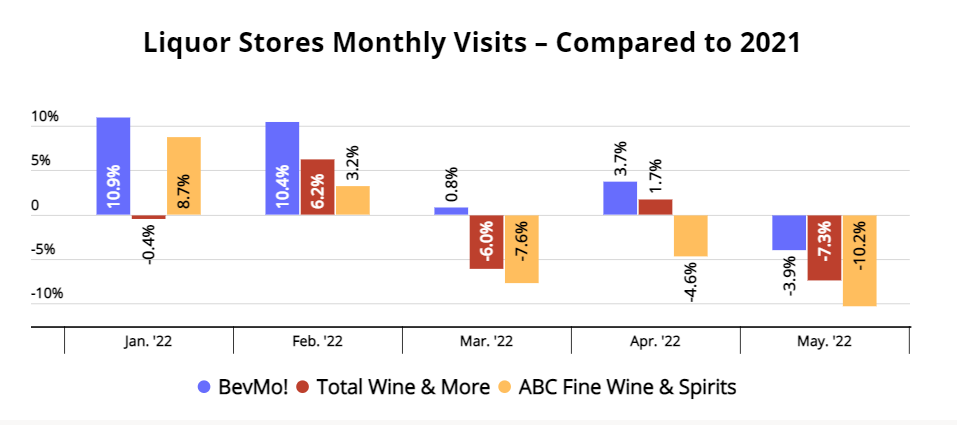

BevAlc foot traffic broke records in 2021, as many Americans turned to alcohol to cope with the pandemic stress. Consumers visited BevMo!, Total Wine & More, and ABC Fine Wine & Spirits in droves to purchase the beers, wines, and spirits they could no longer get at bars and restaurants. And YoY visits in 2022 also started strong with monthly visits in February 2022 up 10.4%, 6.2%, and 3.2%, respectively, for BevMo!, Total Wine, and ABC compared to February 2021.

In recent months, however, BevAlc foot traffic has normalized somewhat from its pandemic heights. Visits have been on a downward trend since March 2022, with all three brands seeing negative YoY visit gaps in May 2022. This could indicate that restaurants and bars are slowly returning to play their pre-pandemic roles in consumers’ drinking routines and social lives.

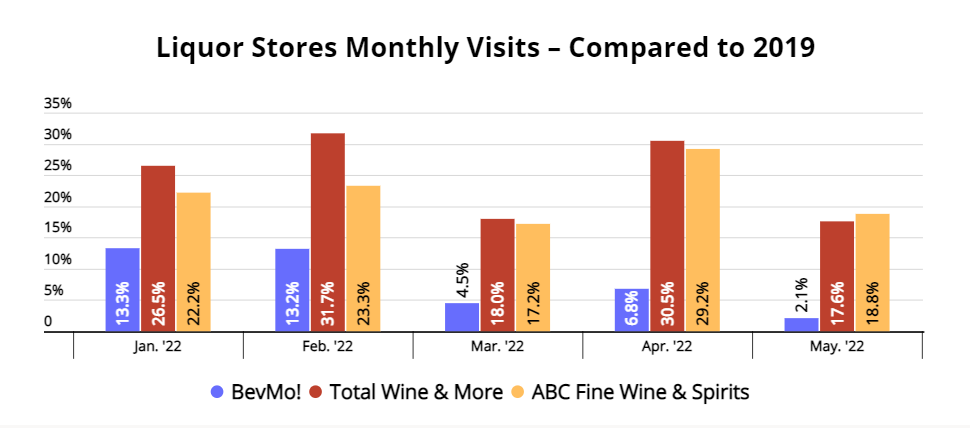

Category Foot Traffic Significantly Higher than in 2019

Still, even as the bar scene returns, foot traffic to the three retailers analyzed is still significantly higher than it was in 2019. In May 2022, visits to BevMo!, Total Wine, and ABC were 2.1%, 17.6%, 18.8% higher, respectively, than in May 2019. And since BevMo!, Total Wine, and ABC have also been investing in their e-commerce channels – and online alcohol sales have risen accordingly – the heightened foot traffic may not even represent the full extent of the increase in demand.

The increase in Yo3Y traffic indicates that, despite the wider bar and restaurant reopening, many of those who increased their drinking over the pandemic are still keeping their home bars better stocked than in 2019.

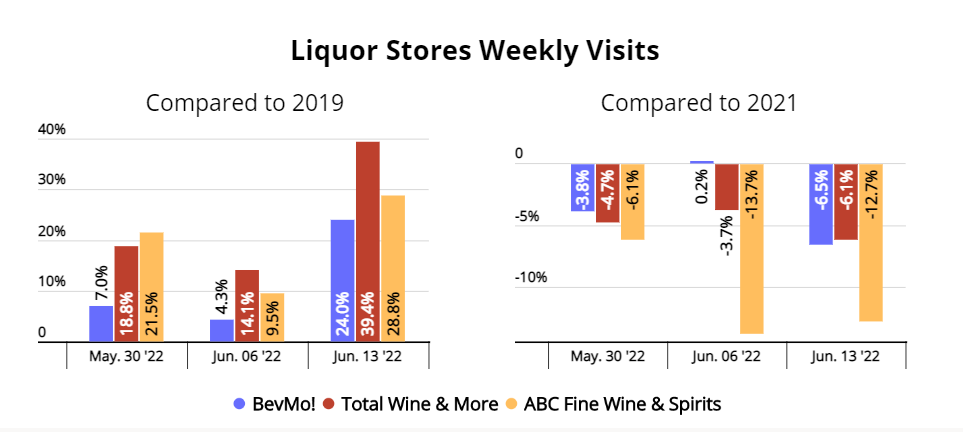

June Foot Traffic Patterns Remain Consistent

Weekly foot traffic trends in June 2022 remained consistent with the visit patterns seen earlier this year – YoY visits fell while Yo3Y visits showed a marked increase. Yo3Y visits for the week of June 13, 2022 were up 24.0%, 39.4%, and 28.8% and YoY visits were down 6.5%, 6.1%, and 12.7% for BevMo!, Total Wine, and ABC, respectively.

The three brands’ strong Yo3Y performance is consistent with the recent 2021 COVID-19 follow-up study that found that the alcohol consumption for several demographic subgroups increased over the pandemic, especially among adults between the ages of 35 to 49. The price of alcohol products has also been relatively un-impacted by inflation, which may make in-store alcohol purchasing particularly attractive now.

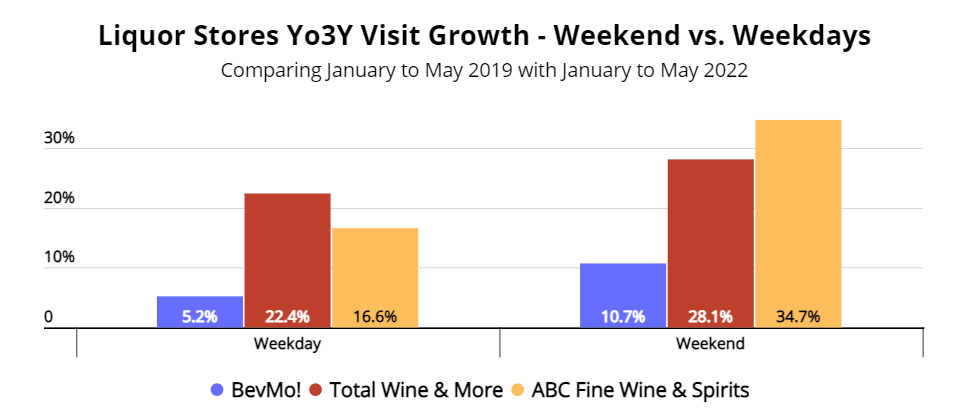

Biggest Increase in Weekend Visits

Looking at location data shows that the growth in 2022 foot traffic relative to 2019 is largely driven by a growth in weekend visits. Between January and May 2022, Yo3Y weekday visits to BevMo!, Total Wine, and ABC increased by 5.2%, 22.4%, and 16.6%, respectively. Meanwhile, Yo3Y weekend visits for the three brands over the same period increased by 10.7%, 28.1%, and 34.7%, respectively.

This may also indicate that more consumers are incorporating a trip to the liquor store into their regular shopping routine. Instead of visiting BevAlc retailers only ahead of special occasions, more consumers may now be adding a stop at BevMo! or Total Wine to their weekend grocery runs. During the isolation and social distancing of the past two years, consumers may have acquired new habits – a glass of wine in the evening, a couple beers on a Sunday afternoon, cocktails with friends on a Friday night – and the sustained increase in Yo3Y BevAlc foot traffic may indicate that these habits are sticking.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.