Placer.ai U.S. Airport Index: The Placer.ai Airport Index analyzes 28 of the busiest airports throughout the United States.

We took a look at airport foot traffic data from the past few months to understand how the travel sector is reacting to easing pandemic restrictions, newfound inflation concerns, and rising gas prices.

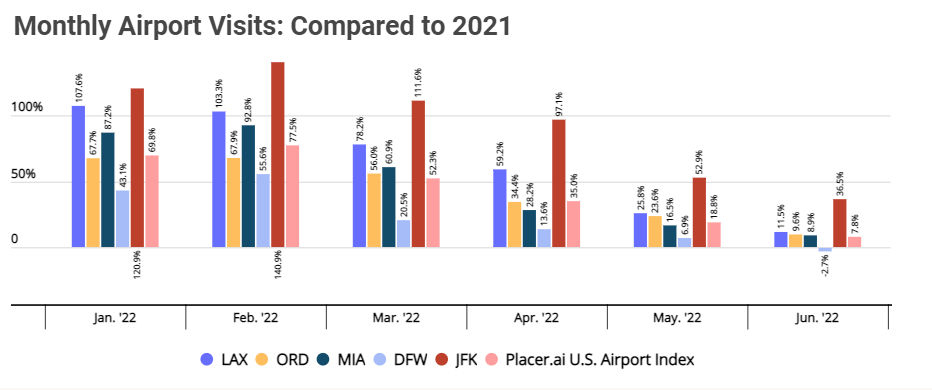

Year-over-Year Visits Continuing to Grow

After two long pandemic years, people are ready to fly again. But a new challenge is throwing a wrench in the budding air travel recovery – airport staffing woes. Many airport and airline employees, including pilots and service workers, were laid off during COVID, and airports are finding that resuming normal operations will take time. Now, demand is outpacing capacity, and delays and canceled flights are becoming the norm as the airport system tries to cope with post-pandemic revenge travel.

But despite these obstacles, year-over-year (YoY) visits have been up almost every month of 2022. And although the growth in YoY visits appears to be leveling out, this is likely a result of the increase in airport visits in Q2 2021 – when cities began to formally reopen – than any downward trend.

So, while June 2022 saw YoY numbers decline relative to earlier in the year, the slowdown in growth is likely more a reflection of the concerns plaguing the industry rather than any real drop in demand for air travel.

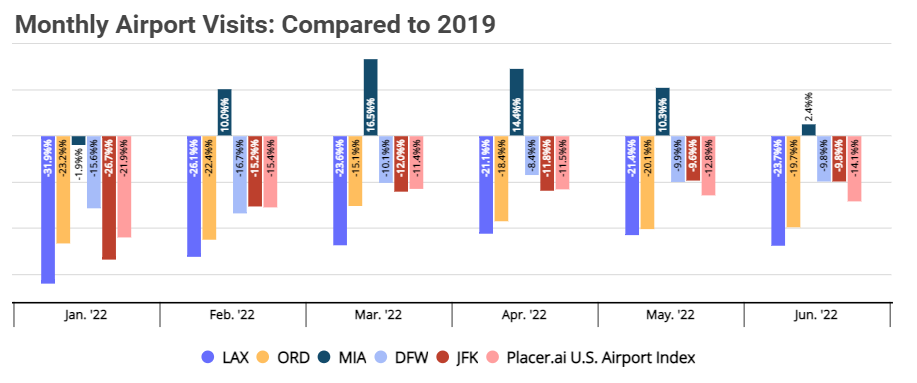

Airport Visits Nearly at Pre-Pandemic Levels

Looking at year-over-three-year (Yo3Y) numbers confirms that, despite the shrinking visit gaps, airport foot traffic has not yet reached pre-pandemic levels. According to the TSA, airports are at 87.7% of their pre-pandemic levels – and foot traffic data confirms these numbers. The Placer.ai U.S Airport Index shows June 2022 visits down 14.1% relative to June 2019. And zooming into a few individual airports (which are included in the index) shows monthly visits in June 2022 down 23.7%, 19.7%, 9.8%, and 9.8% for Los Angeles International (LAX), Chicago O’Hare International (ORD), Dallas-Fort Worth International (DFW), and John F. Kennedy International (JFK), respectively.

Only one airport – Miami International Airport (MIA) – experienced elevated foot traffic, with May and June 2022 seeing 10.3% and 2.4% increases in foot traffic compared to 2019, respectively. This may be explained by Miami’s increased popularity as a place to live and work, and by its seemingly relaxed COVID restrictions.

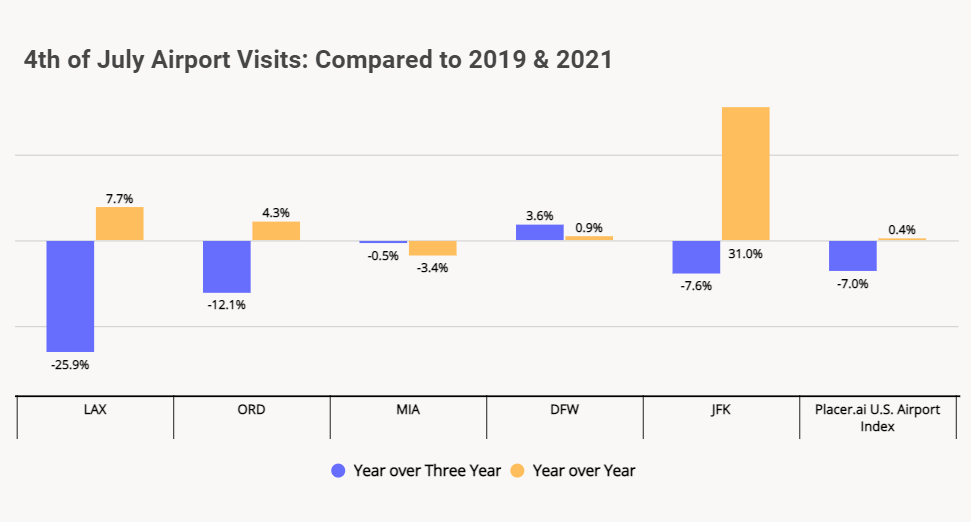

July 4th Visits Lagging

July 4th is a popular weekend for travel – so popular, in fact, that Delta Airlines, affected by overbookings and a scarce workforce, offered cash incentives (including one for $10,000) for travelers on overbooked flights. Overall, more than 2,200 flights were canceled over Independence Day, causing widespread delays and chaos – resulting in fewer people flying and overall reduced airport foot traffic.

Year-over-year visits were still elevated (for the most part) compared to last year – JFK saw 31% more travelers than they had seen in 2021 – which indicates that many have returned to their July 4th travel routine. Still, in almost all cases, Yo3Y foot traffic lagged. LAX, ORD, MIA, and JFK saw a 25.9%, 12.1%, 0.5%, and 7.6% drop, respectively, in Yo3Y July 4th foot traffic. Meanwhile, DFW saw a 3.6% increase in Yo3Y airport visitors – perhaps due to the pandemic population boom in Texas generally, and Dallas in particular.

Despite staffing concerns, widespread chaos and cancellations at airports, people are still ready to take to the skies. However, rising fuel prices and a significant staffing shortage are holding the airport recovery back. So while consumer demand for air travel is high, airports will need to rebuild their capacity before they can make a full foot traffic recovery.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.