Few things are as iconic as the American diner, serving up plates of pancakes and eggs. Over the past few decades, this dining concept has evolved from local stand-alone establishments to regional and national chains. Inflation and other macro headwinds have put pressure on restaurant visitation trends the past several months, but full-service breakfast chains have outperformed the industry.

We catch up with several breakfast and brunch restaurant leaders and take a look at how they are positioning themselves as an affordable luxury and leveraging their knowledge of their customer base to succeed.

First Watch & Waffle House

When we last checked in with First Watch, the company had recently gone public and was in the middle of a robust expansion process. With 449 locations across the country as of 2022, the brand has positioned itself well in the crowded breakfast restaurant space, competing with industry heavyweights such as Waffle House.

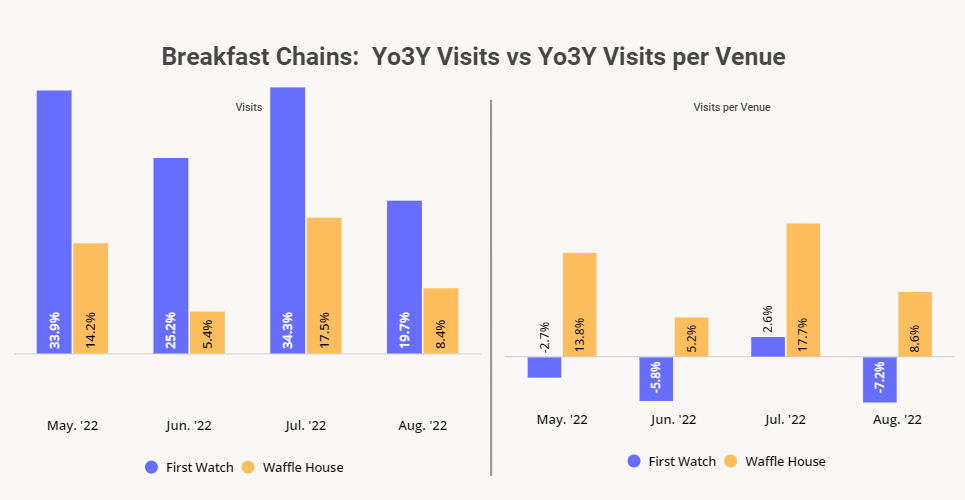

Waffle House, boasting 1,965 locations and open 24/7, has significant brand recognition and cultural cache. This familiarity, and the restaurant’s cult status in many states, may be one of the drivers of its consistent year-over-three-year (Yo3Y) visit growth. Visits to the chain were elevated 17.5% and 8.4% Yo3Y in July and August 2022, respectively, while visits per venue were up 17.7% and 8.6% Yo3Y. The unrelenting success of this chain proves that brand awareness and playing to a loyal customer base pays off.

First Watch saw its Yo3Y visits up 19.7% in August 2022. The company is expanding rapidly, and has been opening around 30 locations a year since 2019 with the hopes of eventually reaching 2,200 locations countrywide. The brand is establishing itself as a force to be reckoned with in the breakfast and brunch space.

Visits-per-venue to First Watch were down – June saw 5.8% fewer visits, while August saw 7.2% fewer visits per venue. But the brand’s ability to maintain elevated visits and only minor dips in its visits-per-venue in a very difficult environment for restaurants is an encouraging sign for its ambitious growth plans.

Smaller Regional Chains

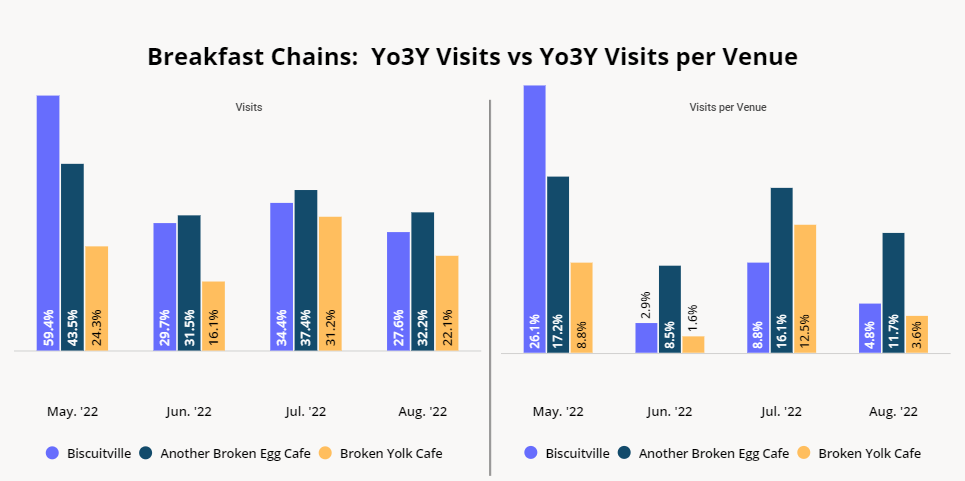

The breakfast restaurant scene in the country is well represented by smaller, regional chains as well. Biscuitville, established in North Carolina in 1966, boasts 65 locations across North Carolina and Virginia, with expansion plans under way. Another Broken Egg Cafe, which offers an elevated Southern-style breakfast, has 80 locations across 20 states and another 20 locations planned. And Broken Yolk Cafe, a California favorite, has 34 locations and 10 more slated to open.

These three chains saw elevated Yo3Y foot traffic every month analyzed, and matched that elevated traffic with impressive visits-per-venue growth. May through August 2022 showed higher visits and visits-per-venue than 2019, possibly driven by the understanding the companies have toward their target audience. These chains all emerged from specific regions and have remained fairly concentrated within those areas, allowing them to learn who their audience is, what they like, and how to deliver it to them. By tapping into regional food tastes, they can position themselves for continued success.

Breakfast has long been said to be the most important meal of the day, and these chains are proving that customers agree. By providing a low-cost option for dining out, and by understanding what their target audience loves about their brand, these chains can continue to see increased success.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.