Our latest white paper, the Q3 2022 Quarterly Index, looks at foot traffic patterns across key retail, dining, and service categories in Q3 2022. For each sector, we broke down weekly foot traffic data over the past quarter and identified several foot traffic leaders that represent the continued resilience of brick-and-mortar businesses over the past quarter. Below is a taste of our findings. For the full report, read the white paper.

Q3 2022 Quarterly Overview

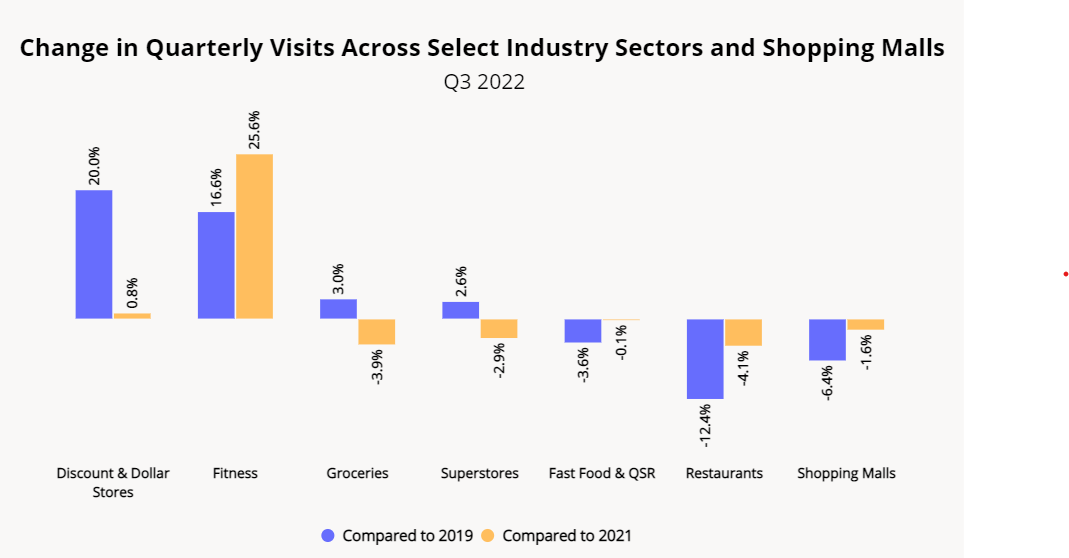

Offline Fitness and Discount stores continued to thrive in Q3 2022, while visits to the Grocery, Superstore, and QSR sectors held relatively steady. Mall foot traffic saw a slight downturn, but full-service restaurants bore the brunt of tighter consumer budgets.

Offline Fitness has been on an impressive growth streak this year after making a full recovery in Q1 2022. The category remained strong in Q2 and the trend continued throughout Q3 2022, with visits up 16.6% relative to Q3 2019 and up 25.6% relative to Q3 2021. Discount and dollar stores also saw their foot traffic up by double digits relative to Q3 2019 and up 0.8% relative to a strong Q3 2021.

Grocery, Superstore, and QSR foot traffic remained more or less on par with previous years. Grocery and Superstore visits fell 3.9% and 2.9% year-over-year (YoY), respectively, but the categories saw a 3.0% and 2.6% increase in visits relative to Q2 2019 – indicating that both segments may still be enjoying a long-term pandemic-driven boost. QSR visits fell 3.6% year-over-three-years (Yo3Y), perhaps due to the numerous permanent branch closures of 2020 and early 2021. Still, visits stayed within 0.1% of Q3 2021 levels, indicating that the category has stabilized post-COVID – an impressive achievement considering the economic uncertainty.

Visits to indoor malls and open-air lifestyle centers are still lagging slightly behind their Q3 2019 levels, but foot traffic is only 1.6% lower than in Q3 2021, showcasing the resilience of the sector in times of economic stress. And restaurants, which bore the brunt of the COVID lockdowns, are now again feeling the impact of inflation, with visits down 12.4% Yo3Y and down 4.1% year-over-year (YoY).

For the full report, dive into Placer.ai’s Q3 2022 Quarterly Index and find out how the current inflation is impacting visit performance across the wider retail and services landscape ahead of the 2022 holiday shopping season.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.