Digitally native brands (DNBs) – or brands that first launch online – take a unique approach to omnichannel business. More than simply drumming up in-store sales, a DNB’s physical presence connects brand and consumers in a way that benefits both offline and online traffic. These stores are well-known for being experiential in nature, and given this past year’s shift in consumer demand from physical goods to experiences, DNBs have the potential to bridge the gap and capitalize during the holiday retail season. We dove into four DNBs – Warby Parker, Allbirds, Marine Layer, and Everlane – and took a closer look at the visitation trends that characterize their expansion into brick-and-mortar to better understand these brands’ offline strategy.

Let’s Get Physical, Physical

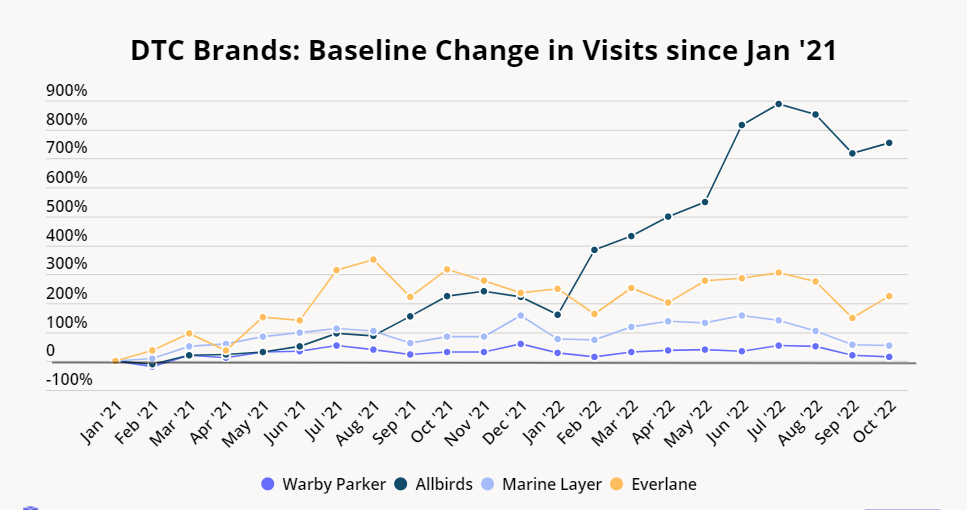

Warby Parker, established in 2010, disrupted the eyewear industry by cutting out the middleman and slashing costs. While the brand’s “Home-Try-On” program became instantly popular, many customers still wanted to try on glasses in person – leading to the brand opening its first flagship store in New York in 2013. Today, Warby Parker boasts over 190 storefronts where consumers can physically connect with the brand, with visits to the company’s stores growing 16.1% between January 2021 and October 2022. And while about 60% of Warby Parker’s transactions occur in-store, the brand reports strong results online and off and is committed to expanding its offline presence even further.

Also launching in 2010, Everlane – a digitally native apparel brand – championed a platform of radical transparency from production to customer. The retailer, which opened its first physical store in 2017, uses its brick-and-mortar locations to communicate this core value. Stepping into Everlane shops, customers find plaques and displays not unlike a museum that aim to educate about the brand’s socially responsible supply chain. Customers clearly appreciate seeing first-hand what the brand stands for – Everlane’s offline visits climbed 224.6% between January 2021 and October 2022.

Marine Layer, which launched in 2009 out of a desire for a simple, soft t-shirt, has developed into a fully-fledged apparel retailer. The brand’s omnichannel strategy is centered around frictionless shopping across offline and digital channels. Services like mobile checkout, endless aisle, and ship-from-store make up a hybrid shopping experience that combines the speed and variety of online shopping with flexible fulfillment options. The strategy is proving to be popular with visitors to Marine Layer. In October 2022 foot traffic was up 53.4% compared to January 2021.

Another DNB that is all about comfort is footwear brand Allbirds which launched in 2016. Through its brick-and-mortar locations, Allbirds conveys comfort and simplicity – the underpinnings of the brand. The chain’s physical stores engage the customer in a natural and un-designed space – just like the shoes themselves – and allow customers to focus on the feel of Allbird’s proprietary fabrics, something that can’t be achieved online. This brick-and-mortar strategy appears to be winning over consumers. Between January 2021 and October 2022 the brand had 753.2% visit growth, a staggering number fueled by record store openings. And the brand’s physical expansion is also fueling online success – after Allbirds opened a Boston store, digital traffic and overall sales in the region jumped 15% and 77%, respectively.

Choice Retail Corridors for DNBs

Looking at where DNBs choose to locate their stores can teach us about the role of brick-and-mortar expansions in these companies’ omnichannel strategy. One reason so many DNBs have been expanding offline is that physical stores are invaluable for building brand awareness and acquiring customers online and off.

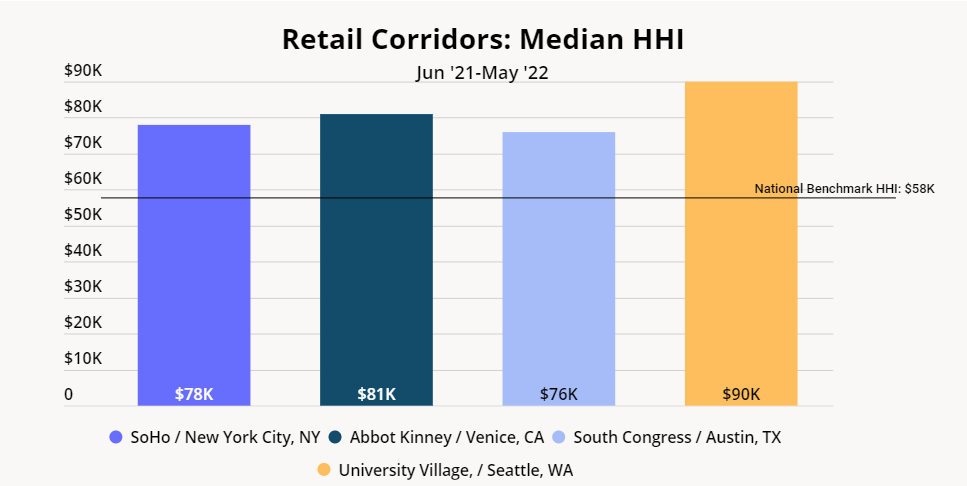

The four DNBs analyzed above are well represented in premium retail corridors, including Soho in NY, Abbot Kinney in Venice, CA, South Congress in Austin, TX, and University Village in Seattle, WA. These pedestrian-friendly clusters of stores and dining venues attract high-income consumers looking to browse, shop, or simply hang out, and are prime locations for companies looking to reach new audiences. DNBs are particularly interested in these corridors because they are walkable, social landscapes that curate a unique customer experience and offer a level of brand engagement that is difficult to replicate online.

Retail corridors that attract upscale foot traffic are particularly likely to deliver special events and a generally rich sensory atmosphere; this is especially true during the holiday season when light festivals and tree lightings are a staple of these districts. Shoppers, in turn, take their time and seek excitement when out and about. The result is a market ripe with high-value customers looking for one-of-a-kind retail experiences that DNBs are known for and who are eager to share via social media when they find them. The offline engagement and increased brand awareness also drives sales through digital channels – a fundamental goal of DNBs’ brick-and-mortar strategy.

Digitally Native, But Not Digitally Exclusive

DNBs prove that investment in physical as well as digital traffic is not a zero-sum game. These brands take an approach to brick-and-mortar expansion that serves both offline and online goals by choosing optimal locations for brand and buyer to connect.

Building maximum brand awareness and driving engagement are the keys to transitioning into a fully omnichannel business and visit data for these DNBs suggests they have successfully made the jump.

Ahead of the holidays and in a retail climate in which consumers are drawn to new experiences, DNBs are positioned to thrive as brick-and-mortar operations.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.