Our latest white paper, Beauty’s Irresistible Allure, draws on location intelligence and demographic data to analyze three leading beauty brands that are adapting to evolving consumer demand in this growing market. Below is a taste of our findings.

When it comes to makeup and perfume, there’s nothing quite like in-person shopping. From finding just the right look to browsing with friends, cosmetics chains offer consumers a chance to find products that make them feel good, while having fun and engaging in social interaction. Looking ahead to 2023, the beauty industry – like fitness and other experiential wellness categories – appears poised for continued growth.

Beauty’s Post-Pandemic Boom

Since March 2021, the beauty industry has been on a consistent upward trajectory. While a health and wellness focus helped drive strength early in the pandemic, as the masks came off and people started getting dressed up again, Americans were given another reason to stock up on beauty supplies. And much of this shopping took place offline. While virtual try-ons can help shoppers choose the right products, nothing beats browsing the make-up counter and sampling new colors and scents in-store. Indeed, even as inflation put a damper on shopping sprees, consumers continued to flock to chains like Ulta Beauty and Sephora, eager to splurge on discretionary items that didn’t break the bank and made them feel good. Other self-care categories, like fitness, also experienced an uptick as the pandemic began to subside.

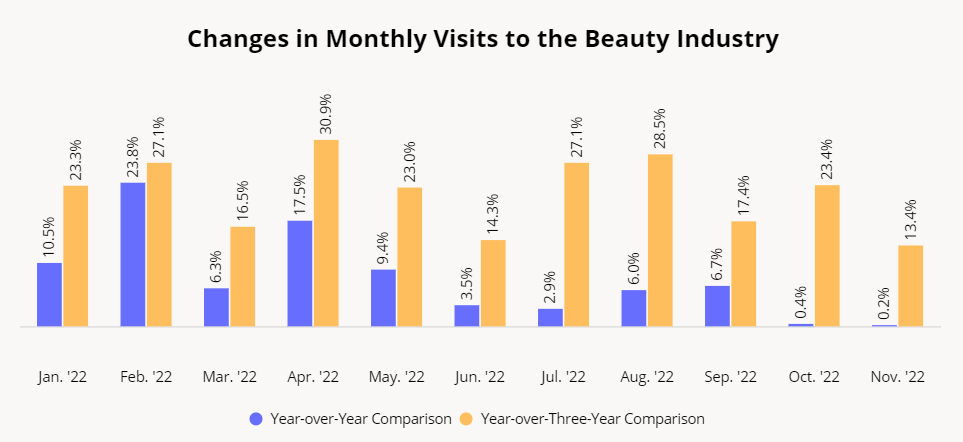

Compared to both 2019 and 2021, visits to beauty industry venues have increased significantly. Throughout 2022, foot traffic remained between 13.4% and 30.9% higher than it was three years prior. And even though 2021 saw particularly strong performance from March onwards, visits in 2022 were also up year over year. This increase in foot traffic was driven, in part, by moves by leading retailers like Ulta Beauty and Sephora to expand their fleets to keep up with growing demand.

Identifying Winning Strategies

While the sector is doing well overall, some strategies have proven especially successful at enhancing performance.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.