Super Saturday – the last Saturday before Christmas – draws crowds of last-minute gift buyers to retailers across the country. We dove into the data to understand how this day fit into the wider 2022 holiday shopping season and how consumer concern over rising prices impacted this year’s performance.

Super Saturday Drives Significant Peaks

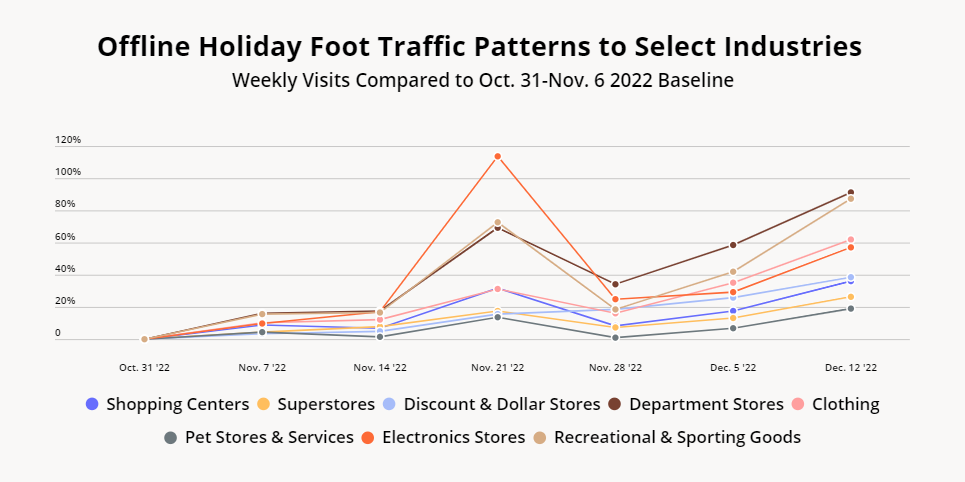

Super Saturday presented a continuation of a trend seen in recent months — a more extended holiday season limits the peaks of any specific day. There is even more time for shopping ahead of the holiday and ample evidence that the lack of major doorbuster deals limits the urgency on any specific day.

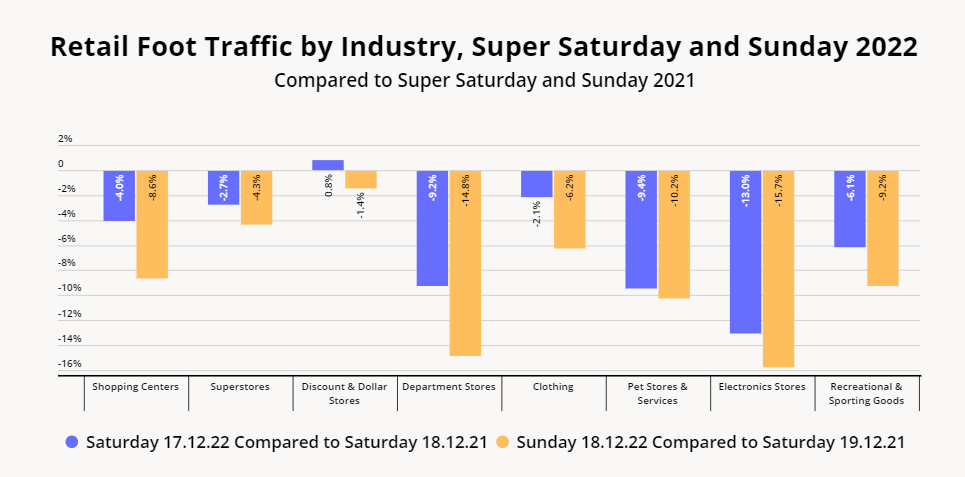

Most categories and chains analyzed saw visits down compared to 2021, which is consistent with some reports of Americans cutting down on gifts this year as inflation squeezes budgets. At the same time, minor year-over-year (YoY) declines could be offset by longer and more significant visits, which may mean that basket sizes have increased or that extended discovery in an offline environment is driving more online sales.

Super Saturday Still Drives Visit Peaks

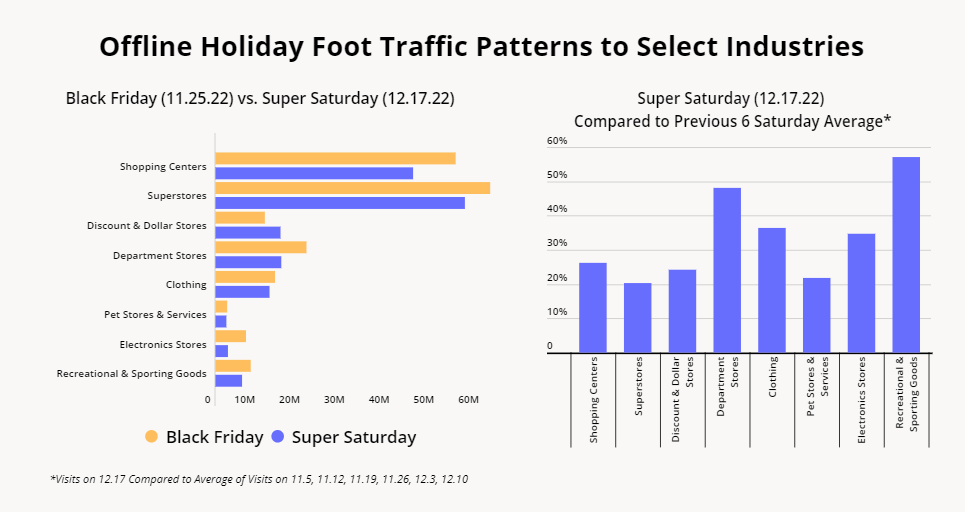

In many ways, Black Friday and Super Saturday bookend the holiday shopping season.

And despite the YoY declines, it’s critical to note that Super Saturday, like Black Friday, still drove massive visit peaks for most chains and categories examined, with visits to select categories up 20-60% relative to the previous six Saturday visit average.

And while Black Friday usually gets the bulk of the attention, location intelligence indicates Super Saturday visits are not so far behind. This year’s Super Saturday visits to superstores, specialty apparel retailers, and pet care brands – a surprising stop on many consumers’ holiday gift buying trajectory – were less than 10% lower than visits to those categories on Black Friday 2022. At dollar and discount stores, visits were actually 31.5% higher on Super Saturday than on Black Friday.

The more traditional Black Friday categories of shopping centers, department stores, and recreational and sporting goods retailers saw 17.6%, 27.2%, and 25.2% declines on Super Saturday 2022 relative to this year’s Black Friday, while electronics visits were down a whopping 59.6% in the same comparison. But zooming out at the larger holiday season paints a more nuanced picture.

Aside from electronics – which still sees its annual visit peak during the week of Black Friday – all other categories analyzed received more visits the week of Super Saturday. This result may not seem all that surprising, given that Black Friday week also includes Thanksgiving, a notoriously weak day for retail. But the strength of Super Saturday week does highlight the limited impact that any single day will have on the performance of most brands and categories.

Super Saturday Winners

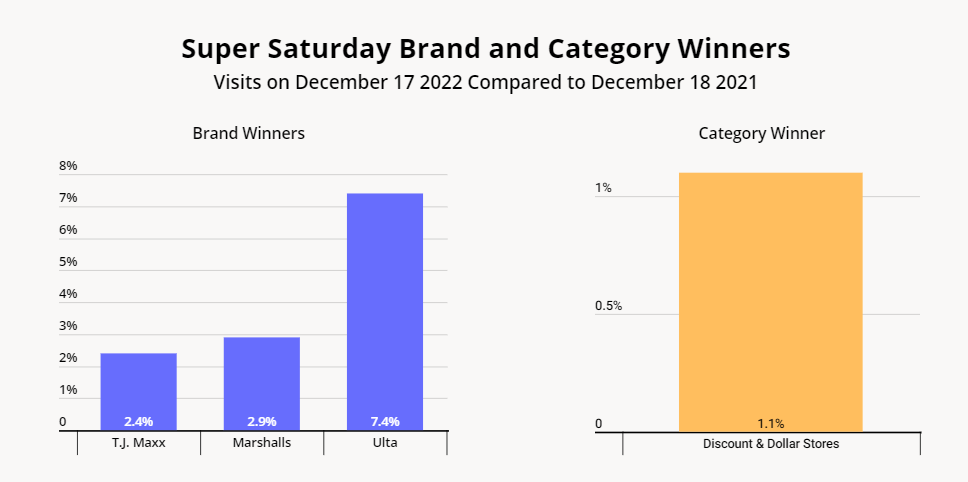

And even as the retail context shifts from promotion days to promotion weeks and seasons, there are chains and segments that did over-perform this Super Saturday. Ulta continued to show its strength, and the strength of the wider beauty category. Off-price retail leaders like T.J. Maxx and Marshalls also saw growth relative to 2021, in line with previous years when the category saw stronger performance later in the holiday season than during the Black Friday wave. Finally, the discount & dollar segment saw growth likely driven by the draw of their value orientation and wide product array ahead of the holiday. This category, alongside superstores, could also benefit from an extended pre-Christmas period after Super Saturday that should drive ongoing visits for those who need last minute items ahead of the holiday.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.