Source: https://www.placeiq.com/2023/03/revisiting-the-impact-of-covid-on-downtown-suburban-regions/

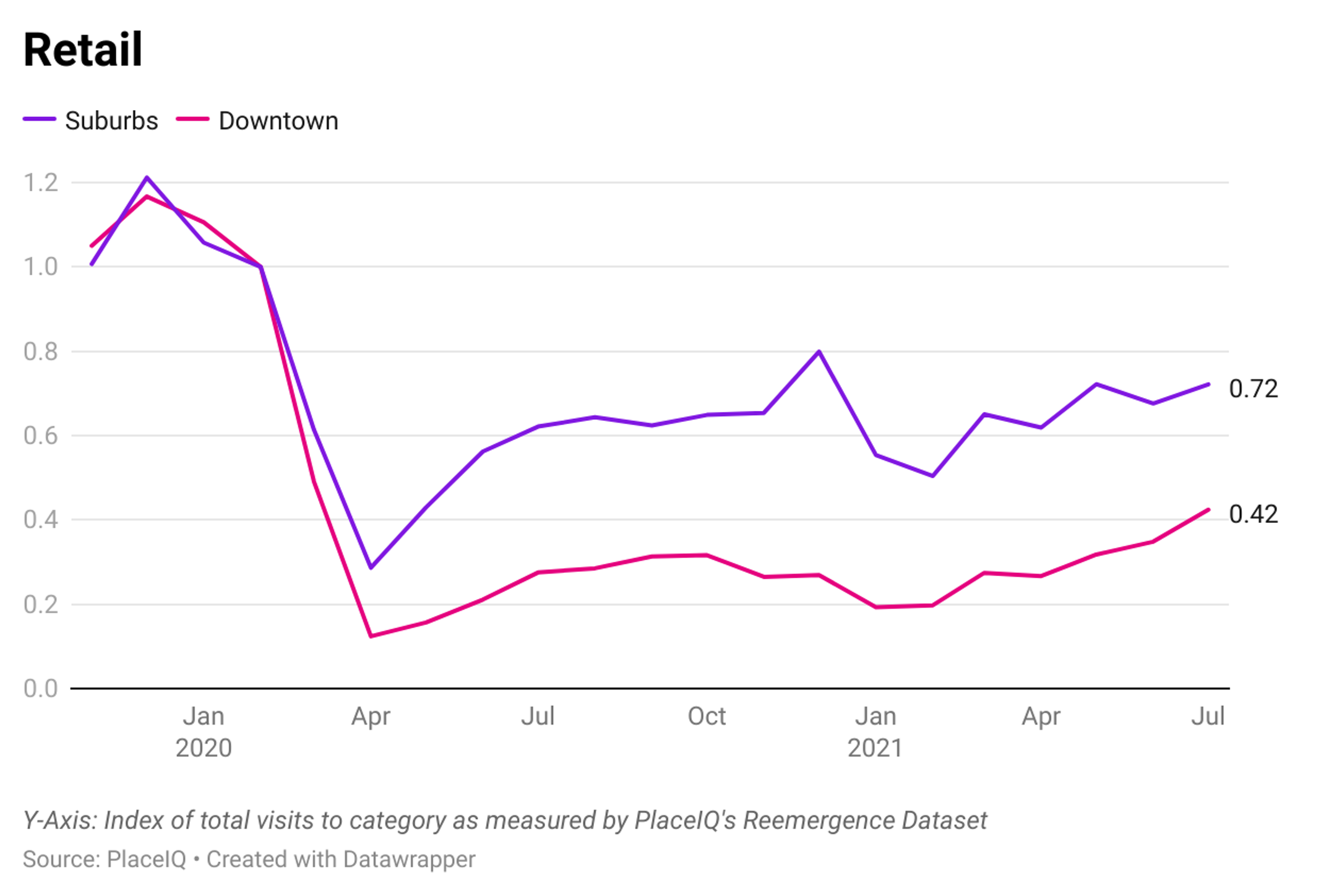

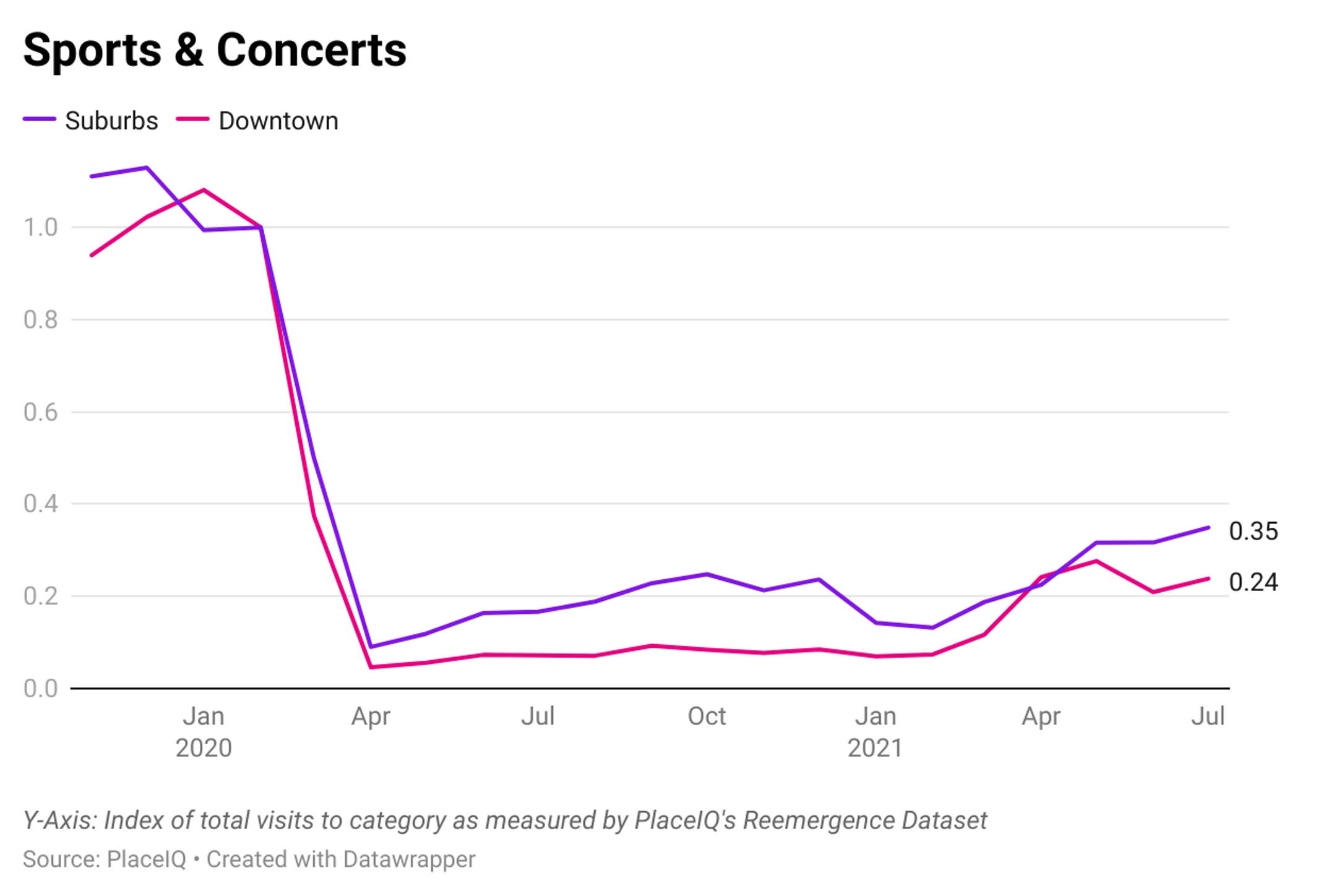

As 2022 wound down, we at PlaceIQ took one last look at our Reemergence Dataset: the year-over-year index we built to power our Social Distance Tracker. The Reemergence Dataset compared a panel of foot traffic against 2019, our pre-pandemic benchmark.

Throughout our analysis, we’ve spotted many hidden trends. From selective returns of consumer demand to changing dining preferences. From the quirks with the return to campuses to shopping while distancing. Before we filed the Reemergence Dataset into cold storage, we had a lingering question regarding the recovery of urban and suburban areas.

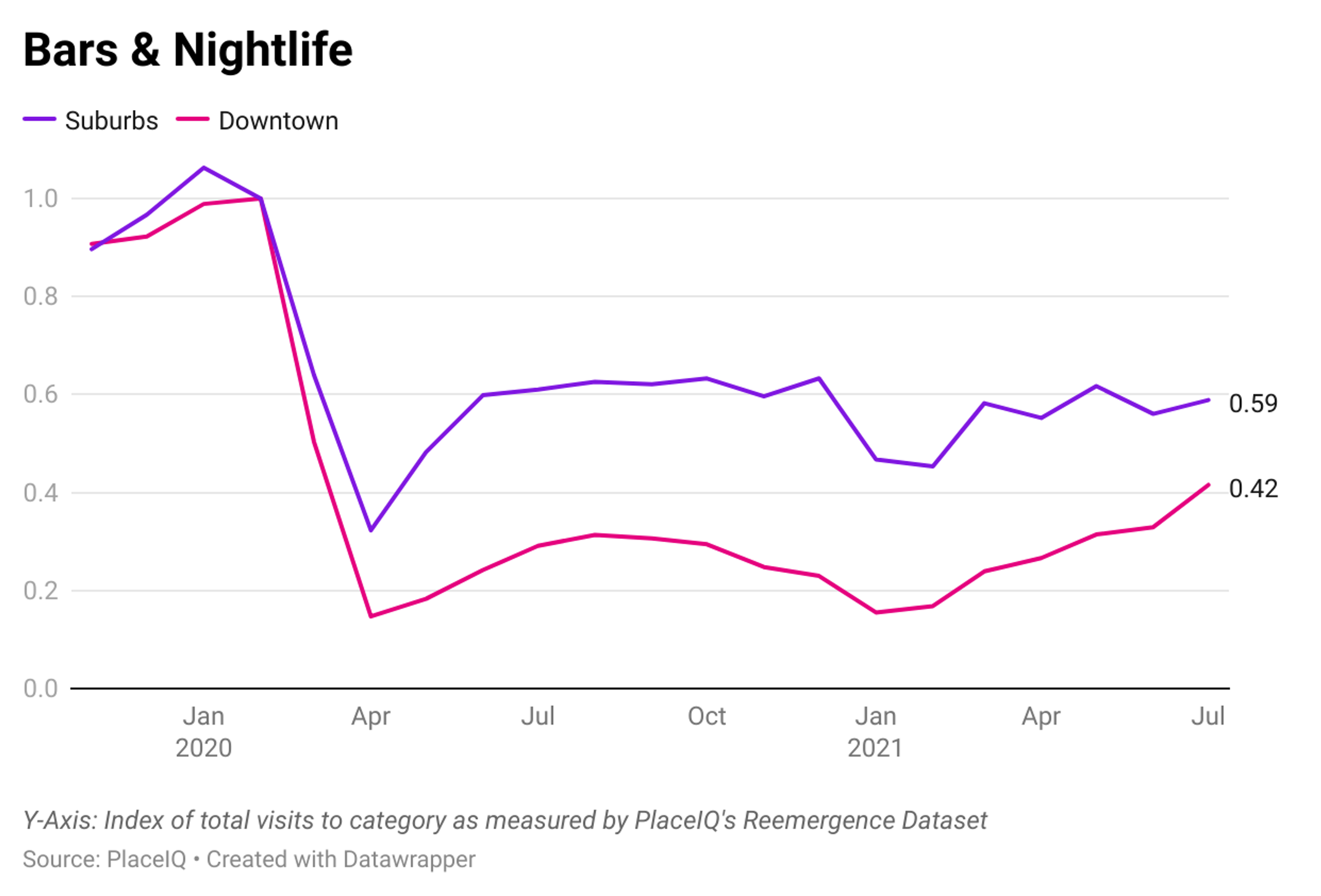

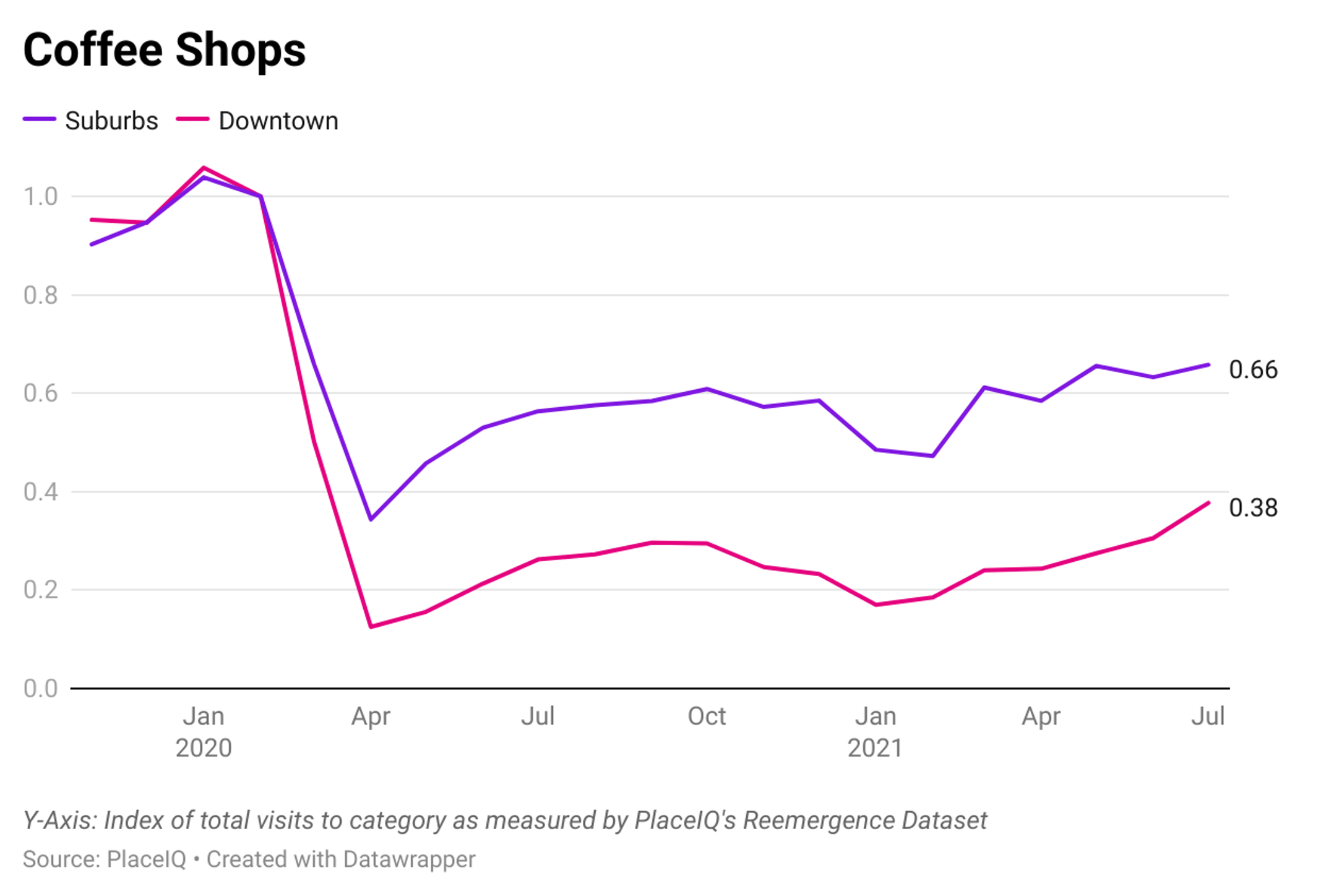

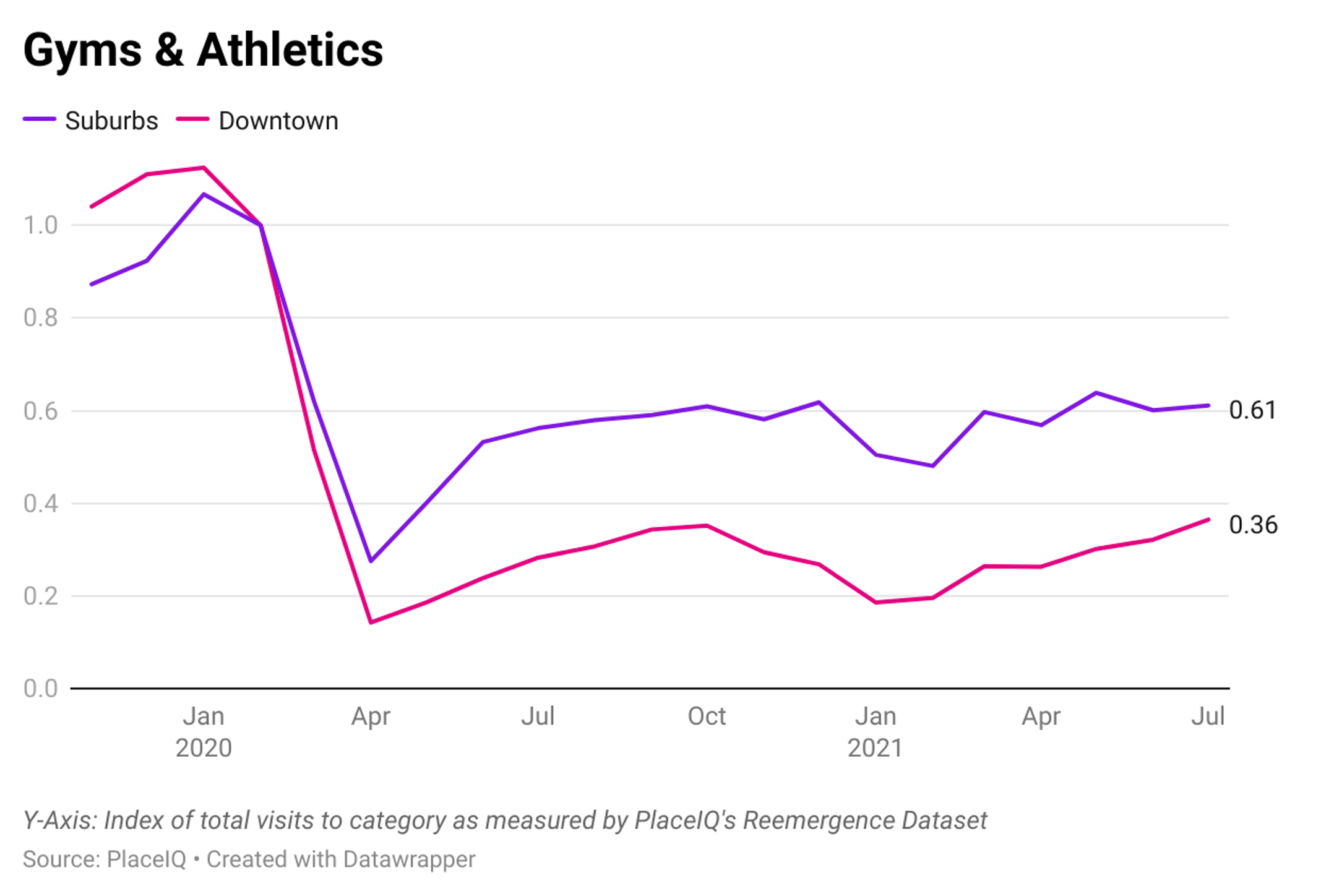

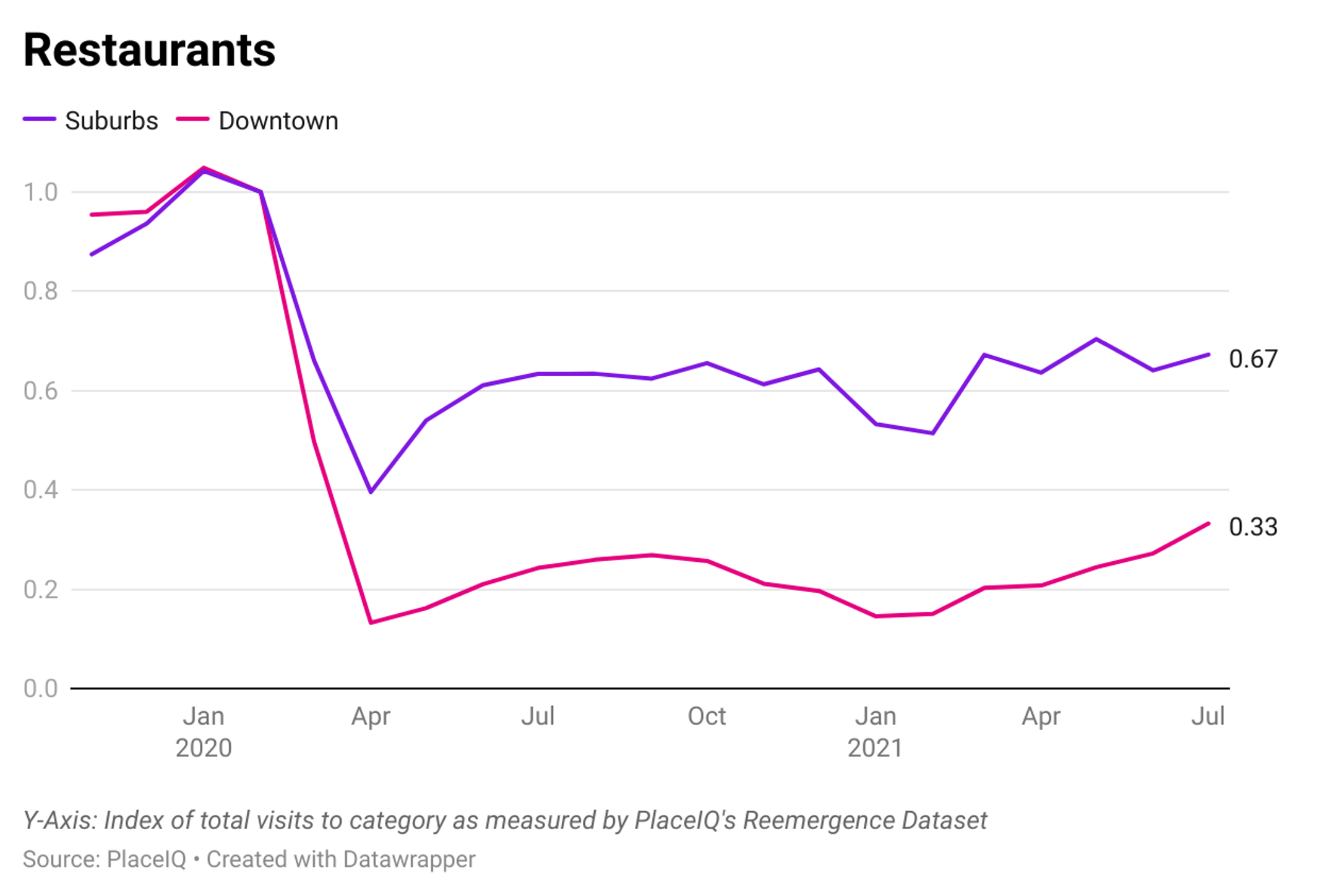

We kept things simple: we identified 6 categories of venues and 12 major cities (New York, Los Angeles, Chicago, Dallas, Houston, Miami, Philadelphia, Washington, Atlanta, Boston, San Francisco, and Phoenix). We then defined “Downtown” as everything within a 2 km radius from each city center. “Suburbs” were defined as everything between the 2 km “Downtown” limit and the respective Census defined Core-Based Statistical Area (CBSA). We then grouped all the Downtowns and Suburb regions for our cities, counted up visits to each category, and indexed them.

Now keep in mind: the Reemergence Dataset ends in July of 2021. All of the regions analyzed here have rebounded significantly since this date. However, our findings show the significant differences in how much rebound occurred in Suburban and Downtown regions.

Both Downtown and Suburban regions fell in lockstep with the onset of COVID. But Suburbs arrested their fall and rebounded significantly compared to Downtowns, which remained largely at their lows. Work-from-home scenarios (removing daily commutes) and urban migration (especially among young families) froze Downtown in time.

Only at the end of our dataset, in Q2 or 2021, did Downtown regions begin to stage a comeback and close the gap with Suburban routines. While the return to office continues apace in our data, driving downtown recovery, the fact that these regions are coming from so far behind means urban recovery lasts beyond the threat of COVID.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.