Hong Kong fully removed its strict border restrictions on 13th December 2022, and its mask mandate on 1st March 2023 - one of the last territories in the world to do so. Throughout their prolonged lockdown, airlines faced stringent measures and strict penalties, leading to many simply canceling their routes altogether. At its worst, airline capacity in April 2020 dropped to -92% compared to 2019 levels, and recovered to a meager -75% in November 2022. As we know by now, reopening presents its own challenges. So, with just over three months’ worth of reduced border controls under their belt, how is aviation recovering at one of the world’s pre-pandemic busiest megahubs?

Following its reopening, Hong Kong has rapidly added back over half a million seats, growing airline capacity to 1.7 million in March 2023, 56% below 2019 levels.

Hong Kong’s Aviation Recovery Inextricably Linked to Greater China’s Reopening

Despite removing its barriers to entry in December 2022, Hong Kong was missing one magic ingredient for its aviation recovery: China. In 2019, mainland China was - by far - the top international arrivals market in Hong Kong, blowing the rest of the arrivals out of the water by garnering a 78% market share with 55.9 million travelers.

Although Hong Kong had (in theory) thrown the borders open to mainland Chinese travelers, China still had tight controls over its borders; Hong Kong-China travelers had to contend with quotas and testing, which limited demand and capacity.

With China’s surprise announcement that it would fully resume cross-border travel from 6 February 2023, we have just started to see the momentum this has added to Hong Kong’s tourism.

The Hong Kong Tourism Board announced that in February 2023 inbound arrivals grew to 1.5 million, the first time it surpassed the 1 million mark since pre-pandemic. and 1.1 million of those were from mainland China.

Whilst many of the arrivals from China are via the land borders, China nevertheless dominates the share of scheduled airline seat capacity from Hong Kong. In March 2019, China accounted for 21% of all air capacity; 802k seats. In March 2023, seat capacity to China is still 60% down on 2019 levels, at 321k seats, but has doubled since December 2022.

Forward-looking scheduled data doesn’t point to much of an uplift in seat capacity by June 2023, reaching 356k seats - but we need to take that with a pinch of salt, as we know that China tends to adjust their airline schedules very late, and we expect to see much more additional capacity.

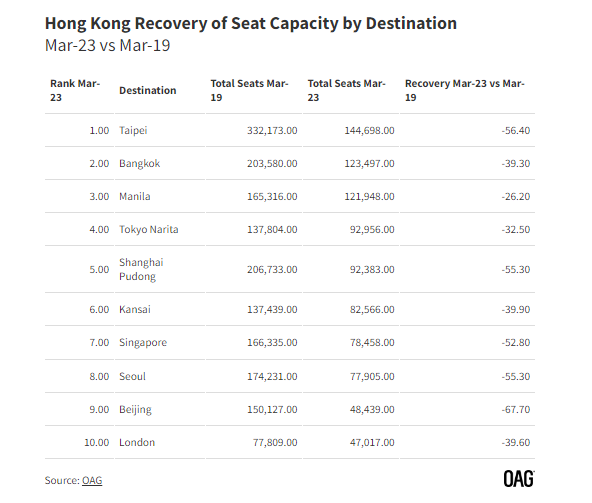

Chinese Taipei is another key market for Hong Kong. In March 2019, Chinese Taipei held the third largest airline seat capacity by country from Hong Kong, with an 11% share and 444k seats. Taipei airport was the destination with the highest number of seats, at 332k.

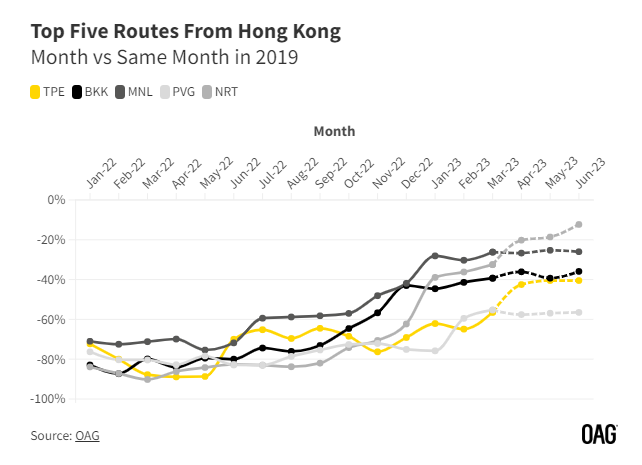

Chinese Taipei had restrictions on arrivals from Hong Kong until even later than China - on 20 February 2023 it allowed independent travelers to apply for entry. The impact of this late easing can be seen in airline seat capacity between Hong Kong-Taipei - March 2023 capacity is still 56% below 2019 levels. However, airlines are planning to add back capacity at a high rate, bringing this figure to 41% below June 2019 by June 2023.

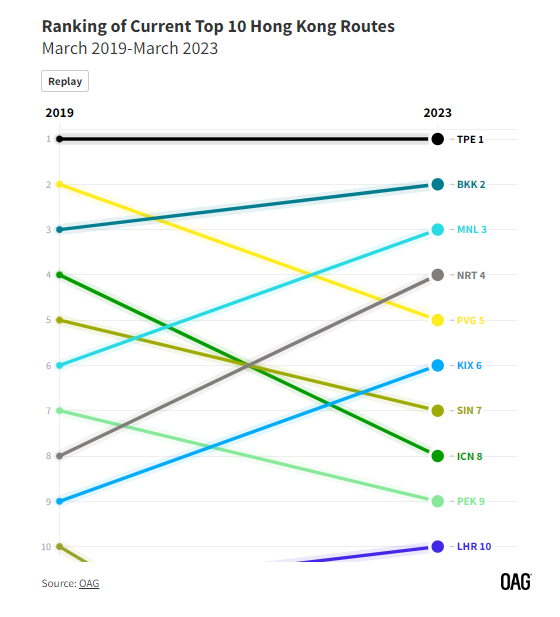

Hong Kong’s top ten destination airports in terms of seat capacity have changed little between March 2019 and March 2023: Taipei, Bangkok, Manila, Tokyo Narita, Shanghai Pudong, Kansai, Singapore, Seoul, Beijing and London Heathrow. Kuala Lumpur, 10th on the list in March 2019, has fallen to 15th place in 2023, whilst London Heathrow has crept up one spot from 11th to 10th.

However, recovery of seat capacities vs 2019 to these destinations varies widely, from Manila’s bounce back of 26% below the same month in 2019 to Beijing’s slow burner 68% below.

Other notable destinations with the highest levels of recovery vs 2019 outside of the top ten include Frankfurt (-19%), and Guangzhou (-11%), with the build back to Guangzhou driven by Cathay Pacific - perhaps with a nod to anticipated intensified competition from Greater Bay Airlines. The latter - launched in July 2022 using Hong Kong as its hub - has recently placed an order of 15 B737-9 planes and has permission to operate 104 routes by 2027.

In terms of connectivity, Hong Kong is still missing many of its destinations, reaching 94 in March 2023 versus 155 in March 2019. Schedules indicate that this will increase to 98 by June 2023. Countries still missing connections include Russia, Myanmar, and South Africa, whilst the US has seen just four of its nine destinations restored, with routes to Dallas Fort Worth, Newark, Washington Dulles, Chicago, and Seattle still not yet operating.

Of course, we can’t talk about aviation recovery in Hong Kong without looking at the Cathay Pacific Group.

Although in March 2023 the Cathay Pacific Group operated just 36 of the 101 routes it was operating in March 2019, it is adding back capacity at a high pace. Cathay Pacific itself was at -35% of 2019 capacity with 782k seats, higher than Hong Kong’s average capacity of -56%.

Apart from Guangzhou, routes that have seen capacity added at a higher rate from Cathay Pacific include:

Whilst Taipei is still in the doldrums (-79%). On the plus side, this means that the only way is up, with schedules by June 23 showing that the airline plans to more than double its available seats over the next 3 months to Taipei.

Cathay Pacific has dominated headlines globally with its latest campaign, “World of Winners” giving away 80,000 “free” tickets to Southeast Asia residents in March. The campaign by all accounts has been a success so far, seeing the website crash on launch through sheer web traffic, and the giveaways being snapped up in hours, rather than days.

The campaign is part of the Hong Kong Tourism Board’s strategy to give away 700,000 free air tickets via Cathay Pacific, HK Express, Hong Kong Airlines and Greater Bay Airlines to travelers in Southeast Asia, China, Northeast Asia and Europe. It also plans to offer 80,000 outbound air tickets for Hong Kong residents and Greater Bay Area residents in H2 2023.

Are Free Ticket Giveaways Enough?

Whilst the campaign seems to be successful in at least generating press inches, the Hong Kong Airport Authority CEO doesn’t believe that these giveaways are enough to reach recovery in 2023, noting that the airport “will need at least 18 months to two years to return to pre-pandemic levels”.

As we’ve seen from Asia’s slow reopening, adding back capacity to reach the mid-way point of recovery tends to be fast. But it is getting across that 80% recovery line that proves to be tricky, and with Hong Kong so reliant on Northeast Asia for its capacity, it’s going to be a slow burn to reach back to 2019 levels.

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.