Based on Transactions in April, DoorDash takes #1 Spot with 45%, Ahead of Uber Eats (28%) and GrubHub (17%)

Key Takeaways

• DoorDash (including its newly acquired company Caviar) has held the lead in market share of transactions since March 2019, and has now extended lead over UberEats by 17 percentage points (45% vs. 28%).

• If UberEats and Grubhub share of transactions were to combine in the event of a potential acquisition, combined share would put them at 45%.

• Grubhub customers spent the highest average price per transaction at $41. DoorDash customers followed at $36, and for UberEats the figure was $31.

With the shelter in place orders putting food and grocery delivery apps in the spotlight, now the industry is also digesting news of potential market consolidation fueled by reports that Uber has interest in acquiring Grubhub. Recently, Edison Trends reported that overall food delivery industry sales increased by 51% since early March when a national emergency was declared in response to the COVID-19 pandemic. DoorDash has since piloted grocery deliveries in addition to restaurant delivery, a new aid to their continued growth. Following our previous report about how on-demand food platform sales in 2019 performed, Edison Trends analyzed two million transactions in April to report the latest insights into this booming industry.

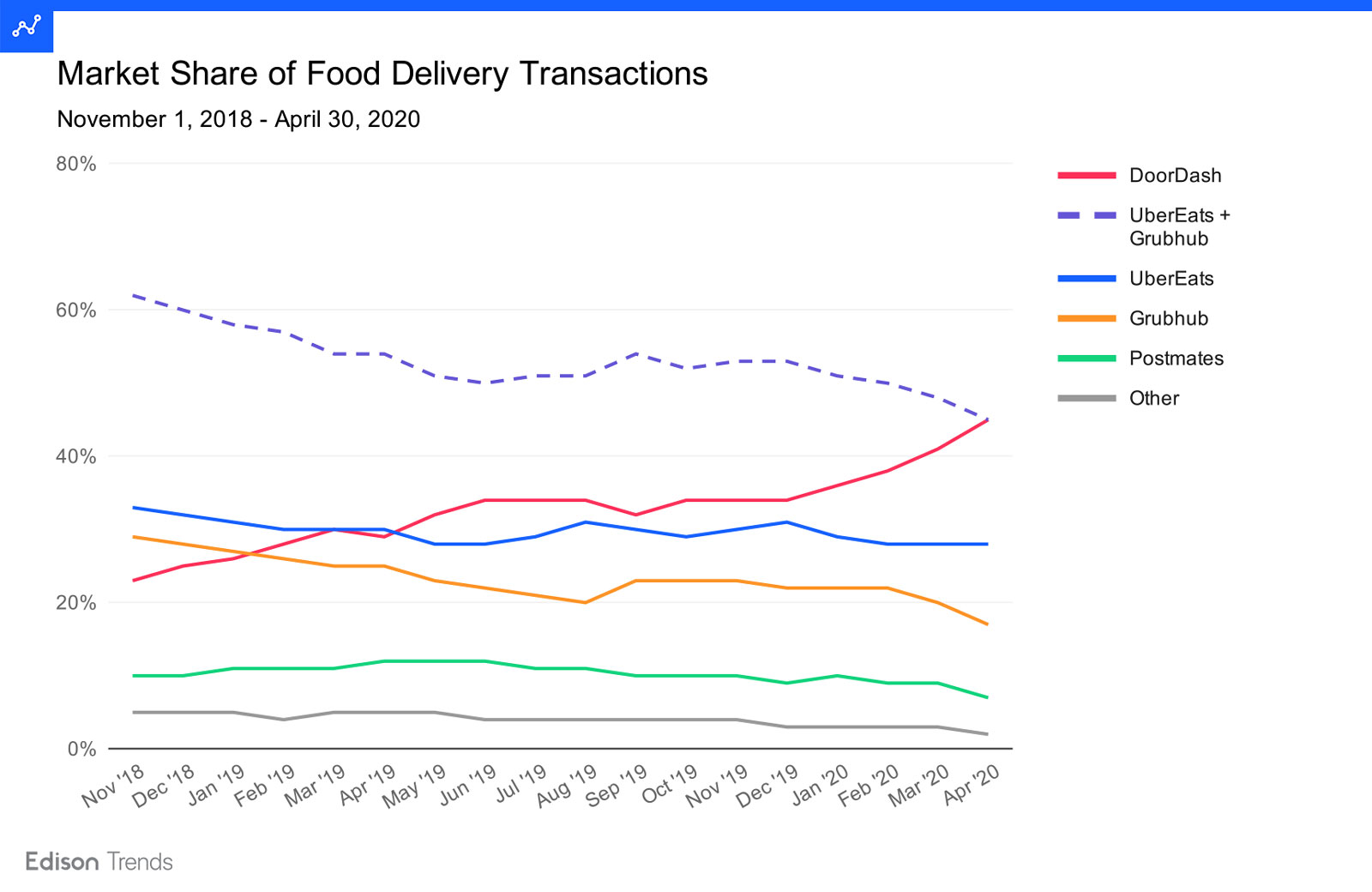

Figure 1: Chart shows estimated on-demand food platform market share of transactions by month for DoorDash, UberEats, Grubhub, Postmates, Caviar, and Other from November 1, 2018 to April 30, 2020, according to Edison Trends. DoorDash includes Caviar; Grubhub includes Seamless, Yelp, Eat24, and Tapingo. This analysis was performed on over 2 million transactions.

Looking at monthly market share of food delivery transactions, DoorDash (including its newly acquired Caviar - as of the March 2019 report prior to the acquisition, Caviar held 2% market share of transactions) has held the lead since May 2019, and recently gained an even greater lead, topping UberEats in April by 17 percentage points (45% vs. 28%). DoorDash has seen its share of transactions grow rapidly the past few months; after hovering at around 34% from June through December 2019, share grew two percentage points into January and again into February, jumping three points to 41% in March and a further four points to 45% in April.

UberEats and Grubhub have held their positions in second and third since May 2019. If these two companies’ share of transactions were to combine in the event of a potential acquisition, their combined April market share of transactions would put them at 45%.

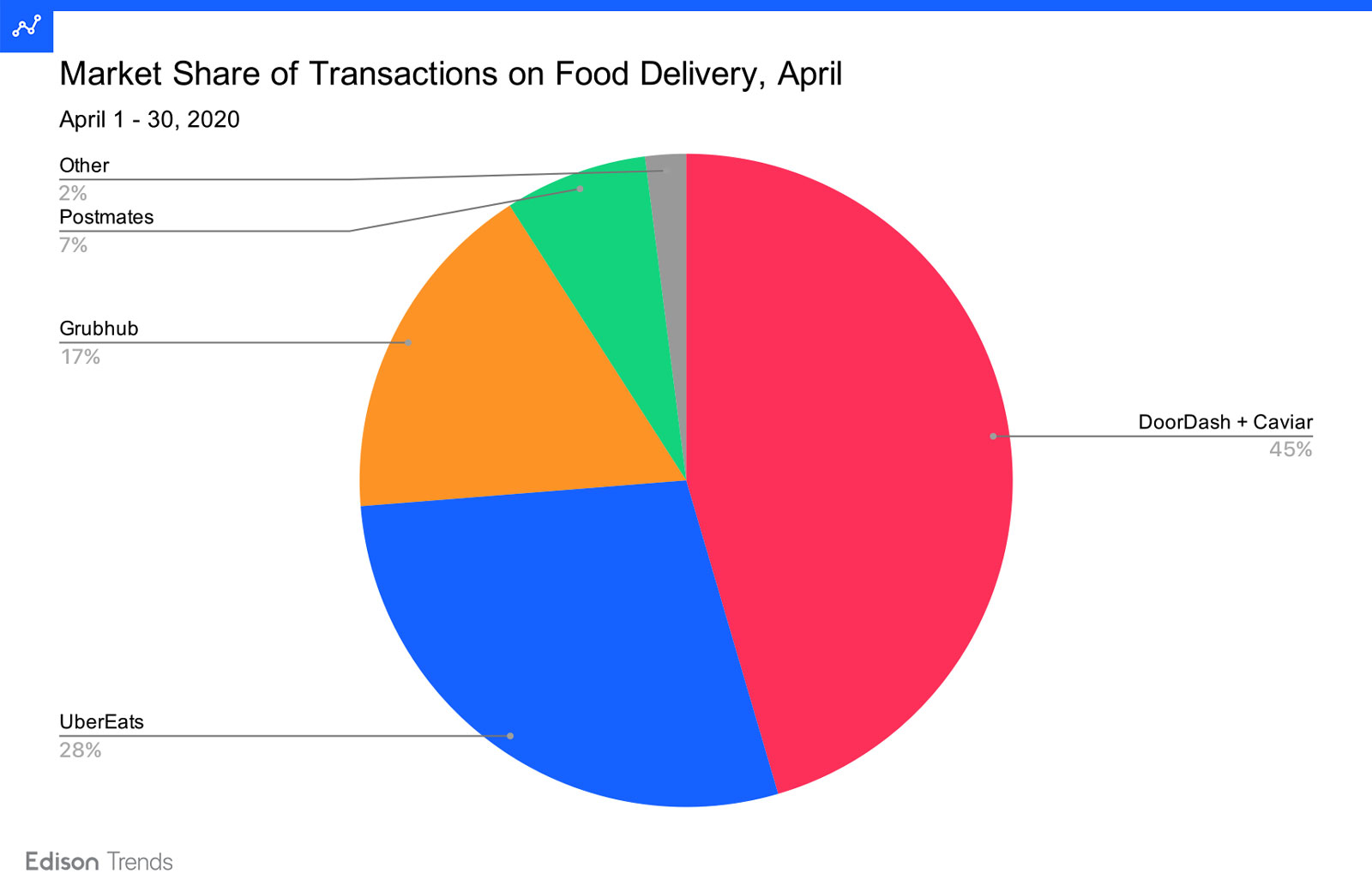

Figure 2: Chart shows estimated on-demand food platform market share of transactions for DoorDash, UberEats, Grubhub, Postmates, Caviar, and Other from April 1 to April 30, 2020, according to Edison Trends. DoorDash includes Caviar; Grubhub includes Seamless, Yelp, Eat24, and Tapingo. This analysis was performed on over 160,000 transactions. Due to rounding, numbers may not add to 100.

DoorDash took the lion’s share of transactions in April, at 45%. UberEats followed with 28%, and Grubhub had 17%. Postmates took 7%, and other food delivery services 2%.

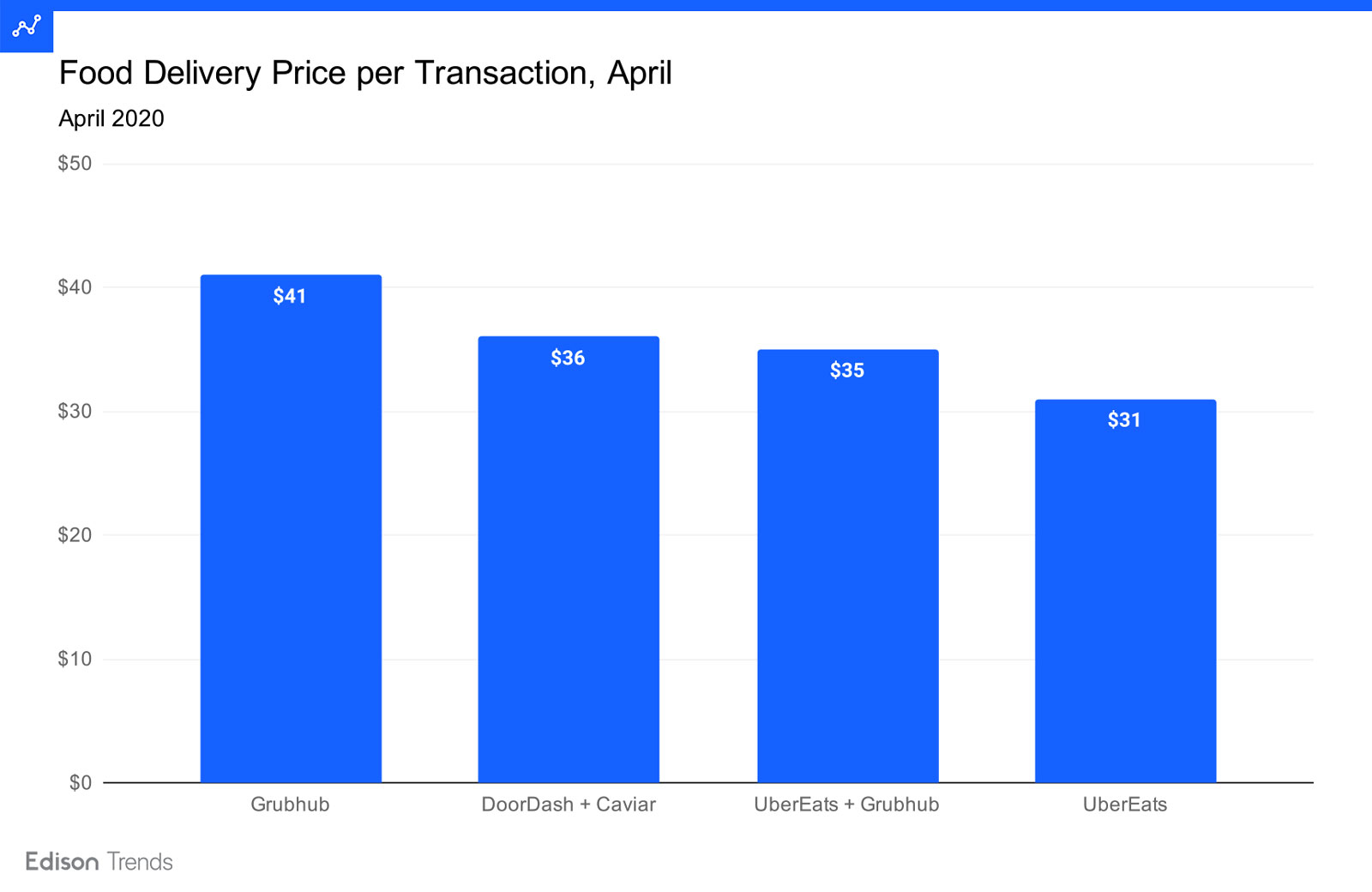

Figure 3: Chart shows estimated average price per order for DoorDash+Caviar, UberEats, and Grubhub for April 1-30, 2020, according to Edison Trends. This analysis is based on over 140,000 transactions.

Looking at just April, Grubhub customers spent the highest average price per transaction at $41. DoorDash customers followed at $36, and for UberEats the figure was $31. If an acquisition were to combine the companies, UberEats and Grubhub would average $35 for average price per transaction in the month of April.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.