Data synopsis:

Dig Deeper:

Student loans of $1.59 Trillion in the United States are now the second largest category of consumer loans behind only Mortgage loans. With students now taking classes remotely, there is little opportunity to work part time either at school or at nearby businesses to pay off those loans. Meanwhile, recent graduates are seeing job offers rescinded and job opportunities vanishing as they graduate into a post Corona world.

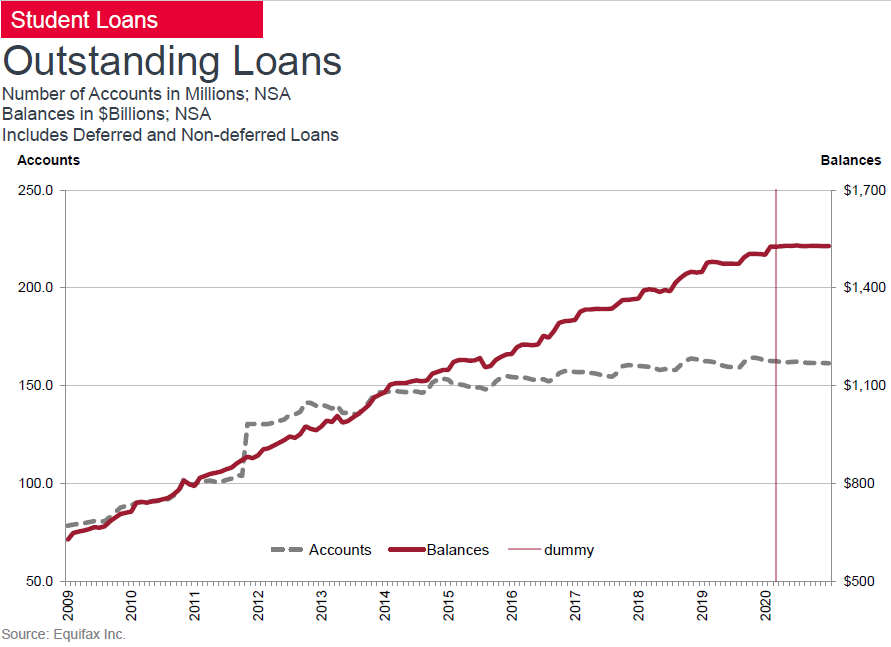

Given this backdrop, the total balance of student loans in the US, which normally increases fairly predictably every year, is now completely flat. Thanks to data from leading US Consumer Credit Data firm Equifax, we can see what’s going on behind the scenes.

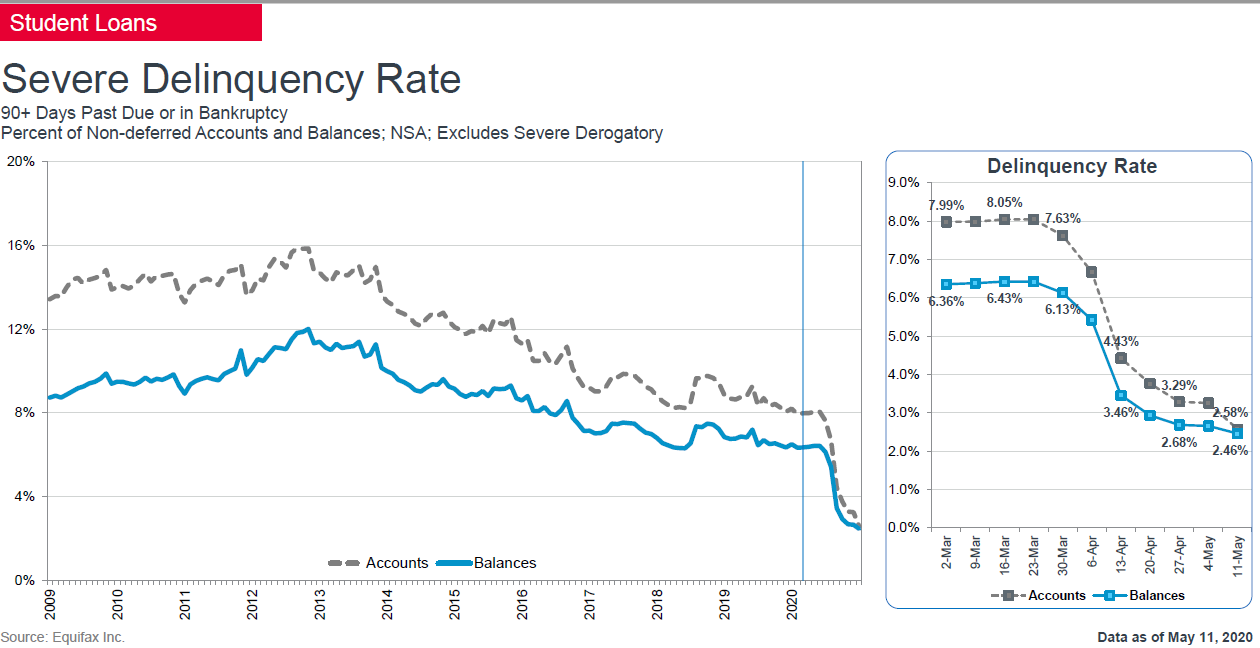

The lack of balance growth on its own isn’t that concerning. By using additional data from Equifax’s credit trends report we can see that the delinquency rates among these loans have collapsed. Below we can see the reduction.

The lack of balance growth on its own isn’t that concerning. By using additional data from Equifax’s credit trends report, we can see that the delinquency rates among these loans have collapsed. Below we can see the reduction.

If the reduction in delinquency was due to a healthy job environment and students paying off debt, then this would be a potential positive. The reality is that this delinquency rate has collapsed artificially. On March 27th the president signed the CARES Act into law. This law placed all federal student loans into administrative forbearance which essentially allowed students to stop making loan payments until September 30th. Forbearance basically moves loans that were delinquent into the forbearance category. The result is an artificial reduction in delinquency rates. With these loans in forbearance there’s no way to see into the true health of these loans.

With no likelihood for a Corona vaccine by September we will have to wait and see to find out what the state of health of these loans actually is. Unlike mortgage loans, there are no assets backing these loans up so the potential risk could be substantial.

To learn more about the data behind this article and what Equifax has to offer, visit https://www.equifax.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.