Source: https://clipperdata.com/shipping-lines-slash-may-container-capacity-extend-cuts-well-into-june/

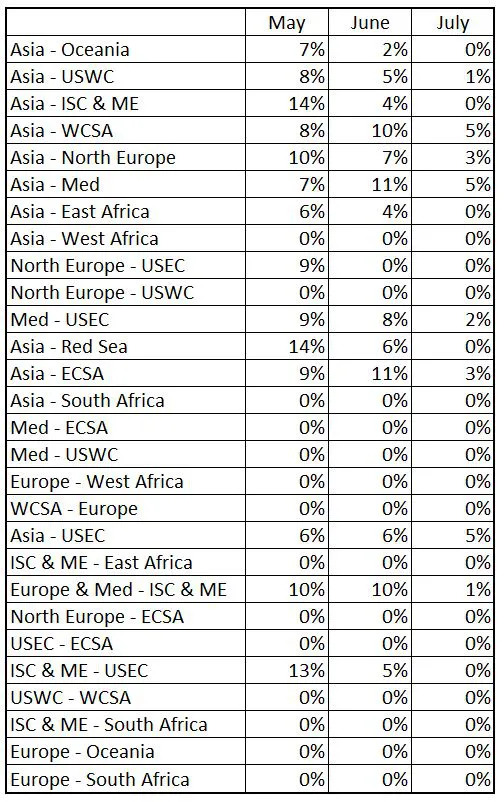

Container capacity on all major trade lanes has been severely reduced, with the deepest cut planned for Asia – Red Sea at 14%. The world’s most active trade lane has taken a 10% haircut, while Asia – US West Coast has been dialed back 8%.

The cuts extend well into June, and in some cases June cuts are deeper than those in May. On the Asia-Med trade lane, which saw some of the highest growth rates in recent years, the June cut is 11%, versus the May reduction of 9%. Asia to the East Coast of South America recorded the same reductions in the two months.

Carriers have cut capacity by cancelling weekly or fortnightly voyages. Since container vessels move on a scheduled rotation, the cancellation of a sailing from the first port in the rotation cascades down to all the other ports served by that carrier in that rotation.

Some smaller ports are particularly hard hit by multiple cancellations from different services. The capacity for transport into and out of Manila and Odessa for example has been reduced by a quarter in May. Beirut and Visakhapatnam were cut by 20%. But even some of the larger ports are seeing sharp reductions. Hamburg and Rotterdam are down 10%, as are Xiamen and Kaohsiung. Shanghai, Ningbo and Cai Mep are each down 9%. Transshipment points, like Colombo and Djibouti are also badly affected, with Colombo down 13% and Djibouti 11% lower in May. This translates into less trade on feeder routes around south Asia and eastern Africa.

The extension of the cuts into June – announcements of new cancelled, or void, sailings arrive every day – signals that demand in the global container shipping market has yet to rebound despite talk of re-opening the economy. Shipping lines would not be slashing capacity, especially on the major routes, if there was demand for space on their ships. A decline in the number of void sailings would be one of the earliest signs that global trade is starting to emerge from its deep freeze.

Capacity cuts in percent of total teu deployed:

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.