Tension between the United States and China has ratcheted up in recent weeks amid increasingly hostile rhetoric. The global spread of the coronavirus has further hurt relations between Beijing and Washington, stoking the possibility of a new trade war amid a global economic slowdown.

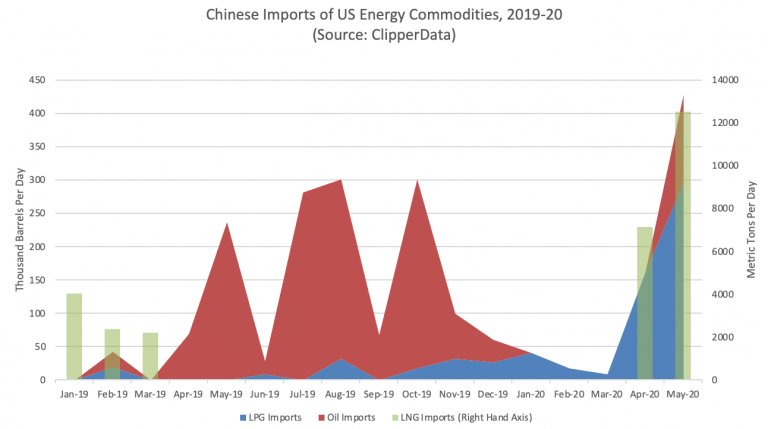

However, from a flows perspective, all seems to be fine. LPG, LNG, and crude imports into China have all ramped up in recent months:

Last month, China imported more than 100,000 bpd of crude from the US, marking the first shipments since December. Additionally, there are more than 10 vessels loaded with US crude signaling for China.

US crude heading to East Asia

Meanwhile, the Asian giant also resumed imports of US LNG in April, after a year-long absence. These imports have continued through May and June, with one vessel loaded with US LNG signaling for China, though several ships are heading to East Asia that could still end up there. Finally, Chinese LPG imports from the US have increased considerably since April and will likely remain strong through this month.

Despite the war of words between Washington and Beijing, the flows tell a different story. While the value of the commodity purchases are nowhere near enough to meet the targets set out in the phase one trade agreement, the broad-based buying across commodities is a sign of China’s willingness to curry favor.

LNG cargoes loaded in the US

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.