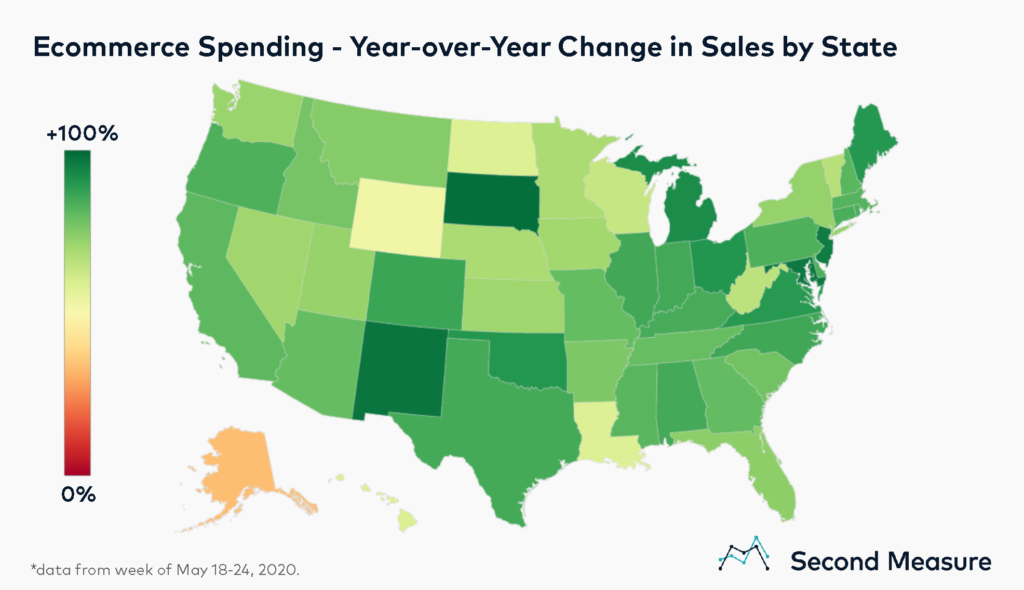

The COVID-19 pandemic has crippled many traditional retailers, with previous analyses showing clothing store sales dropping by half, or more. As many Americans are still unable to patronize brick-and-mortars, that spending may be increasingly displaced toward online shopping. Nationwide, the latest data reveals that weekly ecommerce sales are up 80 percent year-over-year.

The week of May 18-24, ecommerce spending nearly doubled in four states: South Dakota, New Mexico, Maryland, and New Jersey. Even the states with the smallest change in weekly sales still saw considerable growth. In Alaska, where weekly sales grew the least year-over-year, spending was up 34 percent.

Ecommerce spending increase driven in part by new customers

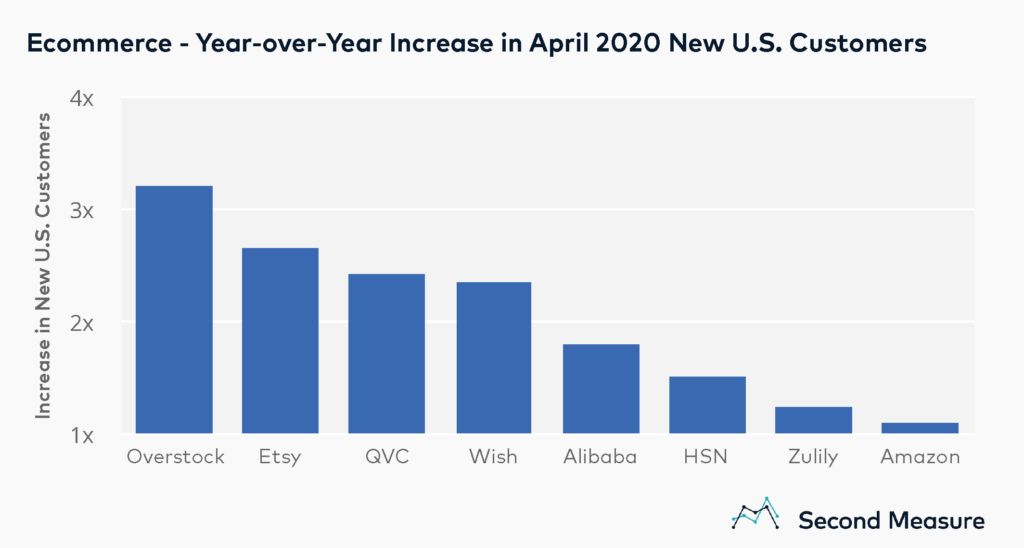

The nationwide increase in online shopping that has carried through May started back in mid-March, when shelter-in-place orders first began in the U.S. In the interim, ecommerce retailers have been able to attract new shoppers to their sites with far more success than during the same period last year. In April, all of the largest names in ecommerce attracted more new customers than they had in April 2019.

Overstock saw the largest growth in new customers, with April 2020 new customer counts more than tripling those of the year prior. Even though Amazon’s new customer counts grew the least, Amazon has the highest market penetration among ecommerce retailers, making new customer acquisition more challenging. Prior to the pandemic, 13 percent of Americans had previously shopped at Overstock while nearly three-quarters of U.S. consumers had placed an order with Amazon.

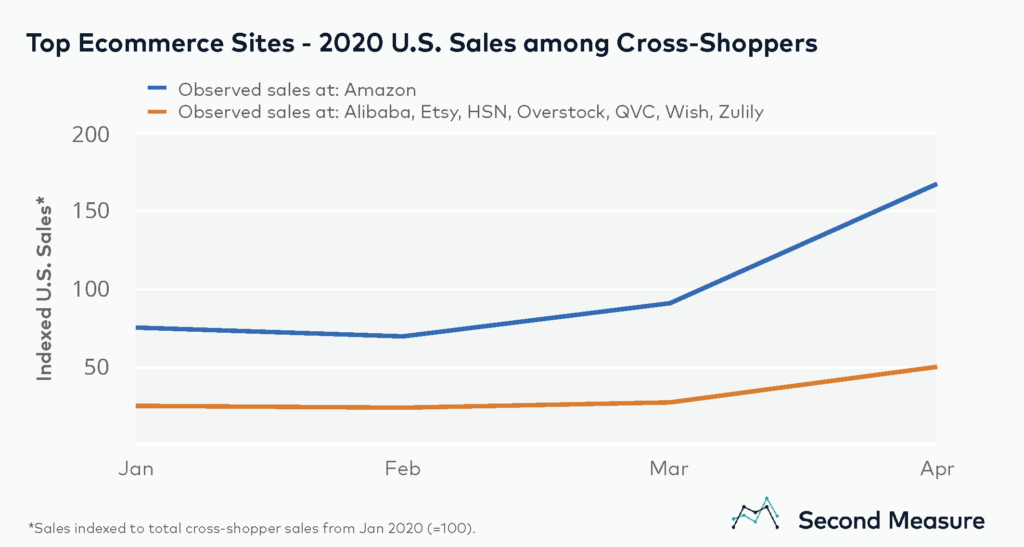

Amazon captures majority of spending among ecommerce cross-shoppers

Though other retailers are benefitting from the shift to online spending, Amazon continues to reign as the undisputed king of e-commerce. In April, 80 percent of all customers among major ecommerce sites shopped at only Amazon, while nearly 15 percent shopped at Amazon and another e-commerce site, and roughly 5 percent shopped at another e-commerce site, but not Amazon. Within the group that shops at both Amazon and other e-commerce sites, sales are consistently higher at Amazon alone than at all other sites combined.

A closer look reveals that Amazon customers cross-shopped most at Etsy and Overstock, which captured 43 percent and 17 percent, respectively, of spending among this subgroup of consumers. The remaining 40 percent of spending is split between QVC, HSN, Zulily, Wish, and Alibaba.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.