This year has not been kind to the beleaguered US retail sector. Several major chains, including Neiman Marcus, JC Penney, and J Crew have declared bankruptcy, joining a host of smaller retailers that have succumbed to the pandemic-driven pause in brick-and-mortar retail shopping. More are expected, and a similar scenario is playing out in the UK retail sector.

Default Risk for US Retailers Up Almost 12% in Last Two Months

US General Retail Firms

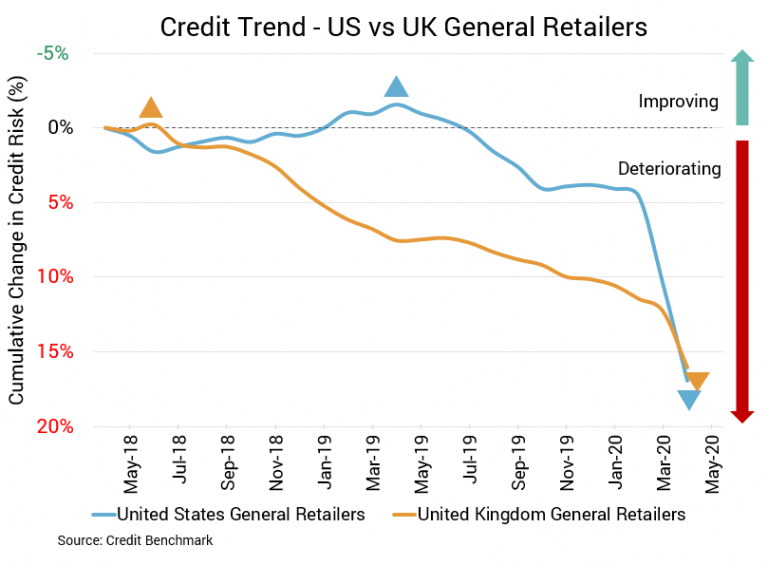

Credit quality for US general retail firms is plummeting. The descent for this sector picked up in the last six months, declining by 6% over the last month and 11.8% over the last two months. Year-over-year, the decline is 18.8%. Average probability of default for this sector is now 54.5 basis points, compared to 51.4 basis points in the prior month and 48.6 basis points two months prior. At the same point last year, it was 45.7 basis points. This decline in credit quality and rise in probability of default is reflected further in the CBC ratings. About 80% of firms in this aggregate with a CBC rating are at bbb or lower as of the most recent update. The overall CBC rating for this aggregate is bb+ and has remained as such over the 12 months.

UK General Retail Firms

Already in a worse position than their US counterparts, UK general retail firms have also seen the pace of credit quality deterioration accelerate. Overall credit quality has declined by 3% over the last month, 4% over the last two months and 8% over the last year. Average probability of default for this sector is now 73.4 basis points, compared to 71 basis points in the prior month and 70.5 basis points two months prior. At the same point last year, the average probability of default for the sector was 68 basis points. Approximately 92% of firms in this aggregate with a CBC rating are at bbb or lower based on the most recent update. The overall CBC rating for this aggregate is bb+, consistent over the last 12 months.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.