Key Takeaways

• Online orders at Staples have also risen 51% since mid-March

As the COVID-19 pandemic began picking up steam everywhere in March, many businesses around the nation ordered their workforces to work from home, causing a dramatic shift in how large numbers of us work. Many companies announced remote work plans that encompassed the entire year of 2020, and some, including Twitter and Square, even declared permanent work from home policies. The logistic setups for these employees, now sent home with their work devices in hand, also resulted in many who found themselves missing out on one of the great perks of office life — access to free office supplies. Joining Edison Trends’ recent research on COVID-19’s effect across e-commerce verticals is a new analysis of more than 60,000 nationwide transactions at major office supply merchants, to determine how sales have changed following widespread adoption of remote work.

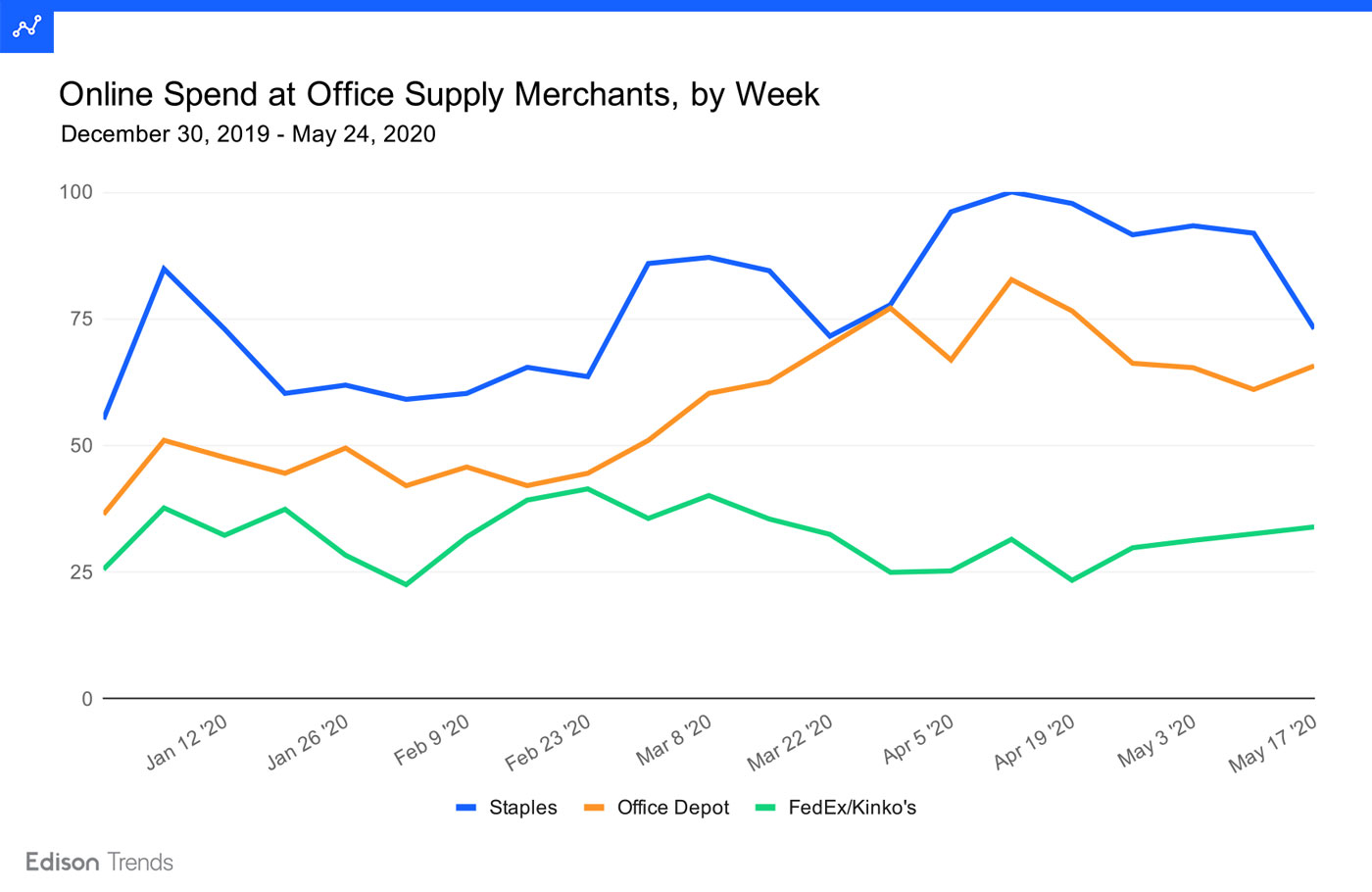

Figure 1a: Chart shows estimated online spend at office supply merchants by week from December 30, 2019 - May 24, 2020, looking at Staples, Office Depot, and FedEx/Kinko’s, according to Edison Trends. Note: The week/vendor with the highest spend was set to 100, and other values were scaled accordingly. This analysis was performed on over 60,000 transactions.

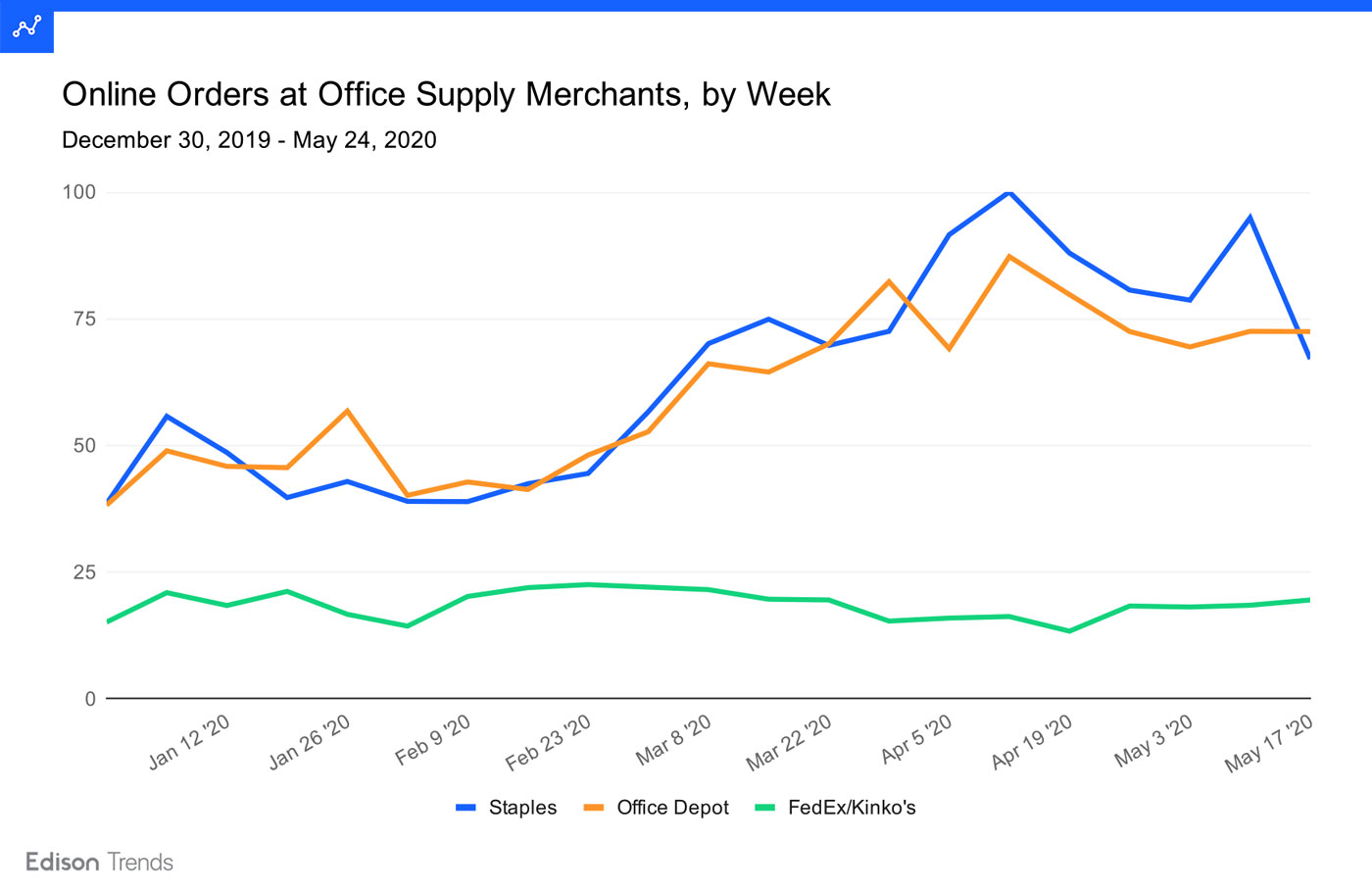

Figure 1b: Chart shows estimated online orders at office supply merchants by week from December 30, 2019 - May 24, 2020, looking at Staples, Office Depot, and FedEx/Kinko’s, according to Edison Trends. Note: The week/vendor with the highest spend was set to 100, and other values were scaled accordingly. This analysis was performed on over 60,000 transactions.

Analyzing spending and orders at office supply retailers Staples, Office Depot, and FedEx/Kinko’s shows an absence of the dropoff in online sales that some merchants have experienced with the changes brought by COVID-19. In the ten week period from March 16 - May 24, consumer spending on online transactions at Staples.com was 25% higher than in the previous ten-week period (January 6 - March 15), and at Office Depot it was 45% higher. For FedEx/Kinko’s, spending dropped 13% between the two periods.

The story is more pronounced when it comes to online orders, where Office Depot has seen an increase of 71% from the first period to the second and Staples an increase of 51%. FedEx’s fortunes remain the same, with a drop of 13%.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.