All 50 states have reopened and consumers are starting to come out of the woods.

Morgan Stanley economists are predicting a V-shaped recovery for the economy, but we aren’t there yet. We are still navigating uncertainty.

Despite many unknowns, we do have ad data across industries.

When we look at the ad dollars—even in industries that have been hit hard—we see that some sectors are having a come back.

Here are the industries that’ve caught our attention with their rebounding ad numbers.

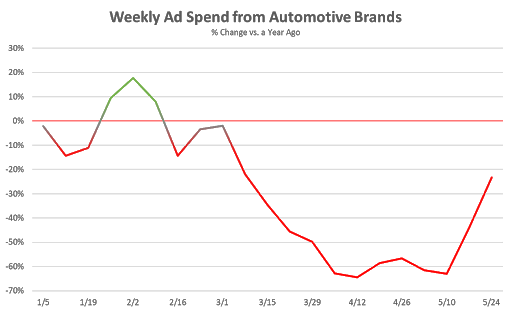

Automotive Brands

This is a good sign of recovery for the auto industry. As we reported in our Trend Report on the Automotive Industry in early March, carmakers have been struggling. In terms of pure dollars, the automotive industry has pulled more money out of advertising in the past two years than any other industry in the US.

The industry looked like it was on an upward trajectory in February before plummeting. The downfall didn’t last too long though.

After the week of May 10, spend started to increase rapidly. Ad spend during the week of May 24th was nearly double where it was just three weeks earlier.

Groups reviving their ad spending in recent weeks include:

Even though car sales were down by roughly 33% YoY, sales jumped 42% MoM in May. China, which is further along in recovery, has seen car sales increase 12% YoY in May. This was its second straight month of YoY growth.

China is a different country with different social and economic factors, but U.S. automakers feel optimistic. Sales may continue to increase in areas where public transit used to be the norm. 20% of consumers who don’t own cars are considering buying one to avoid public transit and ride-sharing.

Domestic and Regional Tourism

As the pandemic eases across the US, domestic tourism is beginning to pick back up.

The week of May 24th, there were 3x more ad placements than the previous month. More than 350 active local tourism bureaus are buying ads right now.

Granted, YoY spend was still down 63% the week of May 24th, but it is a great improvement from April. In April, spend was down 89% YoY.

Google search data reveals that travelers are much more interested in domestic travel for the remainder of 2020. Furthermore, they are favoring smaller attractions over large tourist destinations (i.e. Belfast instead of Barcelona, Orlando instead of NYC, etc.)

AirBnB bookings back this trend up. The company had more US bookings between May 17-June 3 than during the same period last year.

CEO Brian Chesky said that most bookings are made within 200 miles of the visitors’ homes. Many international borders are still closed and many travelers don’t want to take risks by travelling on airplanes. Individuals in Portugal, Germany and South Korea are also traveling domestically.

Although there aren’t official numbers, people are saying national parks are already slam packed. The Zion National Park parking lot has been getting full as early as 7am on weekends.

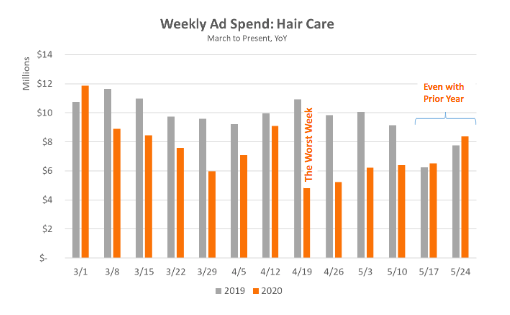

Hair Care

Without going into the office, people were using less shampoo and personal care products.

From Mar 8 to May 16 ad spend on hair care products was down 31% YoY.

With the country reopening and people going outside again, we have seen hair-care spending pick back up to levels consistent with last year. The last two weeks of May, spending was slightly up YoY. This is the first time we saw this since the beginning of March.

Real Estate

Real Estate advertising was hit hard amid COVID-19. It was down 55% in April when compared to the Jan-Mar average.

However, spend levels in mid-May were 34% higher than where they were in early April. This is an early sign of recovery.

A trend we’re seeing is that states that reopened earlier, like Texas and Florida, are seeing ad dollars return more quickly.

The average weekly spend in April (6.7M) was down by 55%, when compared to the average weekly spend in Jan-Mar (14.9M).

These ad numbers correlate with a real estate market that is bouncing back. Real estate experts say that sales and mortgage applications have been up due to a pent-up demand in lockdown.

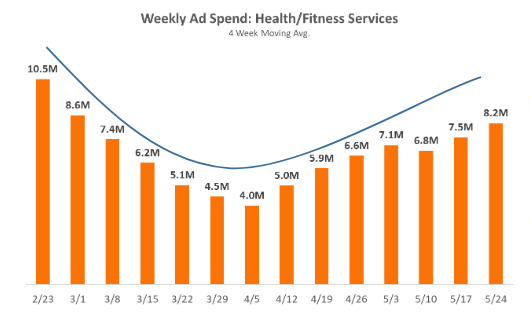

Health/Fitness Services

The reopening of gyms around the country has resulted in a strong bounce-back in advertisements for health and fitness brands. Spending during the last week of May was at its highest point in 11 weeks.

In fact, the last three weeks have been up YoY. This is a big deal because summer is usually when brands begin to taper off their spend. This year, they are ramping up to get their customers back.

Gyms are not completely the same as before—equipment is spaced out, not as many people can come in and there is more hygiene vigilance, but people are returning for their workouts.

We are navigating ‘reopening’ day by day. As businesses open and consumers grow in confidence, we will share how advertisers respond.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.