Earnest continues to monitor how consumers are responding to the gradual reopening of retail doors across the country. In this refresh, we look at spending by state, online spending, restaurant and travel performance, and the potential impact on spending from the nationwide protests.

Key Takeaways

State of Reopenings

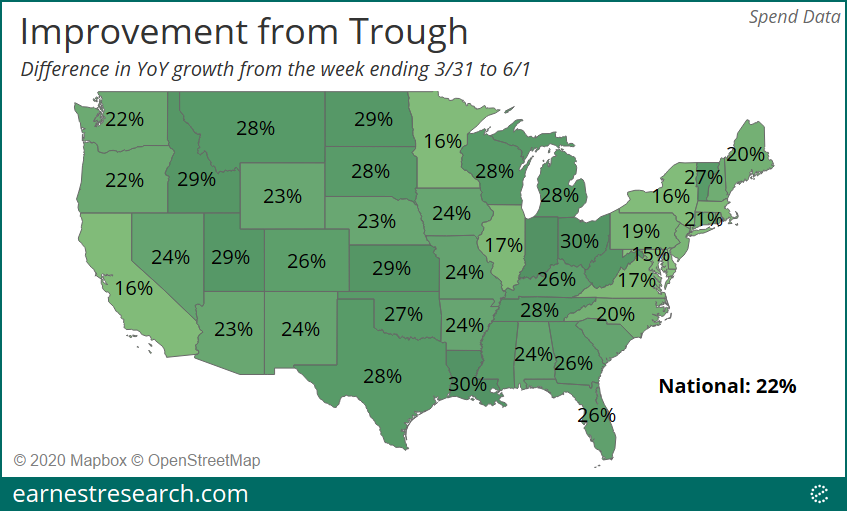

As of June 1st, nationwide spending growth improved over 20 points from trough. While the stay-at-home orders for all but five states expired*(DC, NJ, OR, PA, VA), retail activity is still reopening at varied phases in different regions across the country. As a result, spending improvements have continued to stagger and look different across states.

Generally speaking, states that opened earlier continued to outperform (AK, IN, LA, KS, WV, etc.), improving ~30 points, while recently reopened states improved by ~15 points (DE, NY, CA, IL, etc.). OH and MI, which opened on May 28-29, already improved an impressive ~30 points, while MD, MN, and MA, which opened on May 15-18, are reviving at a slower pace.

Ecommerce Spending Slowing

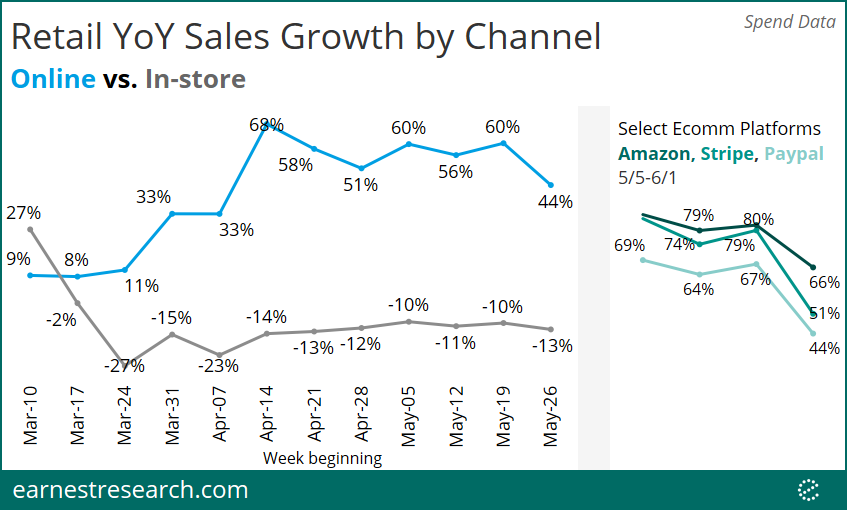

Looking by channel across thousands of merchants (see appendix), the last week of May showed a material slowdown in online sales growth. After growing nearly 70% YoY mid-April, and 60% YoY in the week beginning May 19th, growth slowed to 44% YoY last week. Drilling into the big ecommerce platforms, both Amazon and Paypal slowed down by 15 to 20 points, and Stripe slowed by 30 points.

Making Sense of Restaurants

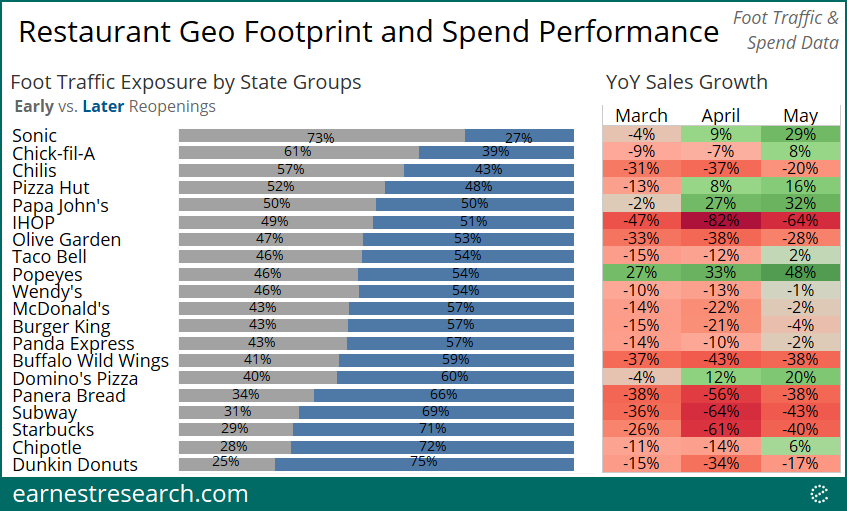

While restaurants as a category continue to improve, many brands are reviving faster than others. To try to understand this, we looked at foot traffic data and analyzed the 2019 state exposure of each brand between early vs. late reopened states, alongside the monthly YoY sales growth using Earnest spend data.

Generally speaking, the outperforming brands are the ones with more exposure to earlier reopened states, such as Sonic and Chick-fil-A. However, this variable is not as relevant for online delivery centric brands such as Domino’s, Papa John’s, and Pizza Hut; these brands were even outperforming beginning March and throughout the lockdown. Chipotle’s outperformance can also be attributed to its growing online channel, as it would otherwise be struggling considering over 70% of its foot traffic is in the later reopened states. Finally, Popeyes continues to enjoy its chicken craze.

Travel is Beginning to Move

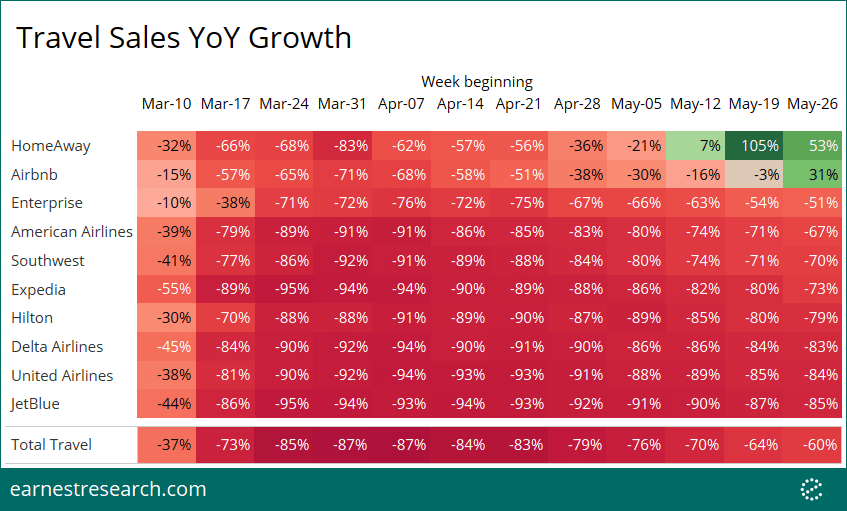

Travel has begun to show some signs of life. Focusing on the top ten travel merchants in terms of sales in the data, growth at lodging marketplaces HomeAway (which includes Vrbo) and Airbnb have snapped back from the 70%+ declines in late March, growing ~30% to 50% YoY in the last week of May. HomeAway saw over 100% YoY growth during the week of Memorial Day weekend. Airlines are now declining ~65% to 85% YoY from seeing virtually no bookings in late March.

The Impact of Protests

It is unclear to what extent consumer spending was impacted by last week’s protests. While many major cities saw some elements of rioting occur, because it was couched in the context of an already depressed retail environment, it is difficult to identify a clear pause of spending in the data.

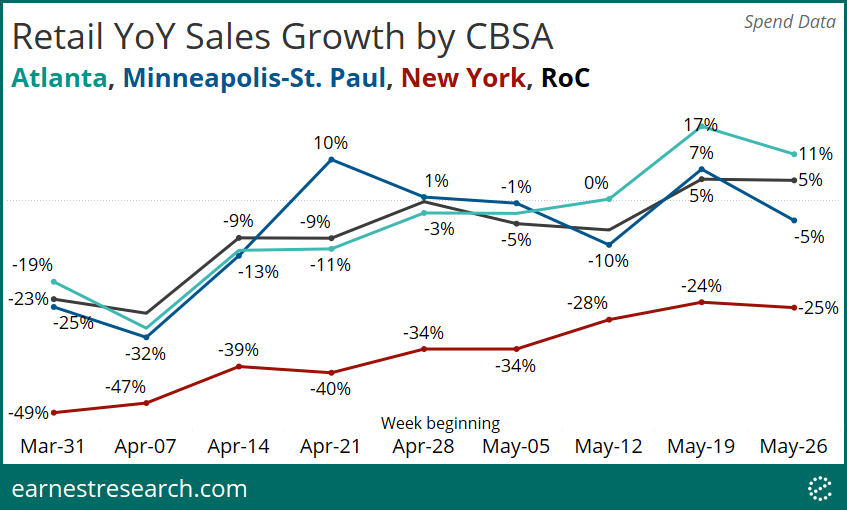

That being said, we looked broadly at retail spend across various categories in Atlanta, Minneapolis, and New York City relative to the rest of the country. Atlanta, which was already outperforming because of its early reopening, saw a material dip week over week. Minneapolis, where the stay-at-home order expired on May 17th, saw its growth slow over 10 points last week. And New York City paused its ascend after gradually climbing out of its ~50% YoY decline every week for the past seven weeks.

Includes Apparel, Department Stores, Home, Restaurants, and Sporting Goods

Notes

*Stay-at-home order expiration dates were sourced from this New York Times piece.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.