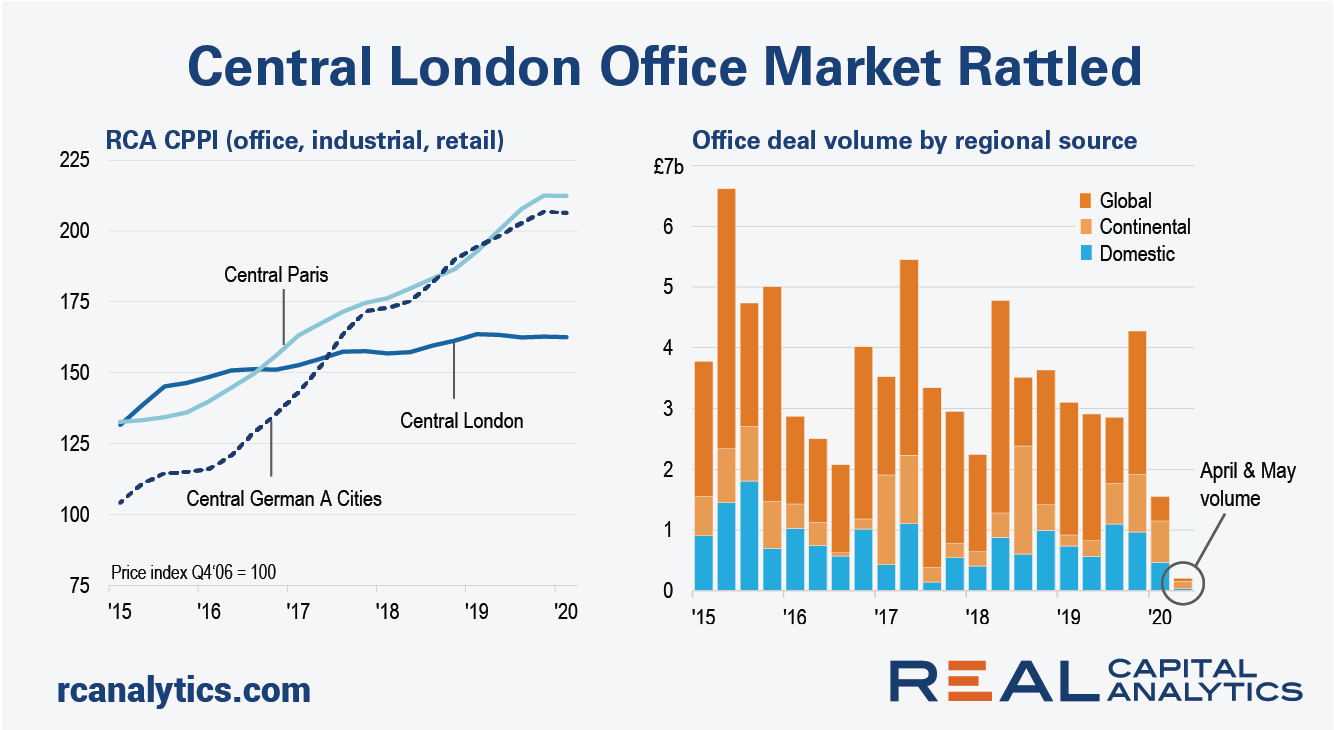

Investment from overseas players into the Central London office market has tumbled in the first five months of 2020 to the lowest level since 2009, Real Capital Analytics data shows. The Covid-19 shutdown, Brexit concerns and shifts in international flows are behind the collapse.

Cross-border acquisitions totaled just £1.2 billion ($1.5 billion) in January through May, a decline of 70% from a year ago. The Central London office market had been the most liquid asset class in the world at the end of 2015, prior to the Brexit vote, according to the RCA Capital Liquidity Scores.

Looking back just six months, December 2019 was one the best months ever for the market: 35 properties traded and just shy of £3 billion was spent. Most of this capital was deployed after Boris Johnson’s election victory, and the resolution this brought to the Brexit saga seemed to presage an expansion in market activity, after three years of low volumes and stalled price growth relative to other core European markets.

However, the market never really got going in January and February, before the Covid-19 pandemic forced large parts of the U.K. economy to shut down. Overseas investment was down 75% year-over-year and the total market was down by more than 50%. Therefore, the lockdown arrived at a time when the market had already shown some signs of weakness. Prices, too, were lower at the end of March in comparison with 12 months prior.

The lockdown has affected Central London more than other major markets in Europe. Only five offices in the U.K. capital have traded since the start of April, fewer than in Central Paris, Munich, Frankfurt or Berlin. Indeed, investment volume is around a quarter of that recorded for Central Paris.

Overseas money has always buoyed the Central London office market – over the past decade non-domestic capital has accounted for just under 75% of acquisition activity – therefore the market was going to be vulnerable in the current lockdown. However, the wave of Asian capital that has sustained the top end of the market was already on the wane, and so the lockdown may just be exacerbating a trend that was already in place.

The myriad of uncertainties that the pandemic has created – from the viability of the office as a place of work, especially in a location as dense as Central London, to the performance of the U.K. economy, which the OECD forecasts will be one of the worst affected by the lockdown – only adds to the lingering sense of unease in the market.

Indeed, RCA has tracked six Central London office transactions that have collapsed in 2020 so far. One property in the Canary Wharf financial district fell out of contact with a sale price of £380 million in March, but that same asset has since gone under offer to another buyer for £318 million – a 16% price drop in less than three months.

We still do not know the shape of the U.K.’s trading relationship with the European Union when the transition period ends in December 2020, and it appears the pandemic and the restrictions on travel are hindering the negotiation process between the two parties.

With the U.K.’s exit from the lockdown lagging other Western European countries and the noises emerging from the Brexit negotiations remaining fractious, it is highly likely investment volumes will be tepid and prices will continue to soften.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.