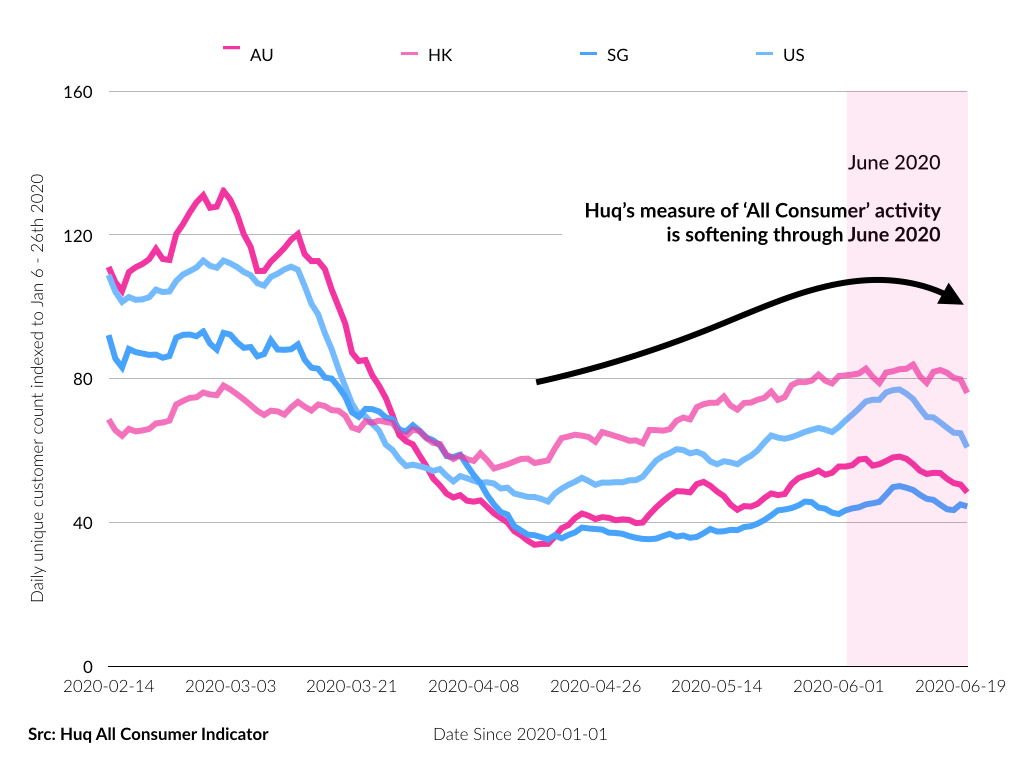

Footfall across consumer-facing shops and stores in the Far East and US has dropped by up to 10 points in the last week, as Huq’s geo-data suggests that social distancing measures and fears of a second wave could be subduing the return to ‘normal’.

Huq’s ‘All Consumer’ Indicator, which tracks footfall across shops and stores around the world, showed an initial increase in activity from the end of April as countries began to lift lockdown measures. However, the last two weeks have seen these early signs of recovery start to soften.

Across the Far East, Australia and US, footfall increased to around 65% of pre-lockdown levels as stores gradually reopened following the series’ low in mid-April. Since 9 June, this growth trend has gone into reverse, with Australia seeing a decline of 10 percentage points along with Singapore (7pts) and Hong Kong (4pts). Physical visits to stores across the US has dropped by 16 percentage points.

The decline in consumer activity has been reflected by a drop in general spatial mobility across these regions too. Reports from around the world suggest that where lockdown measures have eased, there have been increased Covid-19 cases and regions in the far east have been particularly cautious of a ‘second wave’ given their proximity to the source of the original outbreak.

Huq’s data also shows a similar trend across key industrials in Europe with Biotech, Chemicals and Defence seeing an initial growth post-lockdown plateauing in recent weeks. After such promising early signs, Huq’s data offers clues as what shape the ongoing upward trend will take.

To learn more about the data behind this article and what Huq has to offer, visit https://huq.io/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.