When you’re forced to spend several months quarantined in your own home, it’s only natural that you’ll come to identify a few areas for an upgrade. So, perhaps unsurprisingly, the wider home goods sector has been enjoying a significant uptick in traffic during the retail recovery.

In fact, it’s so strong that this could be one of the few sectors to view 2020 in a far more positive light.

Couching the Wider Context (Sorry, had to do it)

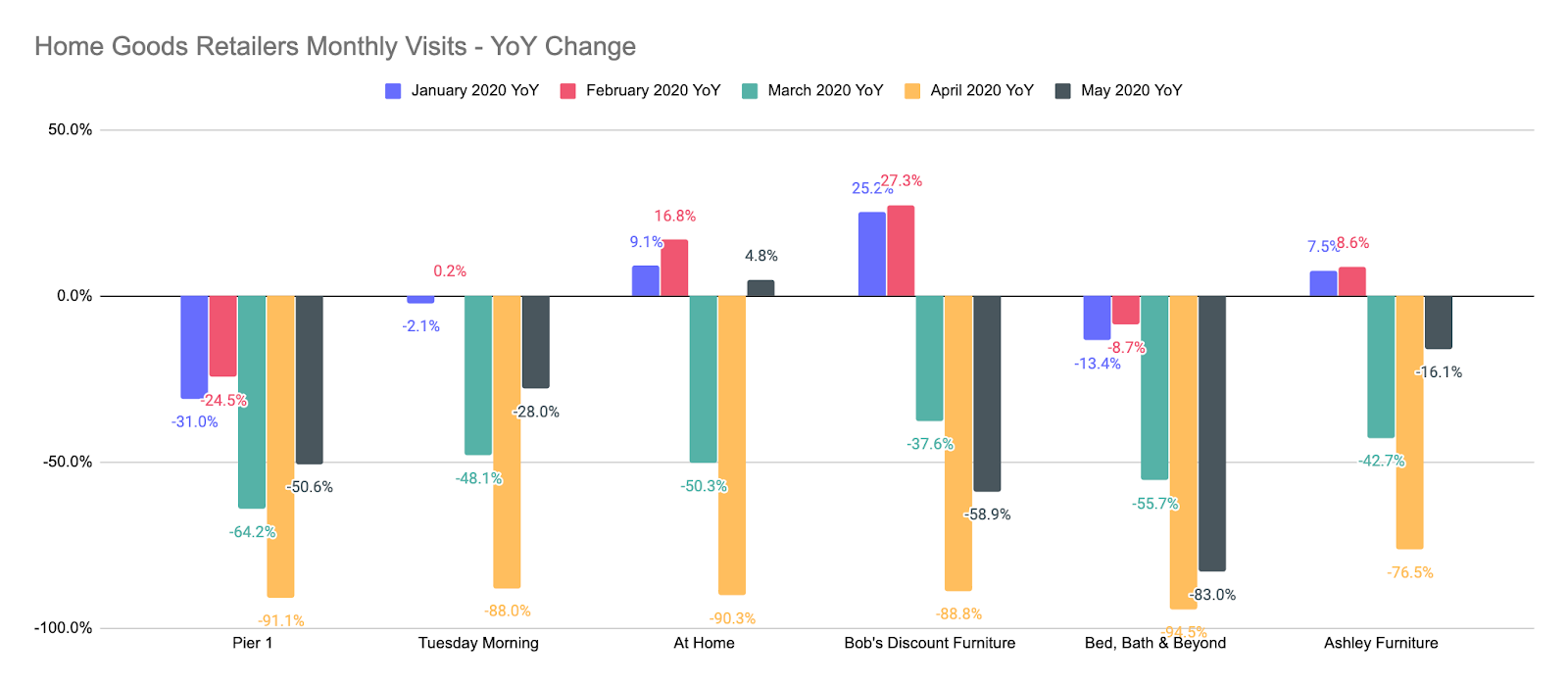

Yes, the pun is brilliant, but the data is equally enlightening. Looking at six major players in the space shows a mixed story of some brands rising and others struggling. The months leading into the pandemic were strong for a few brands but difficult for others. And while the pandemic hammered all retail visits in March, April, and May, several chains including Pier 1 and Bed Bath & Beyond were already experiencing struggles long before.

Pandemic Turnaround

However, it does appear that all that time in relative isolation did give many people a clear idea of what items were truly needed to spruce up their homestead.

Analyzing visits for the six brands on the week of May 4th showed visits down an average of 60.4% year over year. Yet, by the week beginning June 8th, that number had shifted dramatically to an average year-over-year increase of 21.4%. Impressively, all this took place as several key states for several of these brands were still in lockdown or in early recovery stages.

Long or Short Term Impact?

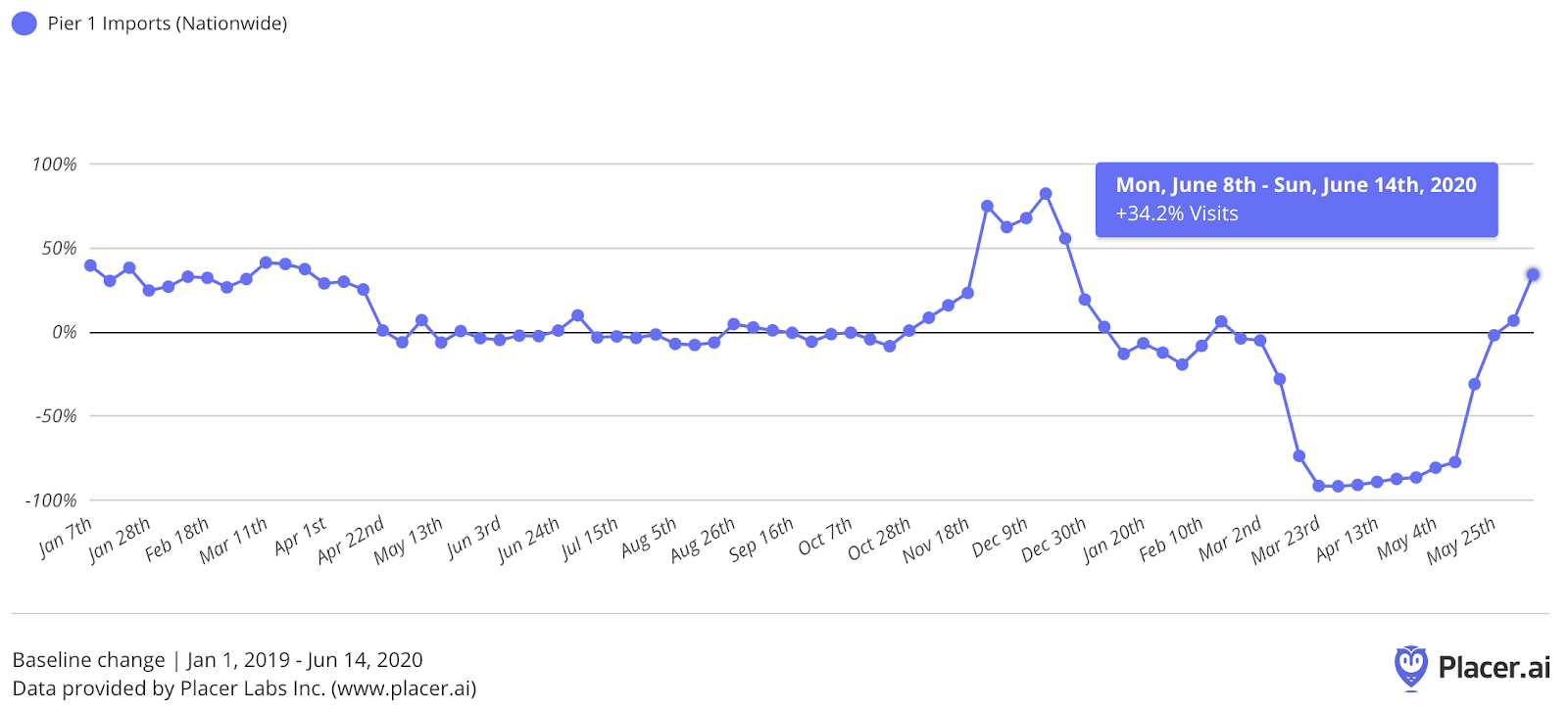

While there is clearly a wider trend powering this sector forward, there are also more specific reasons for the growth in certain cases. Pier 1 is in the midst of closing its entire retail fleet, and the rise in visits is being heavily driven by liquidation sales. While this is giving them a short term boost, weekly visits were 34.2% above the weekly baseline for the period from January 2019 through June 14th, 2020, the bigger question might be which of these brands will benefit most from the closures long term.

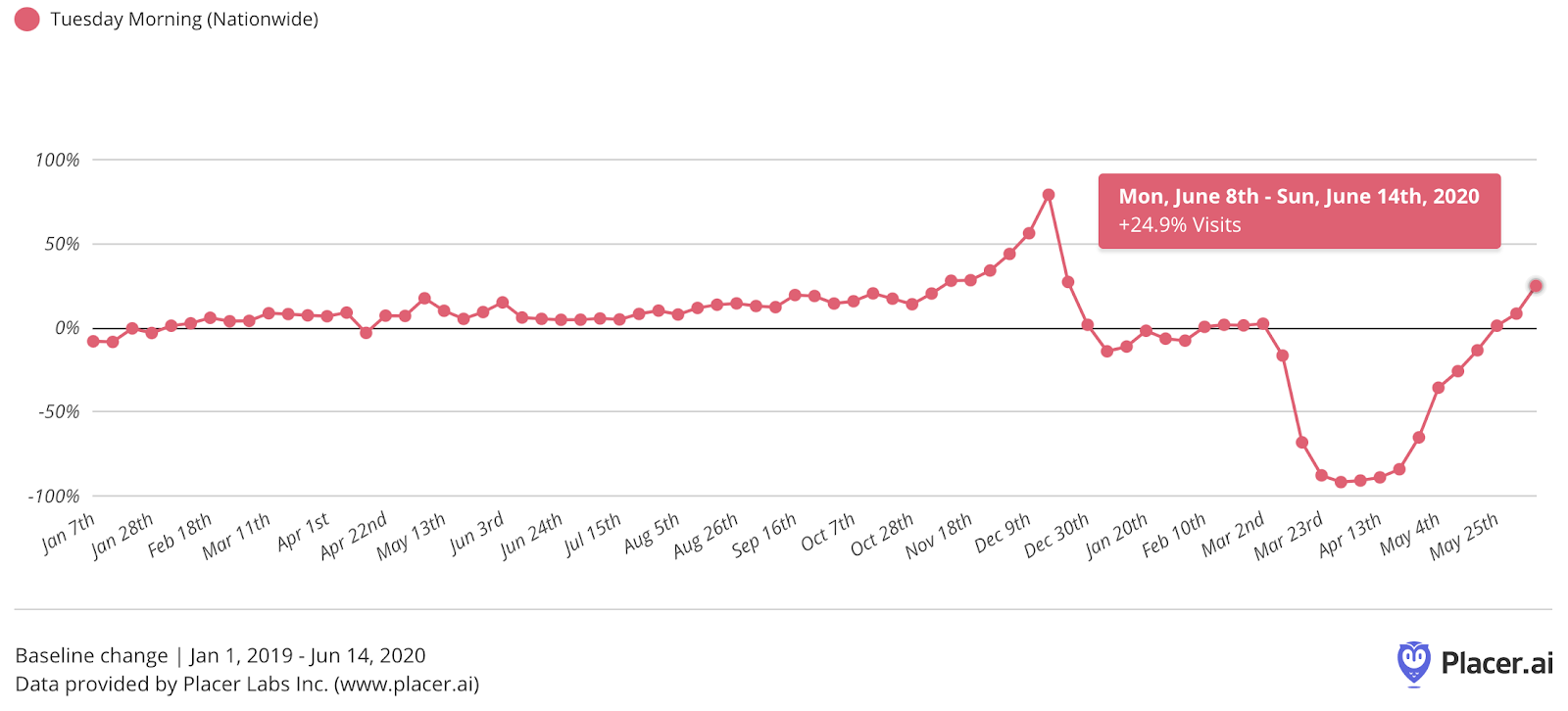

On the other hand, one of the leaders of the space, Tuesday Morning, may be among the best positioned of the wider group for long-term strength. Visits the week of June 8th were higher than any point in 2019 or early 2020, apart from the peak holiday season. And this is a trajectory that could have some staying power considering the value orientation of the brand and the likelihood of an extended period of economic uncertainty.

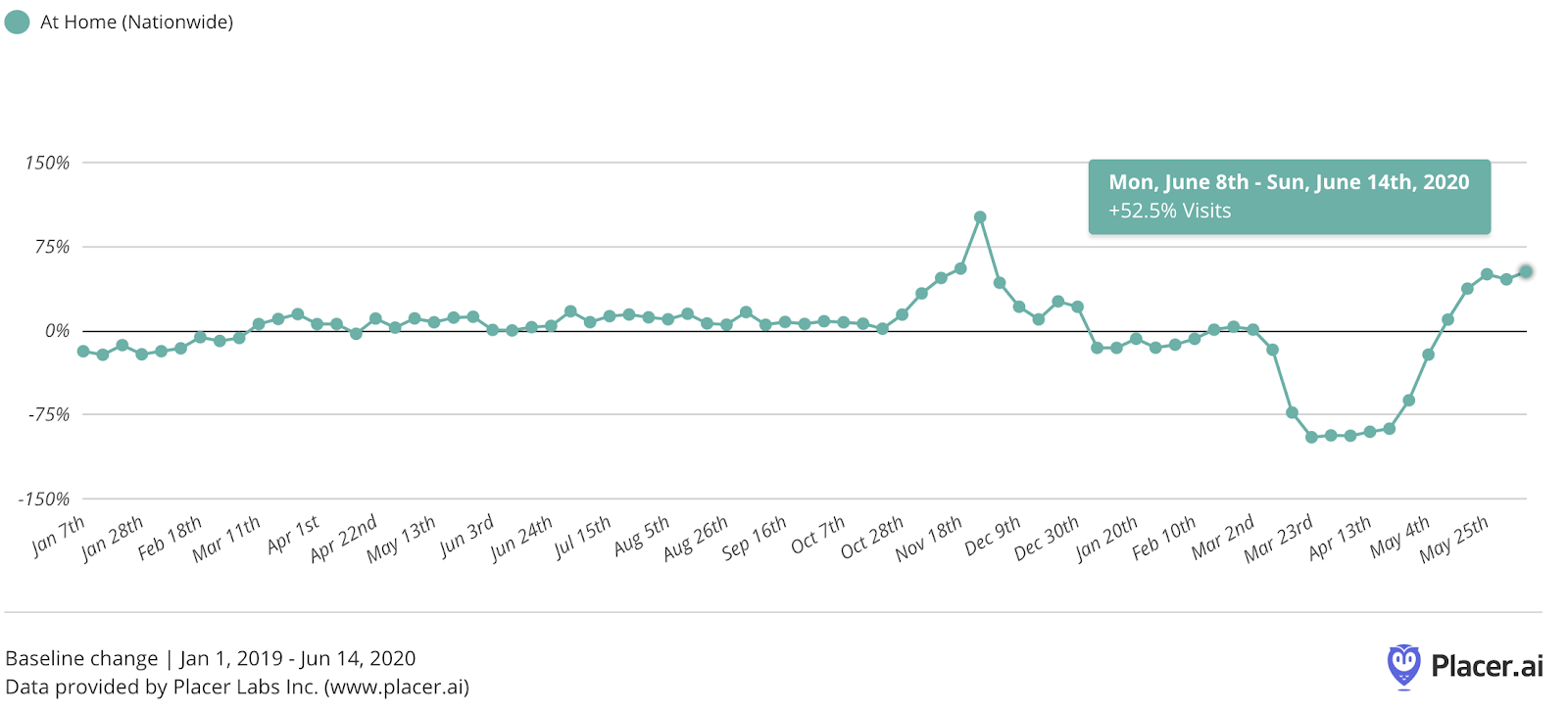

At Home is seeing a similar surge where the peak could be short-lived, but the long term strength may just be beginning. As with the others, the combination of pre-pandemic strength, a well-oriented business model, and pent up demand seem to be creating a perfect storm that could last for at least the coming months. And all this is before the key season of the holidays.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.