Source: https://www.placer.ai/blog/placer-bytes-unstoppable-target-macys-bull-case-and-the-albertsons-ipo/

In this Placer Bytes, we dive into the endlessly impressive Target, take a look at Albertsons following its IPO announcement, and break down the optimist’s case for Macy’s.

Target Cannot Be Stopped

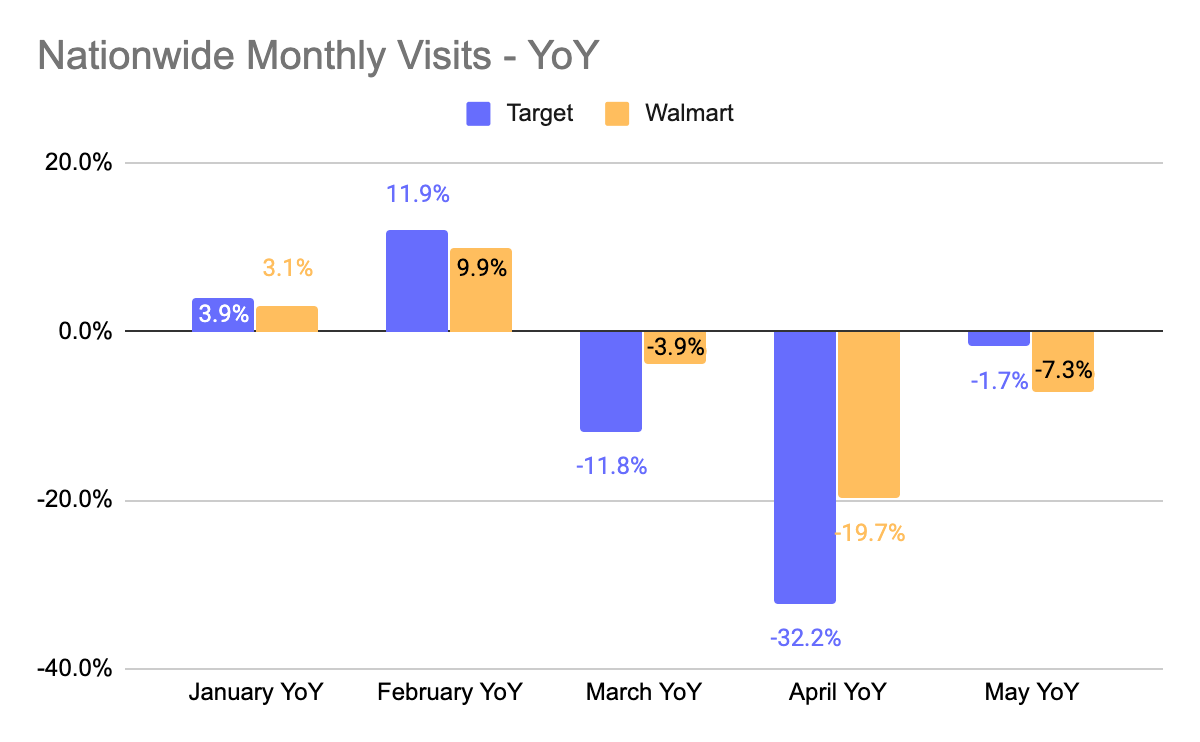

Yes, it was considered essential retail during the pandemic, but Target was still hit very hard. The year kicked off incredibly well, but visits saw a significant downturn, especially compared to superstore competitor Walmart. While Walmart’s traffic never dipped below 20.0%, Target saw visits drop 32.2% compared to the same month in 2019.

Although its offline hit from the pandemic may have been worse, the pace of Target’s return looks to be far stronger. By May, Nationwide visits for Target had returned to a decline of just 1.7%, and the pace of return is picking up.

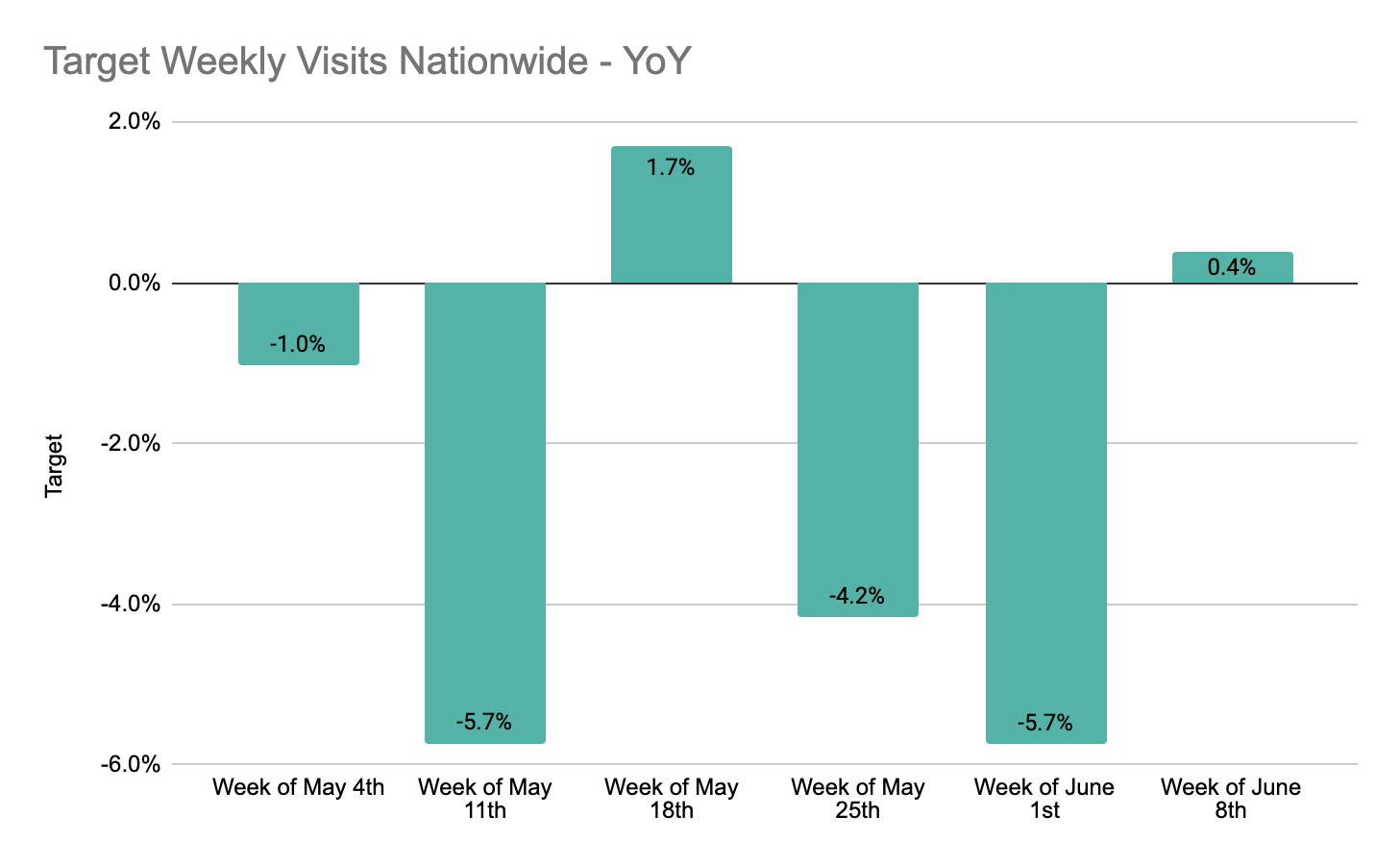

Looking at weekly visits since the start of May, Target has yet to see a year-over-year visit decline of more than 6.0%, and there have even been two weeks with year-over-year growth. This is exceptional performance considering many states were still imposing significant restrictions, and Target does have a significant number of stores in harder-hit states and

cities. Even more impressively, the rate of return actually looks to be increasing with the 15th, 16th, and 17th of June showing year-over-year growth of 4.7%, 7.3%, and 6.9% respectively. So, while May looks to have marked the beginning of Target’s recovery, June could put the rapid return into full focus.

Albertsons Excellent Timing

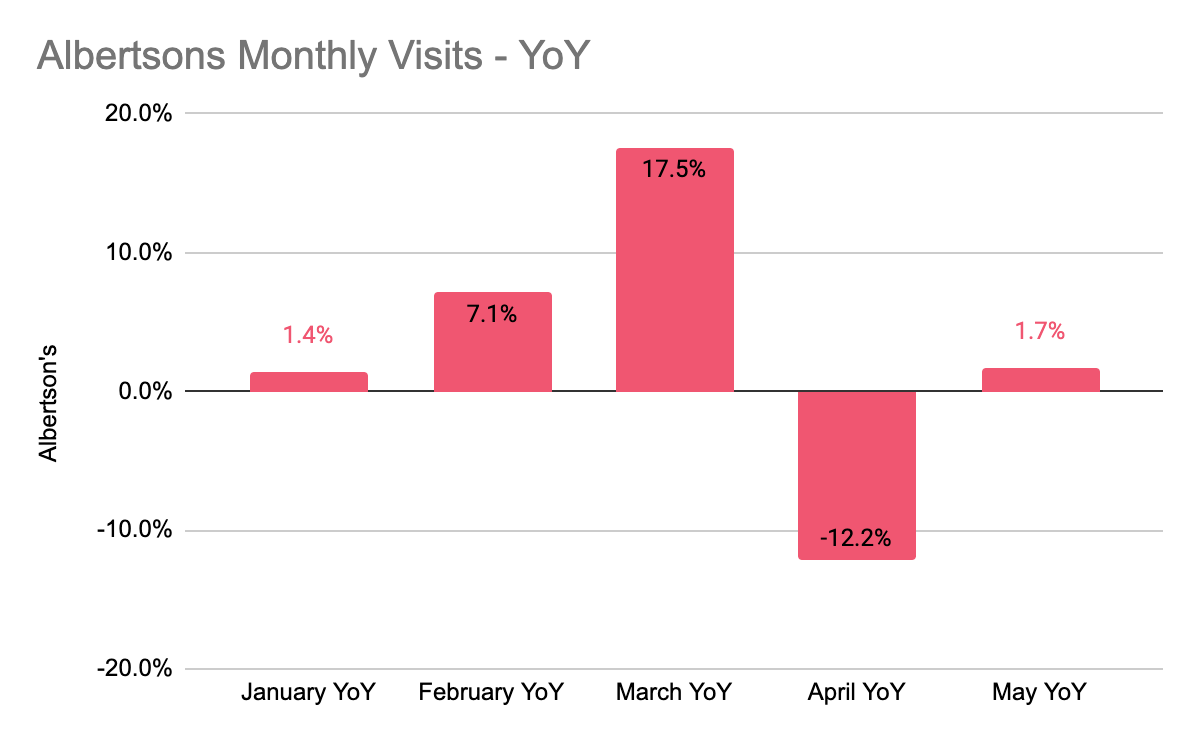

With Albertsons announcing its IPO plans, there’s an increased focus on what the brand’s performance has truly been, and the timing seemingly could not be better. The pandemic put traditional grocers on a pedestal, and this just poured more fuel onto an ever-strengthening fire for the chain. For example, while annual visits in 2019 were up 0.6% year over year, the first five months of 2020 have driven an overall increase of 3.1%. All this while taking into account the drops associated with the pandemic.

Albertsons kicked off 2020 with strong growth in January and February, before seeing a massive March spike, and major April downturn. Yet, May visits, even amid the ongoing effects of the pandemic, were already back to early 2020 year-over-year growth numbers.

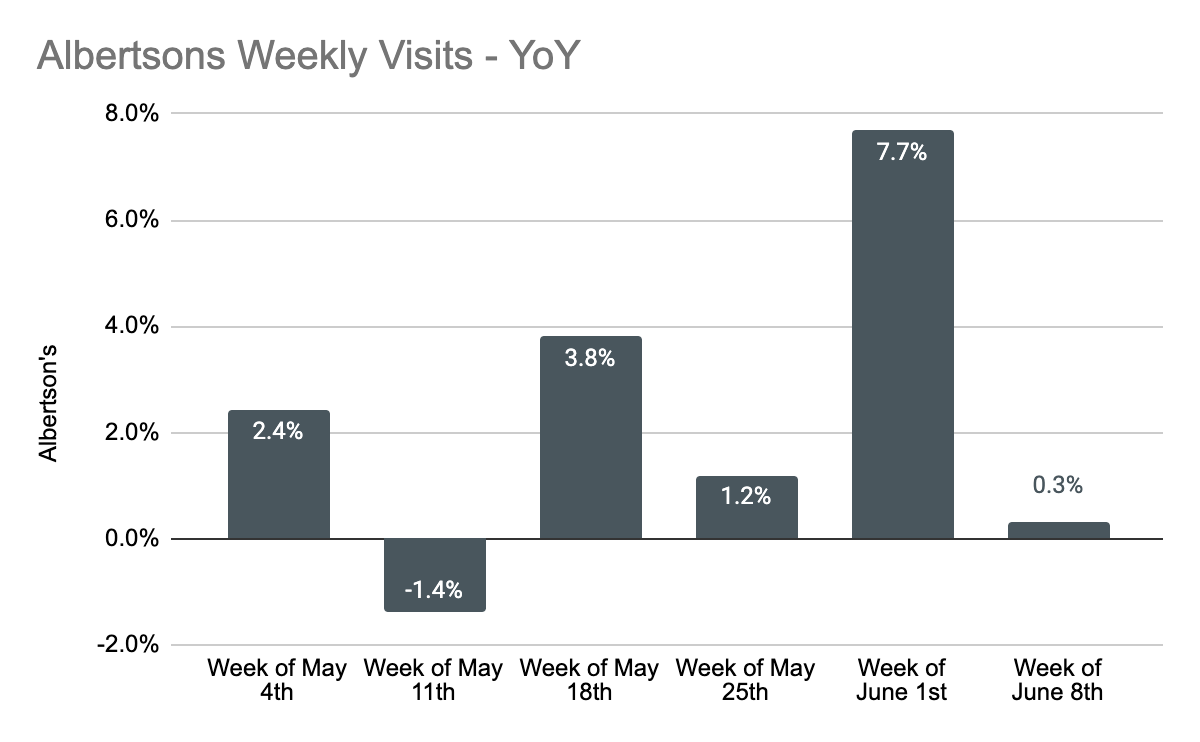

And, here too, the pace is not slowing down. Analyzing weekly visits year over year shows only one week with a decline since the start of May, while visits the week of June 1st were up nearly 8%. Should this pace continue, the brand could be exceptionally well-positioned to carry its newfound strength deep into 2020 and beyond.

Macy’s – An Optimist’s View

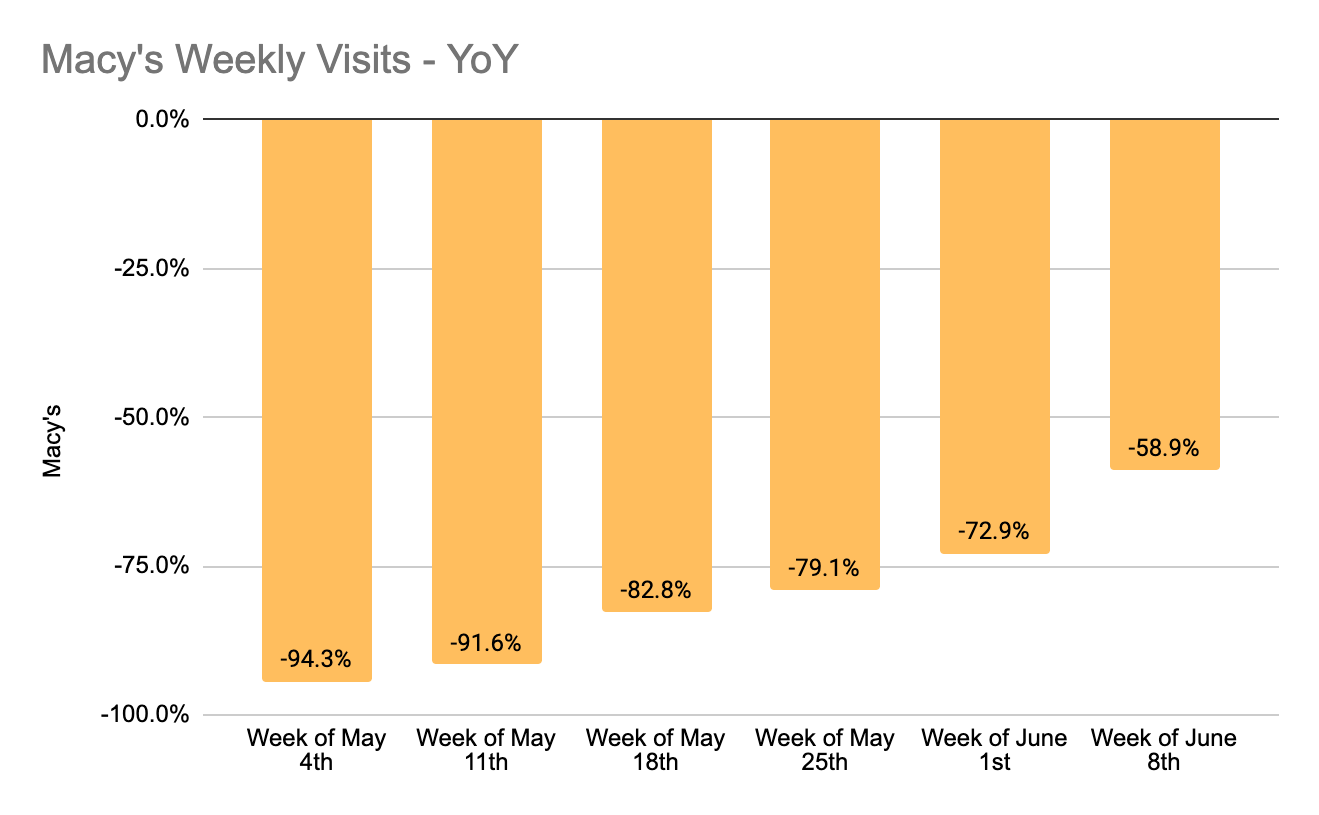

Predictions of the death of the department store have only picked up pace lately, with the challenges facing malls and certain brands taking center stage. However, there is another perspective on the matter, and Macy’s is an excellent example. While visits for the brand are down, they are moving quickly towards normal with the week of June 8th showing a drop of 58.9%, a massive improvement on just a few weeks prior when visits were down 94.3% year over year.

While Macy’s is closing large numbers of stores, it has proven to be strategic in the process, identifying locations that can still be effectively served by other branches. And while not all new concepts have hit home, the retailer has shown a willingness to roll out ideas and innovate. Additionally, the removal of key competitors could create a strong opening for short-term growth. This combination of a more optimized retail footprint, an aggressive approach to innovation, and the opportunities enabled by struggling competitors could unlock new levels of growth for the brand.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.