Since we’ve discussed the Restaurant and Retail industries recently, this week we decided to look at our human mobility data for the travel & hospitality industry. Specifically, we were curious how the motel and hotel categories compared in terms of recovery.

What we found through our analysis of the data is, while recovery trudges along at a slow pace generally, all things are not equal between individual hospitality sectors, states and brands.

General themes and trends

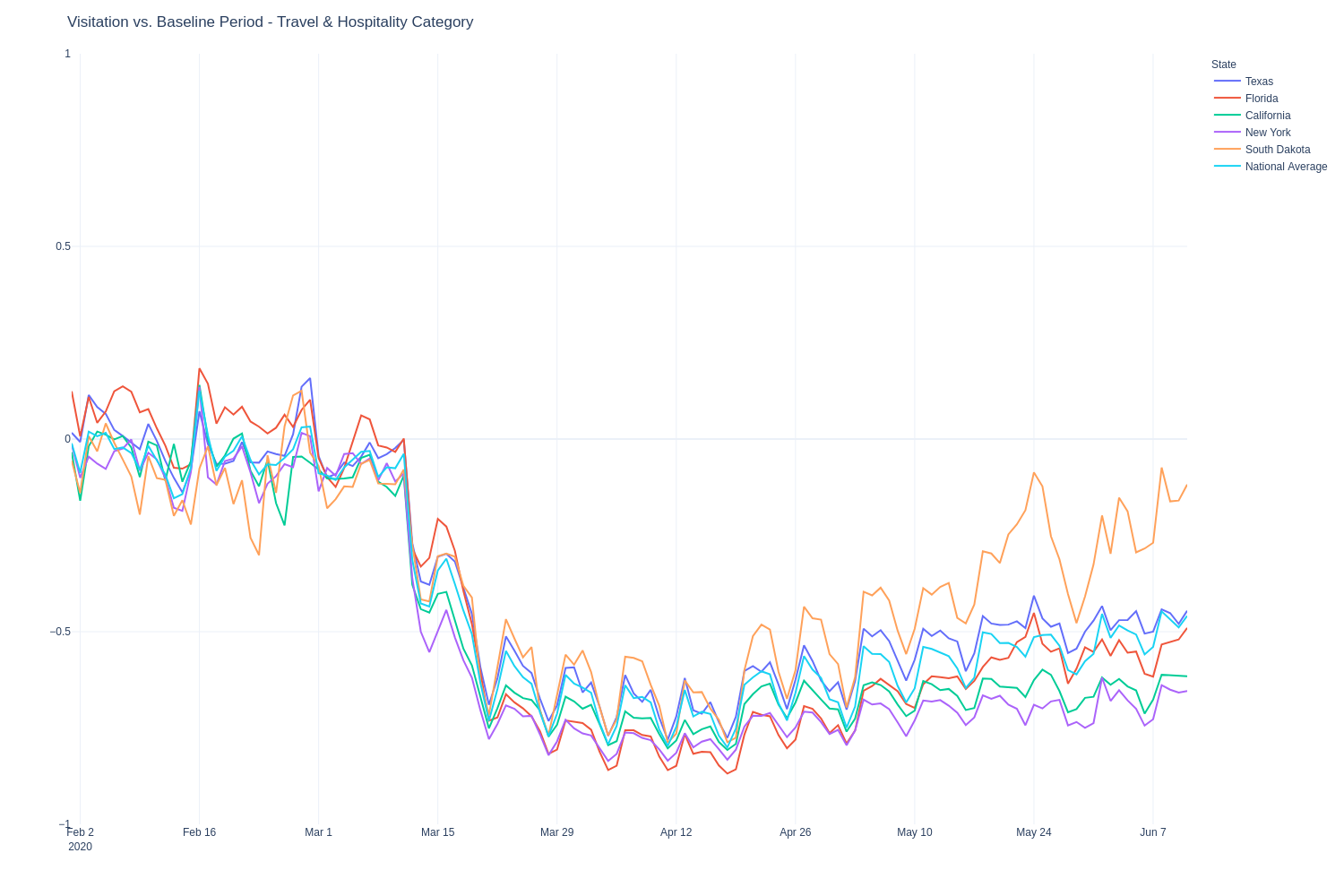

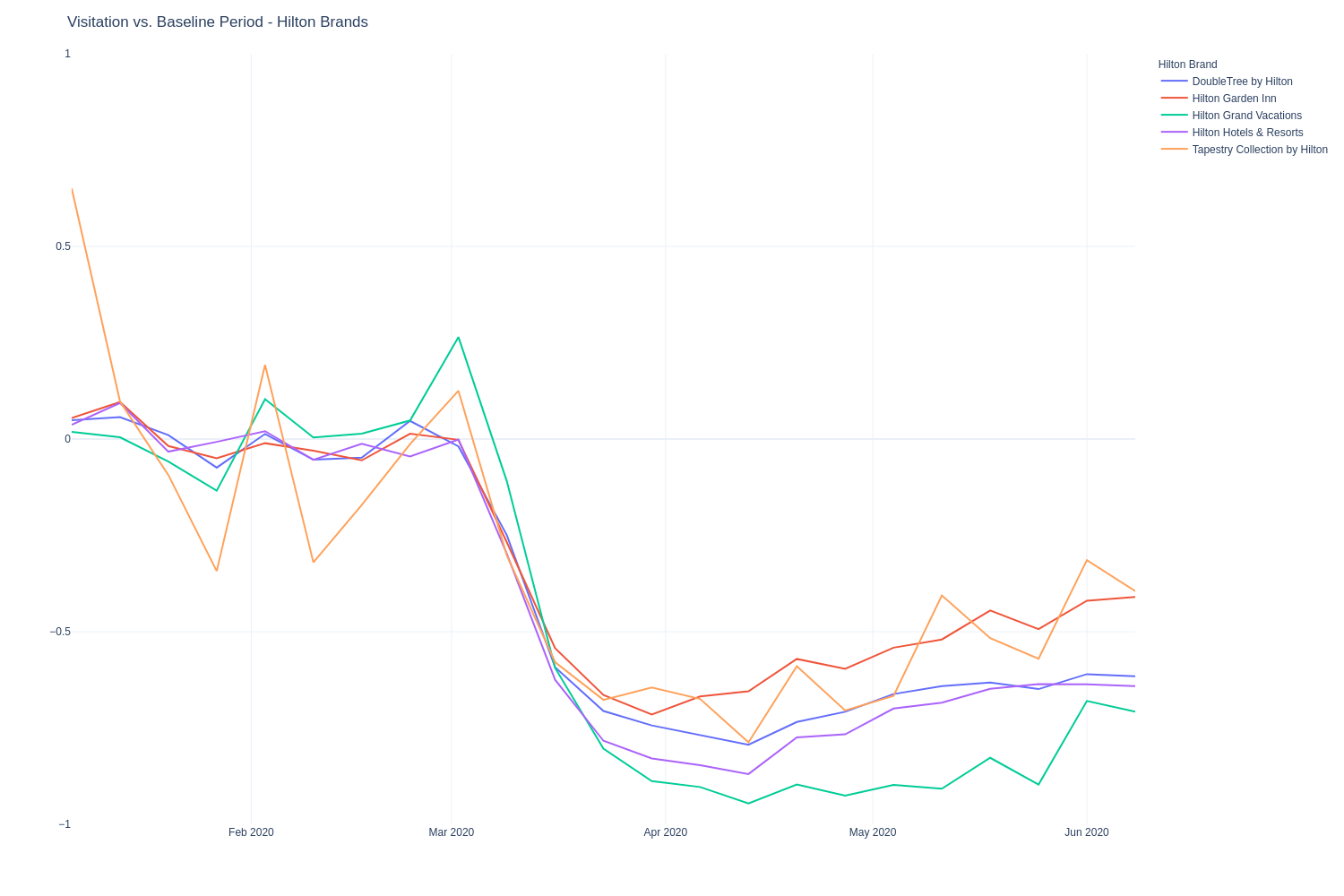

The travel and hospitality category generally continues along a weak recovery trend much as it has since mid-April when visitation bottomed-out between -60% and -80% for most brands. That’s up to a national average of within ~50% of pre-COVID levels, as of this writing.

In South Dakota, where shutdown never happened, travel and hospitality has largely recovered, touching 2020 visitation levels in late May to early June, before falling back within ~10% of pre-COVID levels recently. Most other states saw little to no growth overall over that same time period, with current figures about where they were in early May.

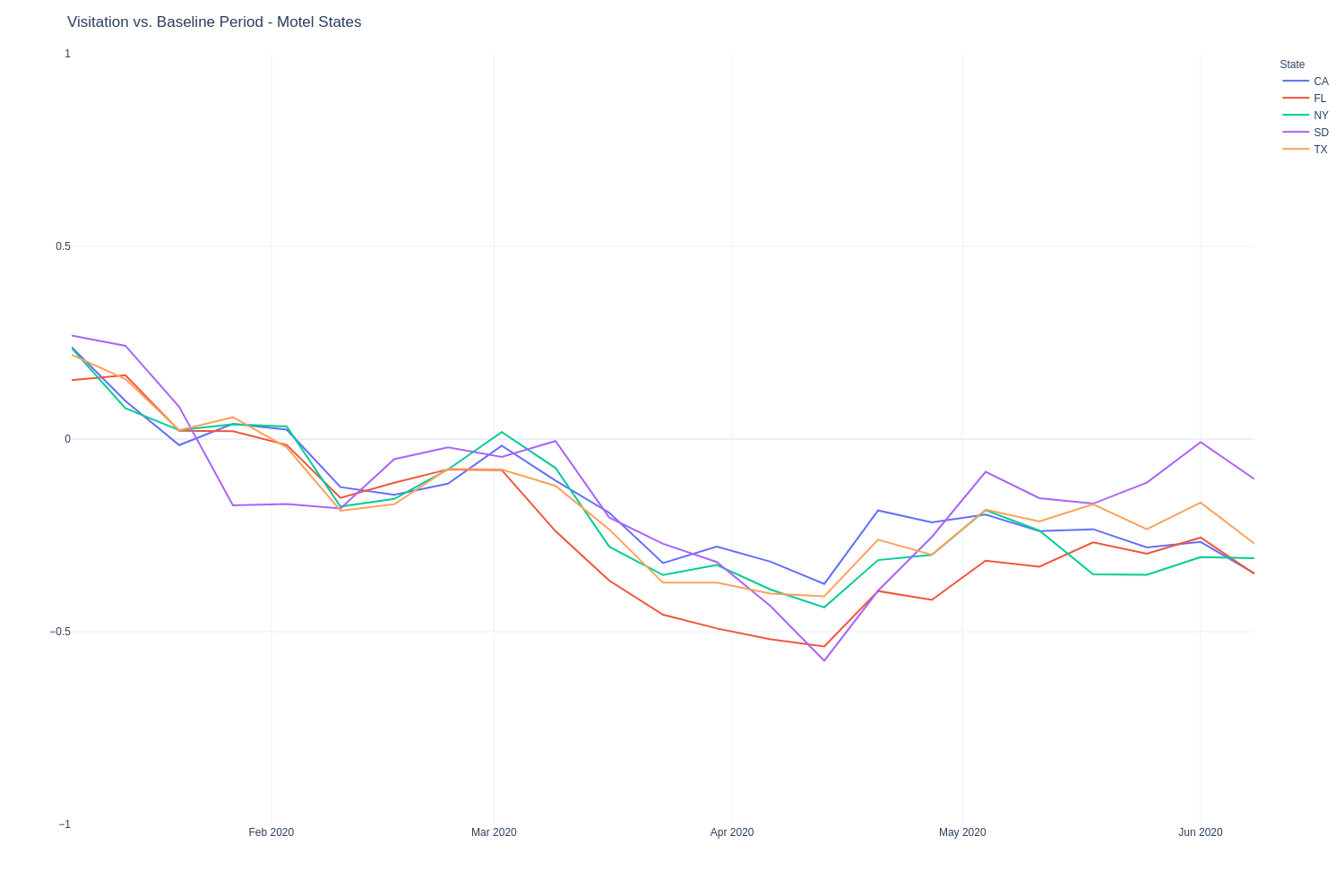

The motel sector is recovering faster on the whole than the hotel sector, though the states leading the recovery charge could soon face a second wave of restrictions.

Both California (Social Distancing Score = F), where motels had achieved near 100% recovery from pre-COVID-19 levels as of the beginning of June, and Texas (Social Distancing Score = F), which had recovered to within ~20% of pre-COVID levels, are currently experiencing a spike in new infections, as are several other southern states, including Alabama and Florida – among the first to re-open public beaches over the Memorial Day weekend.

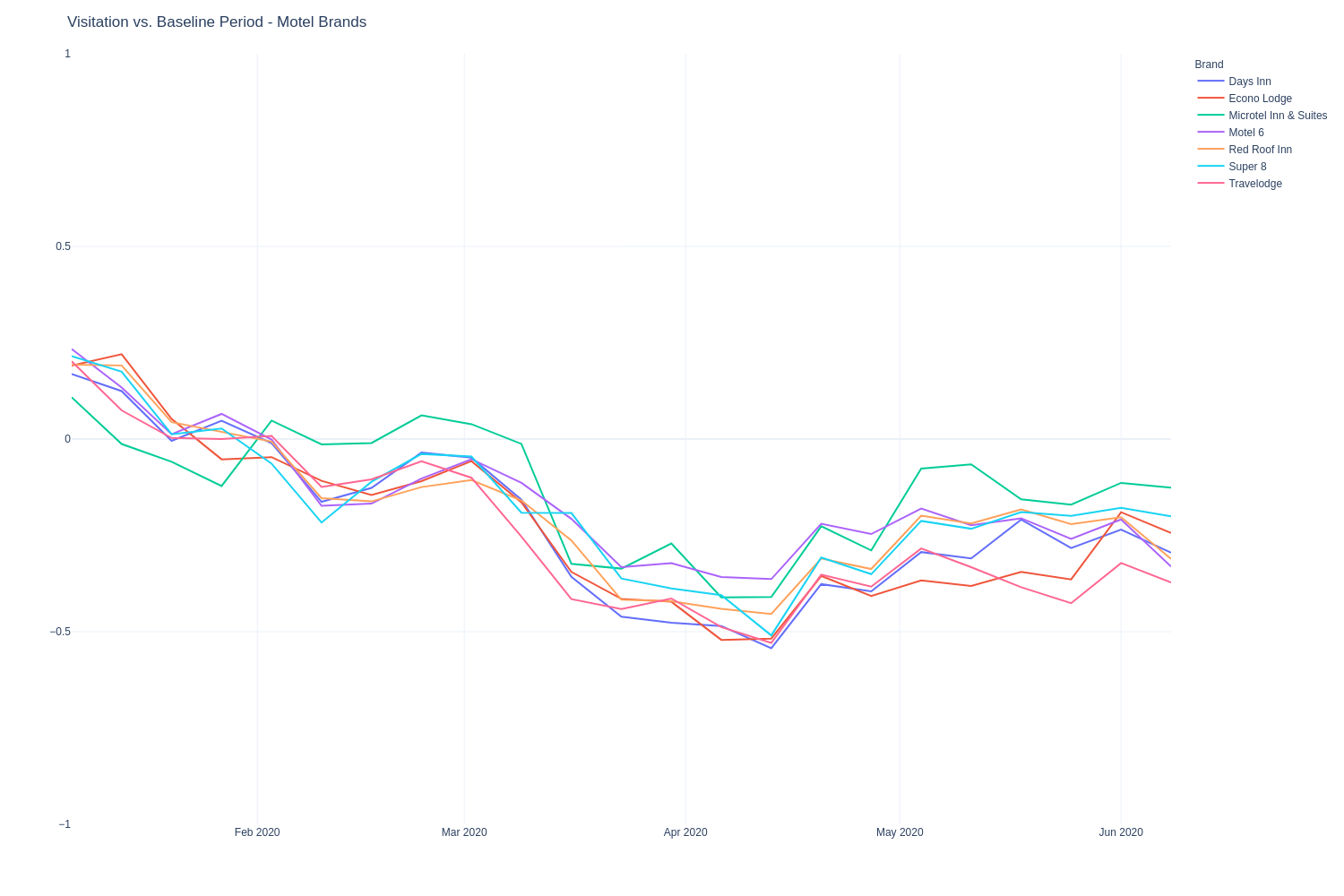

That noted, the recovery trend for the motel sector on the whole remains flat to slightly downward as of mid-June, but there are clear differentiations in the performance level of competing brands, with Microtel by Wyndham Suites setting the pace.

The 351 location-strong Microtel brand had recovered to within ~10% of pre-COVID visitation levels by the second week of May, before falling back to within ~15% as of this writing.

That’s more than twice as strong as category and portfolio laggard Travelodge, also owned by Wyndham, which was seeing visitation levels of negative 35% over the same period.

While those recovery figures appear weak versus its immediate peers, Travelodge and most others in the motel category are still outperforming brands in the higher-end hotel category, including Hilton properties.

Anecdotally stated: It appears visitors are eschewing longer stays and higher-end amenities in hotels, for the utility of a simple night’s stay and the perception of safety in fewer numbers offered by smaller motels.

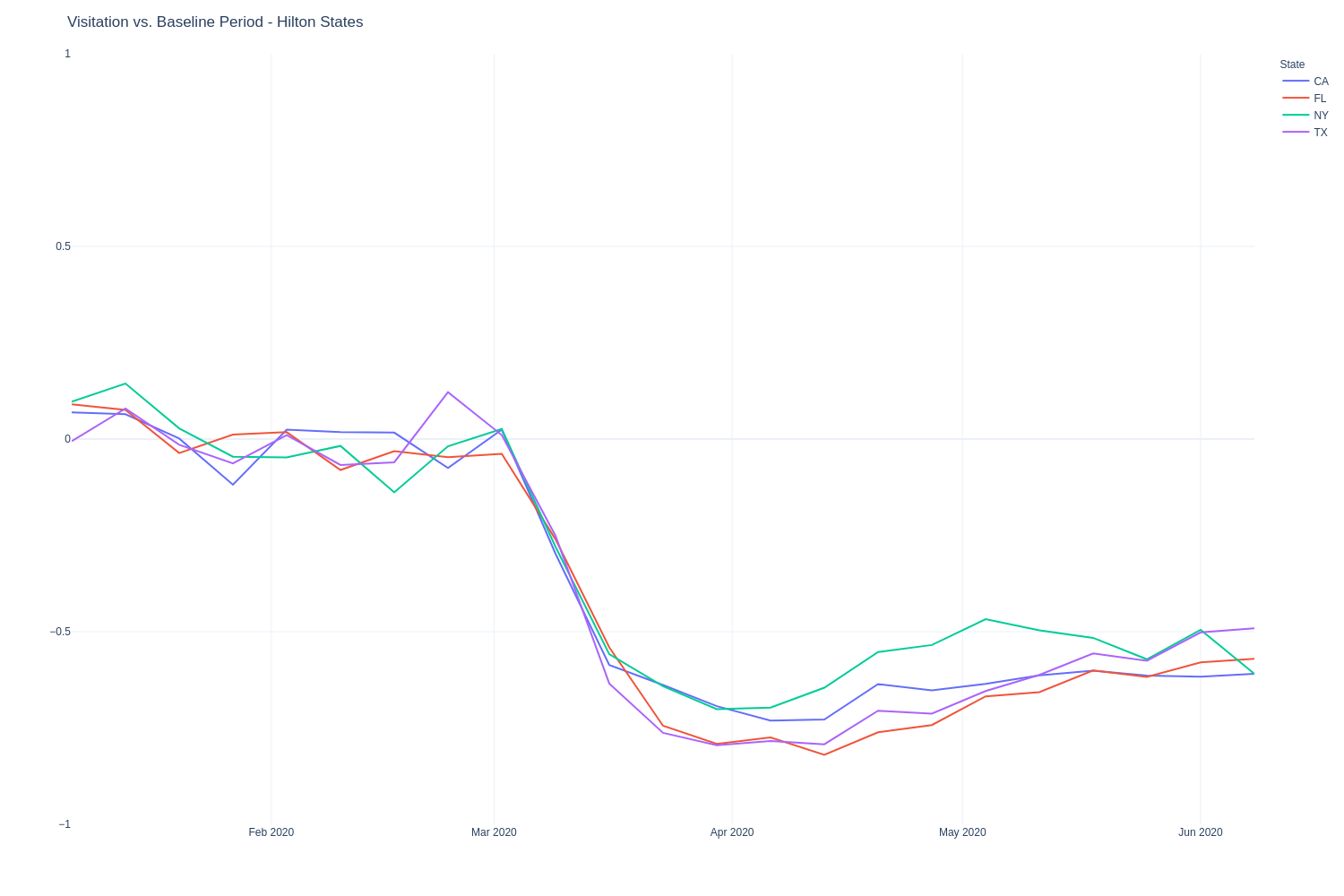

Overall, motels are about 25% to 35% closer to pre-COVID baselines than Hilton brands on average. This finding holds across all states we surveyed, regardless of their respective approaches to shutdown and reopening. While that’s not particularly revealing, the relative performance of different Hilton portfolio brands is.

The Hilton Garden Inn and Tapestry Collection by Hilton, both of which are part of the brand’s Upscale offerings, have each recovered to ~40% of pre-COVID levels, after falling to between -70& and -80% in late-March and early-April. That’s about 2x the recovery rate of other Hilton brands, on average.

Interestingly, Hilton Grand Vacations, the company’s timeshare brand, has caught up to the middle of the portfolio in terms of recovery after a sharp spike in visitations in late May, potentially indicating a willingness on the part of more affluent customers to start traveling again.

As the travel & hospital industry continues to recover, there are clear patterns in human mobility data that indicate visitors are taking a cautious approach to choosing their accommodations, with a preference for smaller locations and mid-market brands as we head into the 2020 summer season.

To learn more about the data behind this article and what Unacast has to offer, visit https://www.unacast.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.