As we make our way deeper into the retail recovery, the question of the lingering impact on certain behavioral changes comes to the forefront. What’s changed? How much did it change? And which of these changes have true staying power? And nowhere is this question more significant than for top QSR brands that had a clear morning orientation.

QSR Magazine analyzed the changes in consumer behavior for this sector in early May using Placer.ai data to break down the changes in March and April year over year. Taking this a step further, we dove into data from a few key players in the breakfast space to analyze how those changes look during the recovery.

Morning Traffic Down

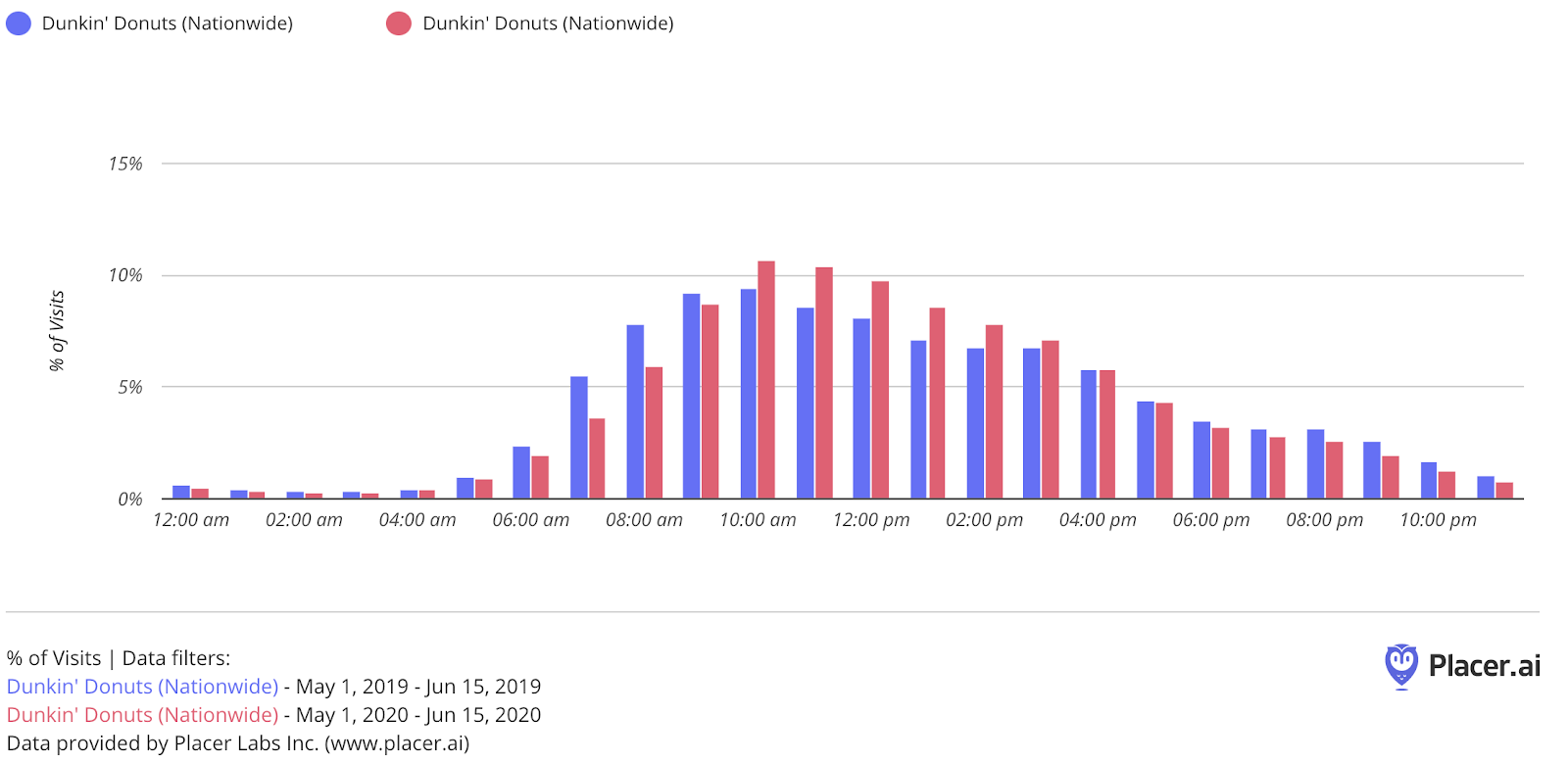

Looking at the period from May 1st through June 15th year over year highlights several insights that are critical for understanding the rebound. The first is that the morning routine driven by commutes to work and drop-offs at school has heavily impacted traffic. In 2019, 15.7% of Dunkin’ visits came between 6 am and 9 am, but this number dropped to 11.5% in 2020.

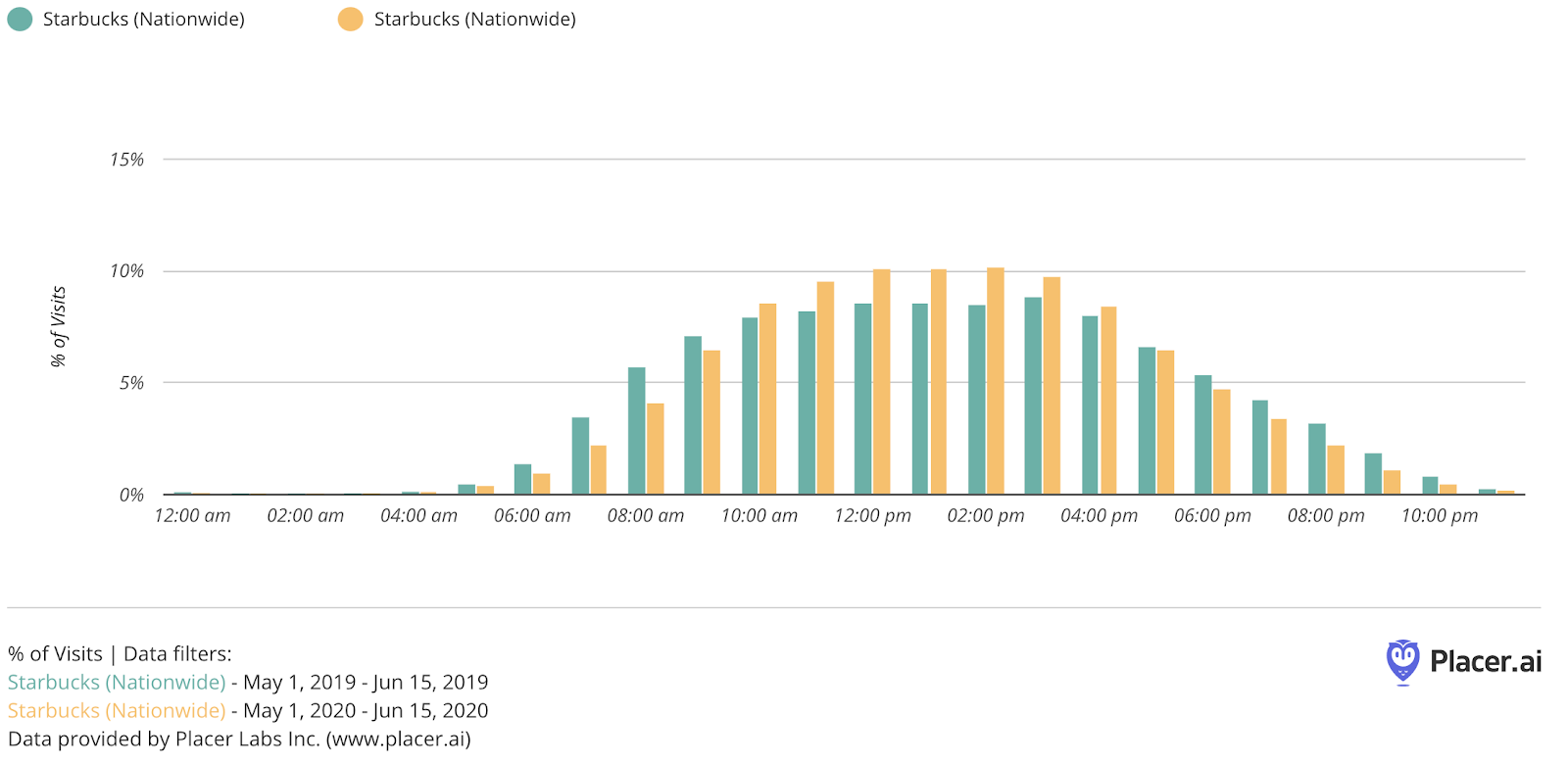

Starbucks saw a similar decrease from 10.6% of visits during these hours from May through June 15th, 2019, to just 7.3% during the same period in 2020. And the identification of this loss is as significant as it is promising. While both brands have seen midday increases, the more the recovery drives people back to work, the more potential customers will likely return.

In fact, the only brand analyzed that saw a morning increase was Wendy’s likely because of its renewed focus on that specific segment. Traffic between the hours of 7 am and 10 am increased from 3.4% of overall visits from May 1st to June 15th in 2019 to 5.3% in 2020.

Other Changes

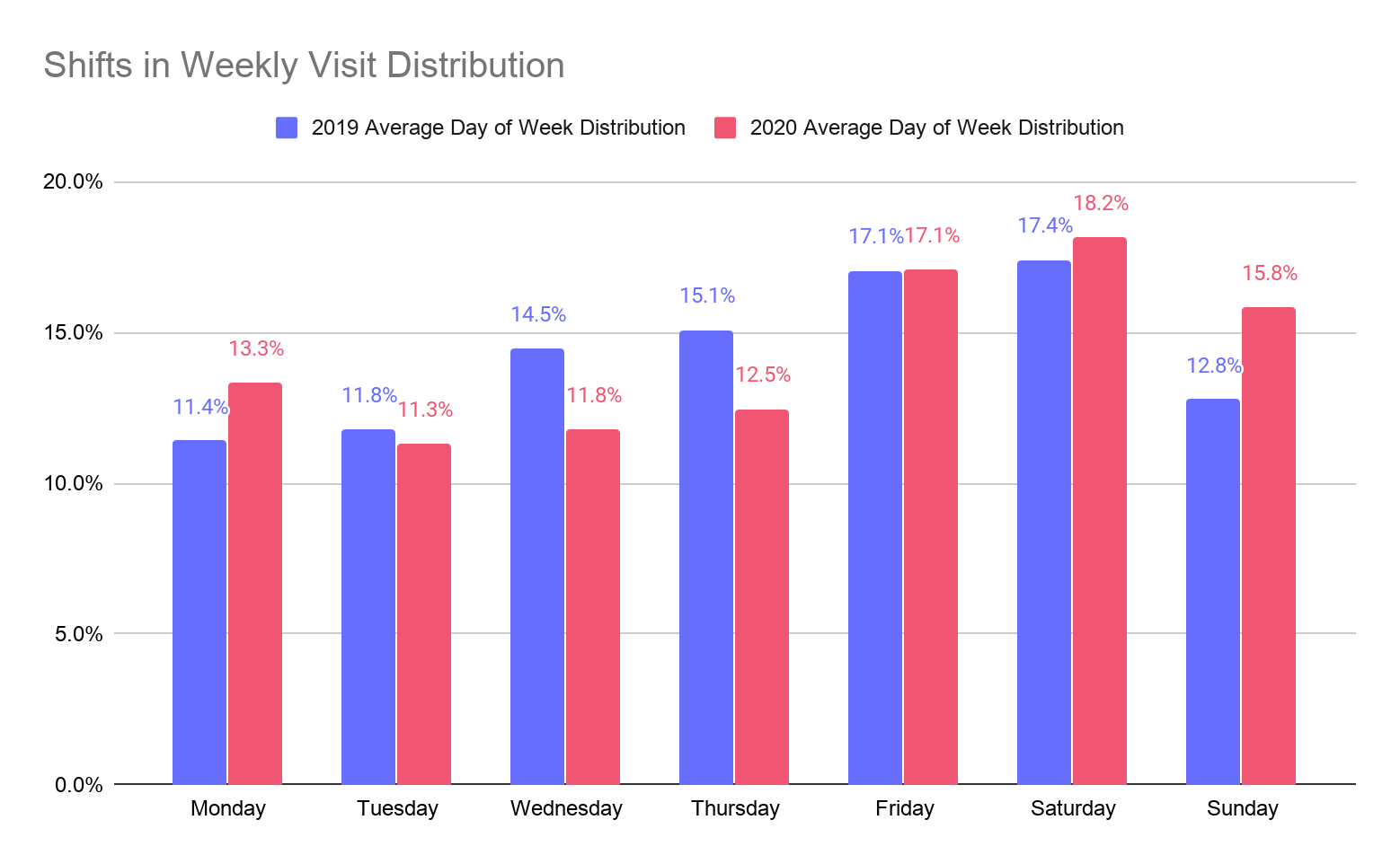

But the time of the daily visits wasn’t the only shift, the day customers were most likely to visit changed too. Looking at the visit distribution for Starbucks, Dunkin’ Donuts, Wendy’s, Panera and McDonald’s showed visits shifted to the weekends and Mondays. Analyzing the average visit day for the group between May 1st and June 14th, 2019 to the same period in 2020 showed a consistent pattern. Whereas visits normally spike midweek, the weekends saw a significant boost.

From declines in midday visits from professionals, to the ‘need’ to supplement a cooked meal with fast food at different times, certain behaviors have clearly shifted. And the weekend shift could have the biggest implication. Already noted earlier in the recovery, visits to grocery stores shifted from weekends to weekdays with a notion that this could open up opportunities for weekend growth. And the fast-food patterns further strengthen this idea.

Are the Changes Good or Bad?

While there are still declines to make up for the sector, as the wider dining category is still down 30% year over year in the US, there are very positive signs from this sector. Shifts away from the morning are likely more related to changes in work and school patterns than any real adjustment in consumer demand. So, it is very likely that the morning and lunchtime surges these brands normally enjoy will return.

But the weekend shift could have some staying power. With a jump in weekday grocery visits among the changes with the highest potential to remain, the use of weekends for a fun alternative to the norm could stick around. Additionally, the value orientation of most of these brands could help support their position across the board for all three meals.

Will these behaviors continue, or will they shift back as the recovery returns us close to ‘normal’.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.