Today’s data from Huq’s new European Travel Monitor indicates that the reasons for British overseas travel during recent months have been closely inline with those permitted – essential work, family and ‘returning home to a main residence’.

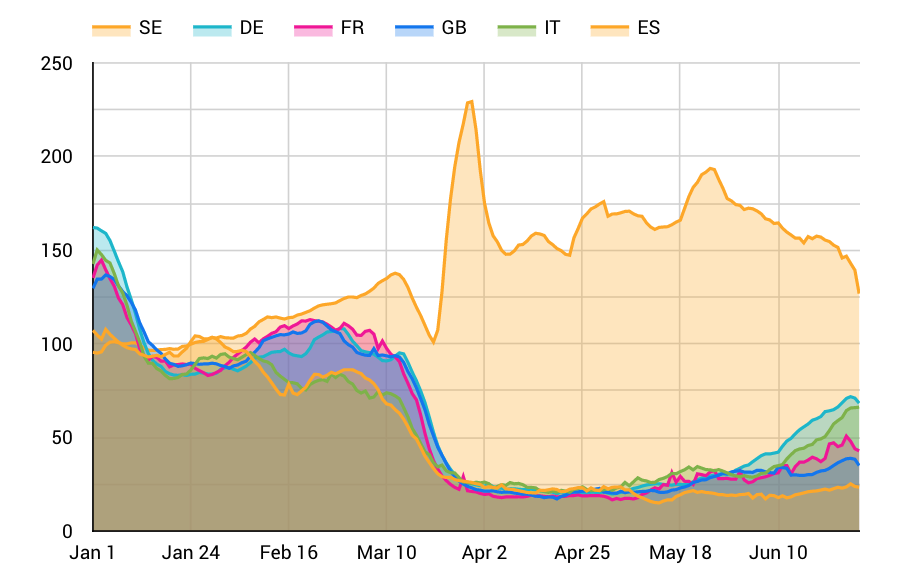

This new monitor – which measures the proportion of European country-residents present in popular destinations across southern Europe – also reveals that Sweden has been the only country to demonstrate some semblance of normality over the period since March, with residents 6x more likely to travel than their British counterparts.

While the number of international travellers from all European countries are rising in relation to pre-Covid levels, they are yet to get anywhere close to previous summers. In the last month, the volume of German residents travelling overseas reached 71% of previous levels. This is followed by Italian residents (66%) and those living in France (51%). Brits have been some of the most cautious in Europe, rising to just (39%) of previous levels, followed by Spain (25%).

So, what have country residents been doing overseas?

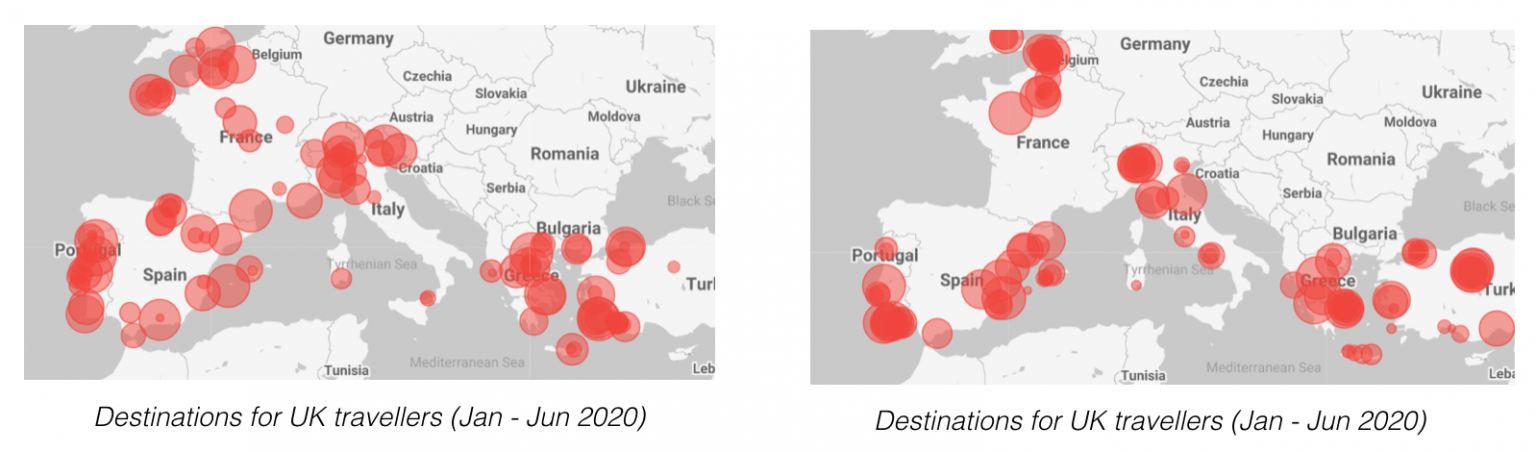

Taking a closer look at Huq’s regional destination maps, the most common destinations have been to major cities and economic centres – leading one to deduce that the majority of travel in recent weeks can be attributed to essential business and family needs. For traveling Brits this is in stark contrast to last year where Catalonia, the Algarve and Greek islands were among the most popular.

While Swedes have been less likely to visit usual holiday destinations with more travel to cities, holiday destinations such as Faro, Barcelona and Southern Italy have nonetheless witnessed greater activity relative to other European residents. Does this suggest some Swedes have been able to enjoy near-empty beaches over the last four months? The higher proportion of activity to major cities however suggests that their reasons for travel have been more sober.

Huq’s new European Travel Monitor offers an in-depth and fine-grained means to measure travel to Europe – all in terms of total volume, regional destinations, key activities and destination brands. We will be closely following the progress of tourism across Europe this summer and to observe how this activity translates into much-needed economic input for the travel and hospitality sector.

To learn more about the data behind this article and what Huq has to offer, visit https://huq.io/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.