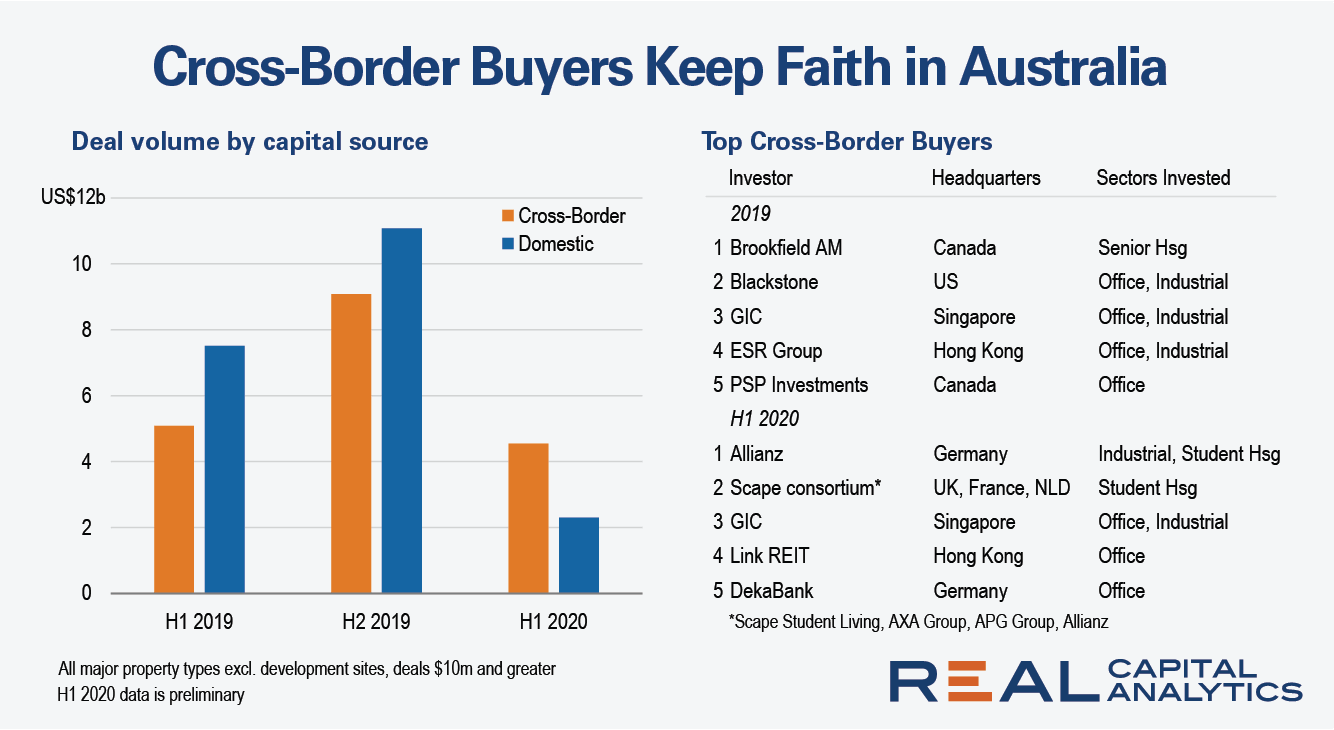

Australia has had a sluggish start to 2020 so far after a buoyant 2019 propelled by a record $14 billion of cross-border investment. The sharp downshift has drawn comparisons to the misery of 2008 which followed a bumper 2007, but the parallels in headline deal activity are just about where the similarities end.

Back in 2007, Australia’s real estate investment landscape was very different. Before the Global Financial Crisis, many international investors were just beginning to build their Australian commercial property portfolios. Over 75% of cross-border capital was deployed by a select group of North American institutions across a handful of megadeals involving entity-level acquisitions and billion-dollar shopping malls. When the financial crisis deepened in the U.S., these players retreated promptly, resulting in a spectacular collapse in cross-border inflows.

In contrast, 2019’s record cross-border acquisition activity was underpinned by a more global spread of capital sources, as new players have emerged from greater China, South Korea, India and various other Southeast Asian nations in recent years. North American investors were still active, but they accounted for only 40% of volume in 2019. Instead, they diverted their attention towards alternatives and infrastructure.

There has been a noticeable lack of North American investment in 2020. While domestic Australian investors picked up the slack in the aftermath of the GFC, they have faced much stiffer competition for assets this time round. The pandemic restrictions on inbound travel have not dampened European and Asian investment appetite, as investors who established a local presence continued to acquire assets steadily. This has pushed Sydney into the top five global destinations for cross-border capital so far this year.

History tells investors to tread carefully in markets which exhibit an overreliance on cross-border investment. While that may be true for smaller cities, Australia’s demand base this time round is much deeper and more diversified, a testament of how far the real estate sector has matured over the past decade. Notwithstanding the tighter regulations recently imposed by the Foreign Investment Review Board, the market is already in better shape to weather a crisis like the one the global economy currently faces.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.