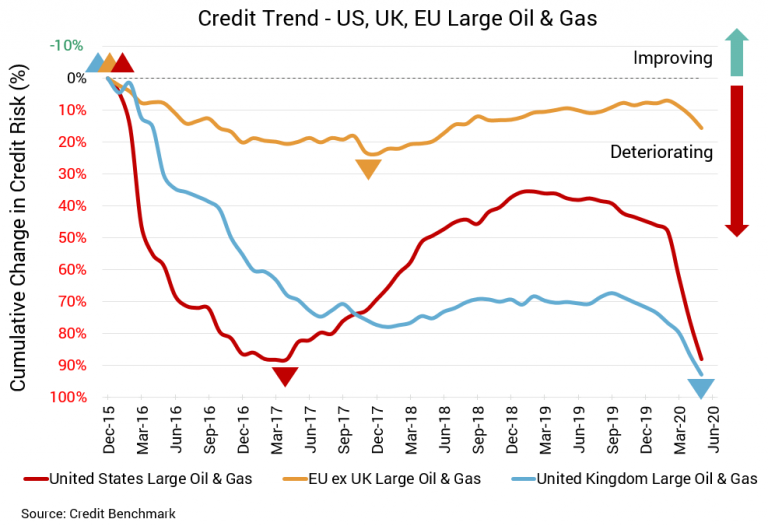

Problems in credit quality abound, yet few sectors are seeing deterioration like the US energy sector. Supplies remain elevated as demand remains lower, and the economy remains weakened as new COVID-19 cases surge throughout the country. So great is the strain for the sector that Deloitte projects up to $300 billion in write downs or impairments, and the list of bankruptcies is growing.

Probability of Default for US Oil & Gas Firms Surges by Almost 40% Over Last Year

US Oil & Gas

The US energy sector continues to see one of the most pronounced declines of all sectors tracked, and this shows no signs of abating. Credit quality for large US oil & gas firms is down 5% from last month, 15.7% from two months prior, and 25.5% from three months prior. Year-over-year, credit quality has plummeted by 37.2%. Default risk is surging. Average probability of default is now 59 basis points, compared to 56 basis points in the prior month, 51 basis points two months prior, and 47 basis points three months prior. At the same point last year, it was 43 basis points. This aggregate’s Credit Benchmark Consensus (CBC) rating remains in the bb+ range. Around 83% of the firms with such a rating are at bbb or lower, significantly higher than aggregates for the UK or EU.

UK Oil & Gas

Credit quality for the UK energy sector is also deteriorating, although the pace is much slower compared to the US energy sector. Large UK oil & gas firms have seen their credit quality drop by 3% from a month earlier, compared to a drop of 9% over the last three months. Year-over-year, the decline in credit quality was 15.2%. This deterioration in credit quality corresponds with an increase in default risk. Average probability of default is 38 basis points, compared to 37 basis points the prior month and 35 basis points two and three months prior. This aggregate’s CBC rating is unchanged at bbb-, and about 67% of the firms with such a rating are at bbb or lower.

EU Oil & Gas

Credit quality for the EU energy sector is unchanged from the month prior and down only 4% over the last year. Average probability of default remains at 25 basis points, unchanged from the prior month, and compared to 24 basis points at the same point last year. This aggregate’s CBC rating is unchanged at bbb, and about 66% of the firms with such a rating are at bbb or lower.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.