Many families were caught financially unprepared with the sudden onset of the pandemic in the U.S. earlier this year. The national unemployment rate spiked from a 50-year low of 3.5% in February 2020 to an 80-year high of 14.7% in April. And while the sudden loss of income was partly muted by an income tax refund and enhanced unemployment insurance payments for eligible taxpayers and workers, nonetheless, many homeowners are struggling to stay on top of their mortgage loans, resulting in a jump in non-payment.

The CARES Act provided mortgage forbearance for homeowners who were financially harmed by the pandemic-bred recession but still had a federally backed loan – a home loan insured or guaranteed by FHA, VA, or the USDA, or purchased by Fannie Mae or Freddie Mac. Moreover, servicers can extend the forbearance to other home loans, but they are not obligated to do so under the CARES Act.

Since the large majority of loans contained in private-label Residential Mortgage-Backed Securities (RMBS) do not meet the “federally backed” definition, an analysis of CoreLogic® private-label RMBS data suggests what could have happened absent the forbearance provisions.

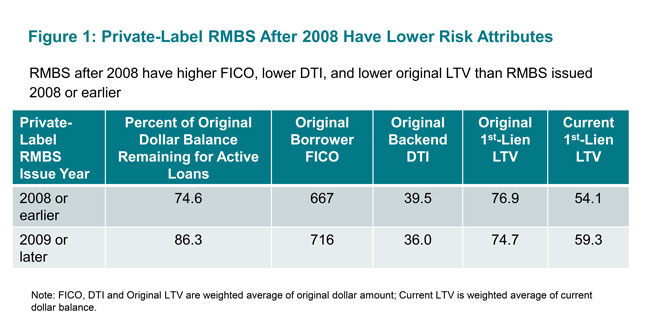

After 2008, underwriting quality improved, allowing CoreLogic to separate our data into two buckets: private-label RMBS issued 2008 and earlier, and those issued after 2008. And judging by important credit risk attributes, the loan quality is much stronger for RMBS issued during the last decade (Figure 1).

Figure 1: Private-Label RMBS After 2008 Have Lower Risk Attributes

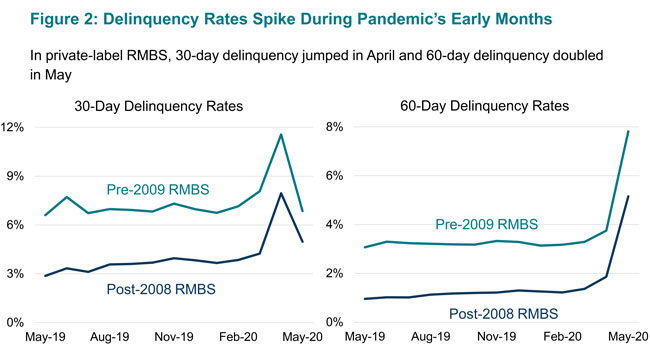

Comparing 30-day and 60-day delinquency rates reveals two clear differences (Figure 2). The younger private-label RMBS have delinquency rates that are roughly one-half that of the older RMBS, reflecting the higher quality of underwriting after 2008. Additionally, delinquency rates over the past few months were about double what they were pre-pandemic. The delinquency spike was initially reflected in 30-day rates during April, and subsequently in 60-day rates this past May. Thus, June data will likely show an approximate doubling in 90-day rates, especially since double-digit unemployment rates continued through the second quarter.

Figure 2: Delinquency Rates Spike During Pandemic’s Early Months

Depending on the amount of home equity homeowners have and whether or not home prices fall by a certain amount, this may result in an increase in delinquencies, leading to a hike in foreclosures and real estate owned.

While the average current first-lien loan-to-value (LTV) is 59% for private-label RMBS issued after 2008, 3% of borrowers remaining in these securities have a current first-lien LTV above 90%. Thus, for homeowners with a current LTV in the latter group, a decline in home prices could erase any remaining equity and heighten the risk of an eventual foreclosure.

Summary:

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.