Source: https://www.placer.ai/blog/placer-bytes-home-depot-lowes-and-the-endless-home-improvement-surge/

In March and April, the home improvement sector was already showing a unique potential for a post-pandemic surge. The brands were enjoying a “lightning in a bottle” moment where essential retail status, home quarantines and an unstable economy were making their offering as valuable as possible. Yet, even for those that saw promise for the sector, the growth has been surprisingly strong and is lasting far longer than anyone could have hoped for.

Pushing Beyond Seasonality

Early on, it would be fair to argue that much of the success was related to the fact that Home Depot and Lowe’s were open at the right time. With a normal seasonal peak between March and May aligning with their essential retail status, visits never saw the huge declines that other sectors experienced.

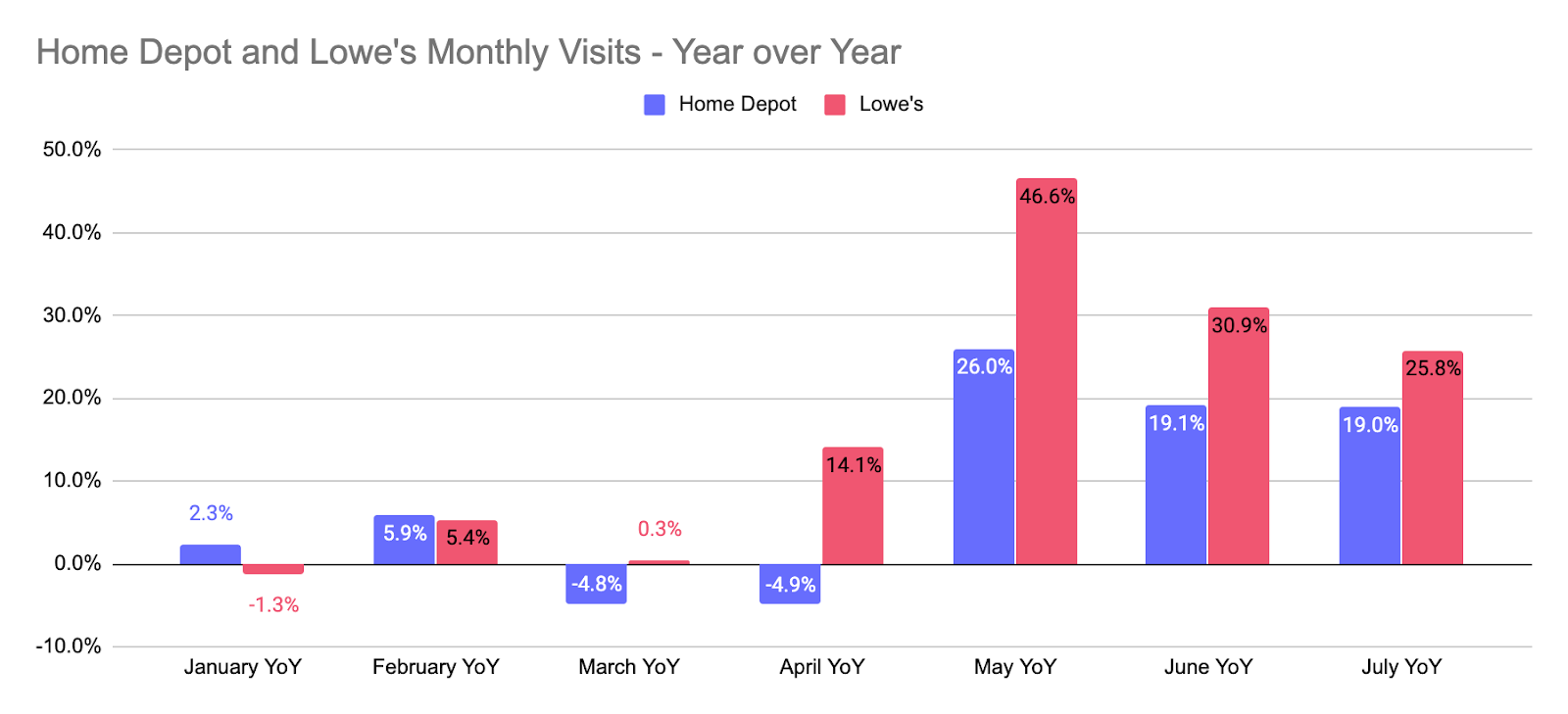

Lowe’s saw a jump earlier on with April visits rising over 14% year over year, before Home Depot’s pace picked up in May. Since that point, the visit growth has been huge for both brands. In June and July, Home Depot saw visit growth of 19.1% and 19.0% respectively, while Lowe’s enjoyed increases of 30.9% and 25.8%. And these months are hugely important to both brands’ stories, as they come after the normal seasonal peak came to a close and the competitive advantage of essential status ended.

Ongoing Trend?

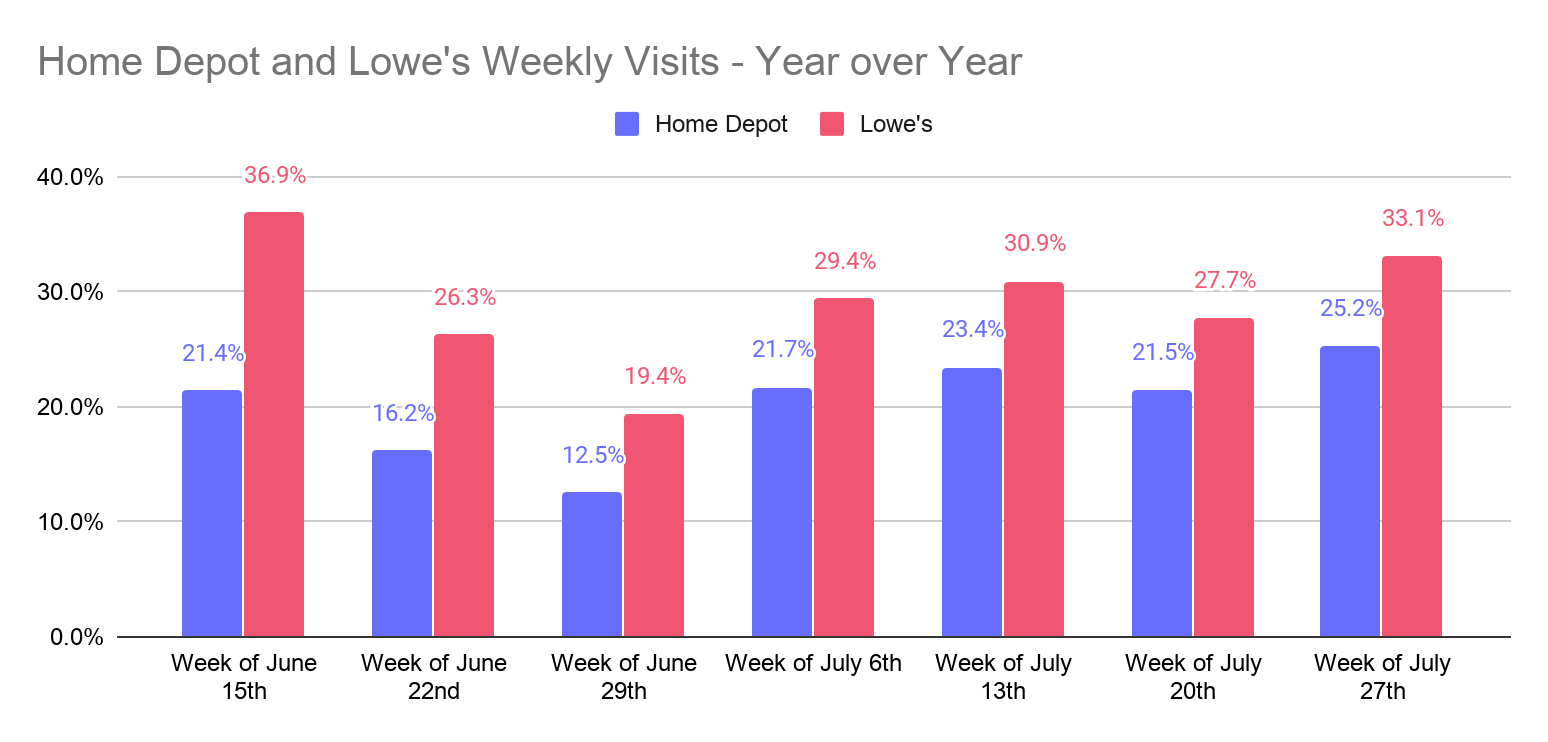

This leaves the major question of whether this is a trend that could last deeper into the summer and fall. Looking at weekly visit rates since mid-June, both brands saw growth rates drop heading into late June but enjoyed a second wave in July that has continued into early August. This indicates that the demand could be longer-term creating a powerful opportunity for both brands. The idea here is that greater levels of focus on the home alongside economic concerns that reduce the desire to buy new create a scenario where upgrades become the most desirable way forward. And the early August returns were especially strong with visits on August 1st and 2nd rising 25.5% and 35.4% respectively for Home Depot and 34.3% and 38.2% for Lowe’s year over year for those dates.

Conclusion

The wider home improvement sector is enjoying a uniquely powerful surge of consumer demand, but the larger question is whether the trend will continue. Thus far, weekly data from July and daily insights from early August are showing that the growth for brands like Home Depot and Lowe’s could sustain deep into the summer. Should this be the case, both brands could potentially enjoy exceptional growth.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.