Retail woes show no sign of stopping, particularly for the US. Joining chains like JC Penny, Brooks Brothers, and Sure La Table in bankruptcy are The Paper Store, Lord & Taylor, and Tailored Brands. Even with positive signs, like the second monthly increase in retail sales, optimism is hard to come by. The news is no better in the UK, with companies like Ben Sherman and Selfridges closing stores or cutting jobs. COVID-19 is still raging in the US, and new restrictions were imposed in the UK as cases begin to rise. Until the pandemic is under control, economists say, the economy can’t return to normal.

Each Month Brings More Deterioration in Credit Quality

US General Retail Firms

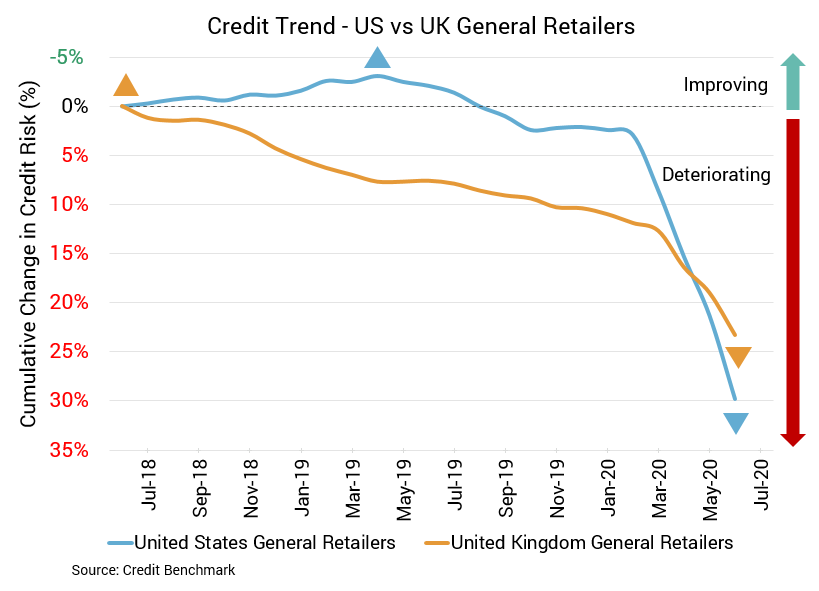

Credit quality for US general retail firms continues to sink and has been getting worse steadily since earlier this year. The latest update shows a drop of 8% from the month prior, 12.5% from two months prior, and 20% from three months prior. But the real inflection point came four months prior; since that point, credit quality has declined by 28.6%. Year-over-year, it’s down 35%. This drop in credit quality is reflected in climbing default risk. Average probability of default is now 54 basis points, compared to 50 basis points the prior month, 48 basis point two months prior, 45 basis points three months prior, and 42 basis points four months prior. At the same point last year, average probability of default was 40 basis points. Approximately 78% of firms this aggregate with a CBC rating are at bbb or lower with the most recent update, and the overall CBC rating for this aggregate is bb+.

UK General Retail Firms

Starting from a worse credit position than their US counterparts, UK general retail firms have also seen their credit quality declining – down by 4% from the prior month, 5% from two months prior, and 10% from three months prior. Year-over-year, credit quality is down 14.9%. Average probability of default for this sector is now 77 basis points, an increase from 74 basis points in the prior month, 73 basis points two months prior, and 70 basis points three months prior. At the same point last year, average probability of default was 67 basis points. As of the most recent update, about 92% of firms this aggregate with a CBC rating are at bbb or lower. The overall CBC rating for this aggregate is bb+.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.