There are few industries that have experienced more change in our pandemic world than healthcare. Since COVID concerns came to light, there has been no shortage of news stories about everything from scandals at the nation’s largest hospitals to AI’s role in reinventing the industry. Meanwhile, preventive and routine care were paused early in the pandemic, with Americans forced to skip physicals and screenings this spring, and many doctors only seeing emergency cases. Even as clinics open for issues not directly tied to COVID, people largely remain wary of seeking out care that is not immediately essential.

Given this deluge of information and disruption of “normal” operations, we wanted to know what the data says about labor demand. We dove into our job listings to see what they suggest about current conditions in the healthcare industry, as well as the road ahead. We examined the SOC/ONET codes related to healthcare to get a sense of what labor demand has looked like since the beginning of the year.

Healthcare Support Occupations

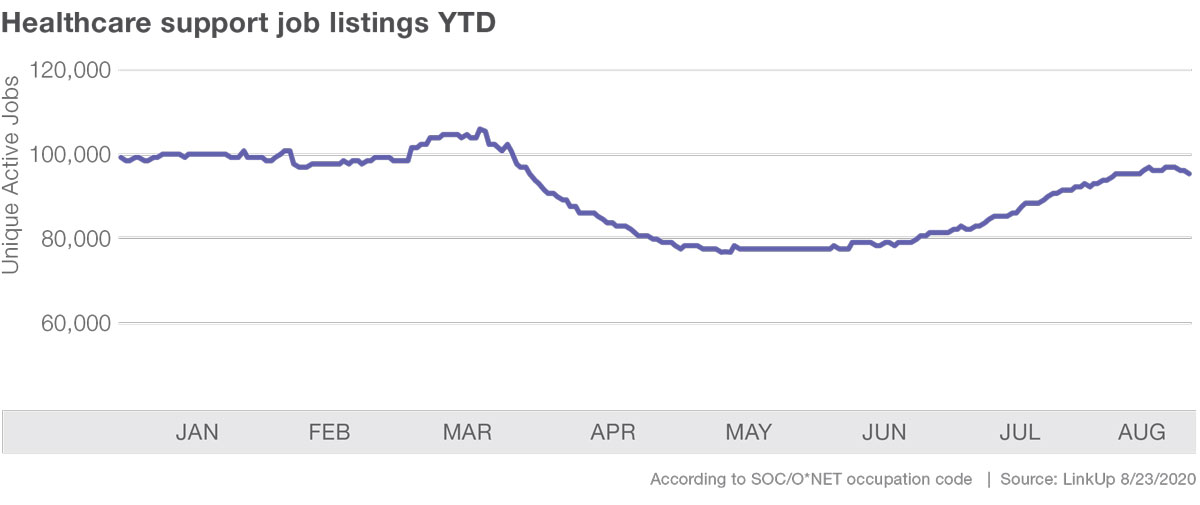

We see that healthcare support occupations are nearly back to January levels (down just -4% between January 1st and August 23rd), but still down -10% from the peak in mid-March. Job listings have increased 23% since their lowest point, which came in mid-May.

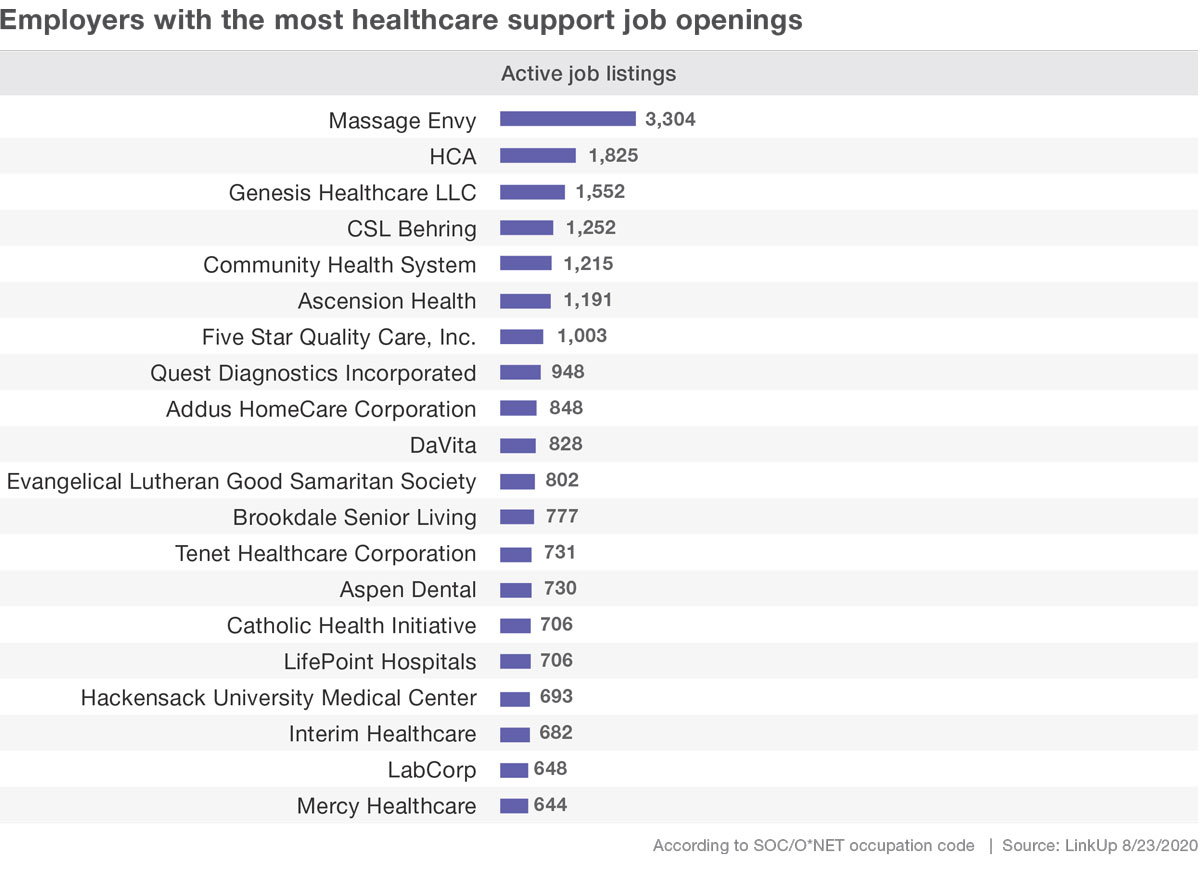

Looking at active job listings for healthcare support employers, we see Massage Envy at the top with 3,304 current job listings. This is perhaps a nod to the tensions of life in a pandemic, or the aches and pains induced by working from home in less-than-ergonomically correct conditions. We also see more traditional healthcare support employers high on the list with HCA in the number two slot, and Genesis healthcare following.

Practitioner and Technician Occupations

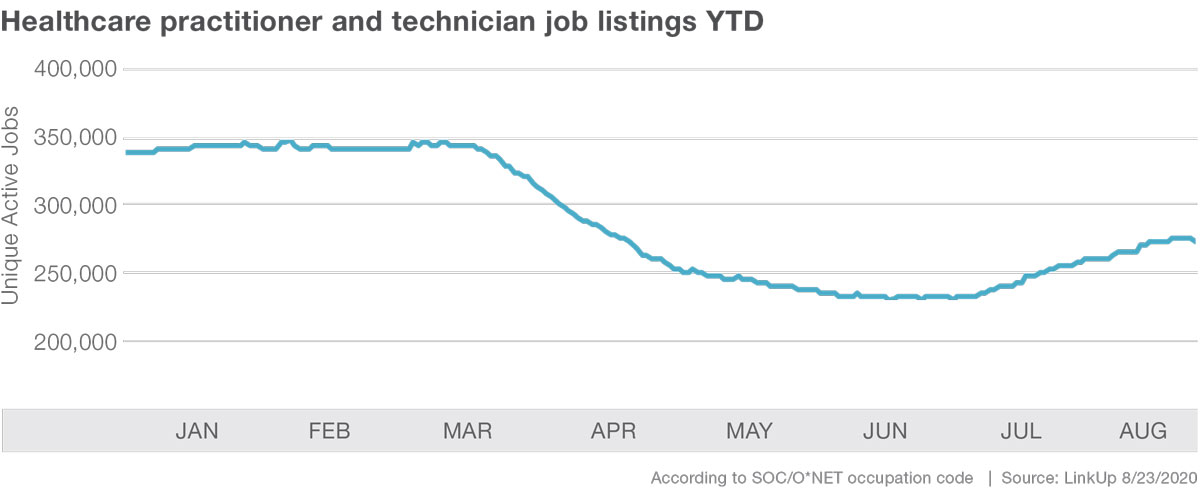

The picture for healthcare practitioners and technicians, on the other hand, is a bit less inspiring. New jobs created for these occupations continue to trail early 2020 levels; down 20% since January 1st. Though these occupations trail healthcare support in their recovery, we do observe some upward momentum with new jobs created up 18% since their July 1st low.

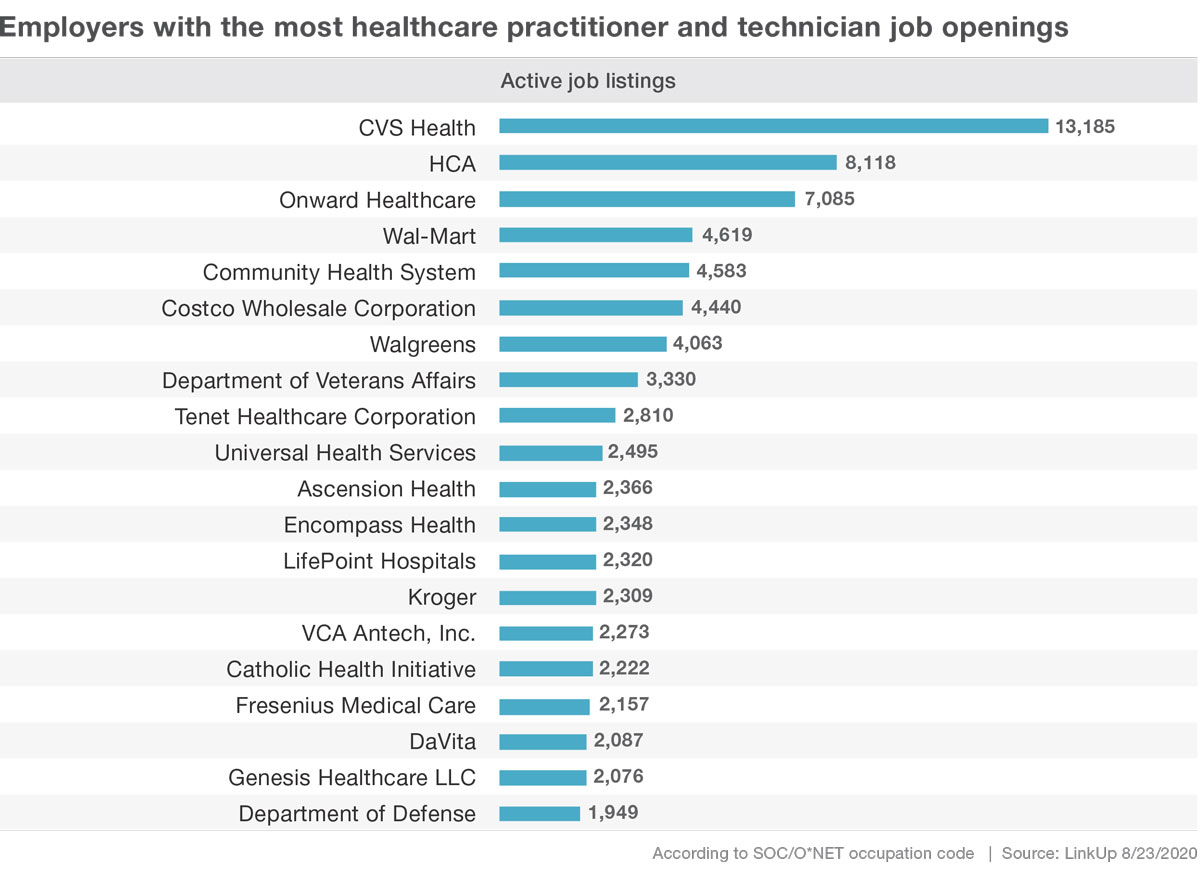

CVS, who has made news with their staffing efforts ahead of the impending flu season, leads practitioner and technician hiring. HCA and Onward also appear at the top of the list. We are seeing increased demand for healthcare practitioners and technicians at businesses like Walmart, Costco and Kroger, that offer pharmacy or health services but are not solely dedicated to healthcare.

Overall, we are observing some upward momentum in healthcare labor demand with occupations reaching or approaching their pre-pandemic levels. Though healthcare in 2020, understandably, is a bit of a moving target. We will continue to monitor our data for industry trends and notable shifts as COVID continues.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.