McKinsey, in a recent article “Meet the next-normal consumer” noted that companies will need data to increase their investment in insights to stay ahead of change and as critical to helping shape a positive future.

In fact, in times of unprecedented change leveraging data and analytics to create insights to changing consumer behaviors can fuel successful corporate strategies.

Covid has had a sudden impact on where consumers allocate their spend as well as how they buy. Robust alternative data can tell a story of consumer behavior that can provide brands and retailers with the information to stay ahead of what promises to be ongoing change for the foreseeable future.

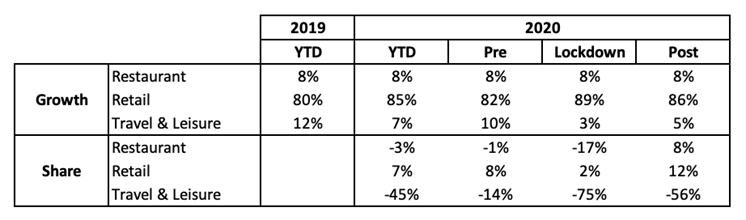

Covid has changed how consumers allocate their share of wallet spend:

When we look at how Covid impacted the share of consumer spend, it drove a sudden shift from Travel and leisure spending into retail spending, which includes grocery. While Travel and Leisure went from 7% to 3% of share of consumer spend during the lockdown, the share of spend dedicated to Restaurants held flat, helped by a move to online ordering which grew by 95% YOY coupled with pickup and delivery. As you would expect during the lockdown Retail spend was aided by online ordering which grew 77% YOY.

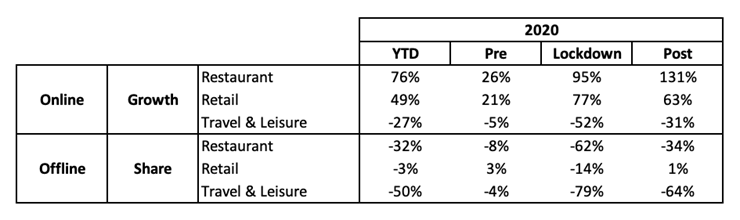

Online buying has accelerated but will the trend persist?

With many retailers shuttered during the lockdown online spend in Restaurant and Retail spiked but with more and more establishments opening up will consumers still favor buying online? At a high level early indicators show the trend continuing for Restaurants where consumers continue to adopt a pre-Covid trend of growth in food delivery. And in retail overall while we clearly see that more consumers are returning to buying in store.

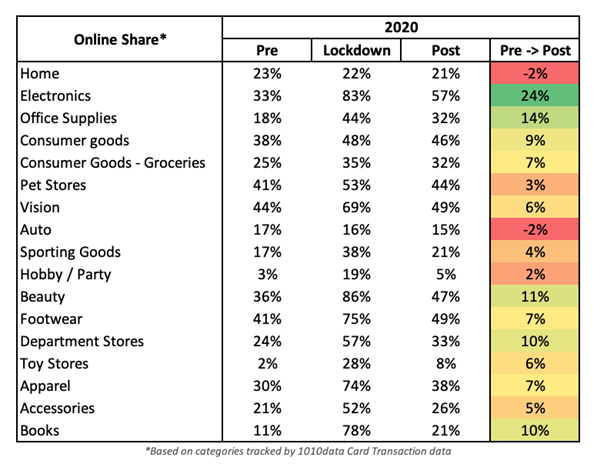

While a high level view is useful, decisions need to be made with more detailed information. Almost every category meaningfully increased online penetration during the coronavirus, but not all. Home improvement stores stayed open during the pandemic, so they actually didn’t have a meaningful increase in online spend.

Consumer goods have given back almost none of the online penetration gained during the crisis. Electronics’ online penetration has increased alongside office supplies, beauty, and book stores- interesting that these are categories Amazon should be dominating. While these tend to be a very small share versus Amazon, the growth does show that some of the retailers associated in these spaces likely have some benefits either in brand name, assortment, price, or stock.

Although in store buying levels are starting to recover, indicators are that Covid has accelerated the adoption of buying online. For brands and retailers this clearly increases their need to understand changing preferences and implement next generation eCommerce strategies including fulfillment options including picking up at store.

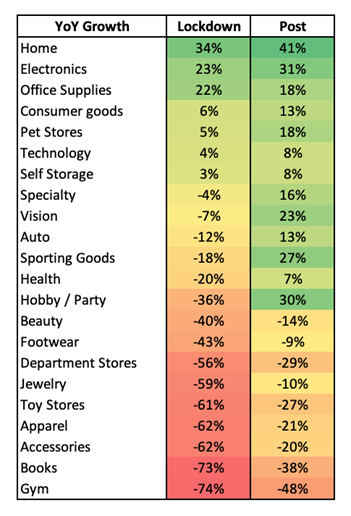

A closer look at Retail, dynamic changes continue:

So while there was a shift in the consumer wallet to retail, taking a closer look, retailers didn’t win across the board. The areas that grew during the lockdown involved the same themes- setting up to work from home and consumer staples. They have also been amongst the biggest winners after the height of the crisis.

The losers were also the same- discretionary spend where in-store spend was the focus. However a few of the losers have bounced back; hobby stores and sporting goods are now among the fastest growing industries. The growth here could point to a meaningful restructure of leisure time.

In fact Covid is redefining consumer preferences within many categories. Taking a look at some of the fastest growing items tells a story of continued change. The move toward virtual education has fueled the sale of educational products, like interactive white boards which have grown over 400% YOY. Doing more at home has not only resulted in growth of home improvement projects and cooking but in areas like Arts and Crafts where for example sewing tools have grown over 450% YOY. Added changes to the way we live and work have also shifted consumer demand in areas like beauty where “above the mask” products like eye shadow have grown significantly.

So while the “next-normal” consumer is still emerging, best practices in use of alternative data combined with retail analytics can provide a view of changing consumer behaviors from the macro trends impacting channel and fulfillment strategies down to the category preferences needed drive product assortment and supply chain decisions.

To learn more about the data behind this article and what 1010 data has to offer, please reach out to Andy Burrow at andy.burrow@1010data.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.