Source: https://www.placer.ai/blog/should-nike-own-offline-department-store-comeback-and-walmarts-key-asset/

In the last few weeks, there has been an endless amount of fascinating retail narratives, but there were three that really caught our attention. Nike was shutting down more of its wholesale accounts, department stores got headlines for less than positive reasons, and Walmart crushed earnings by making more out of less.

So what can location analytics reveal about these three issues?

Nike Owns Offline

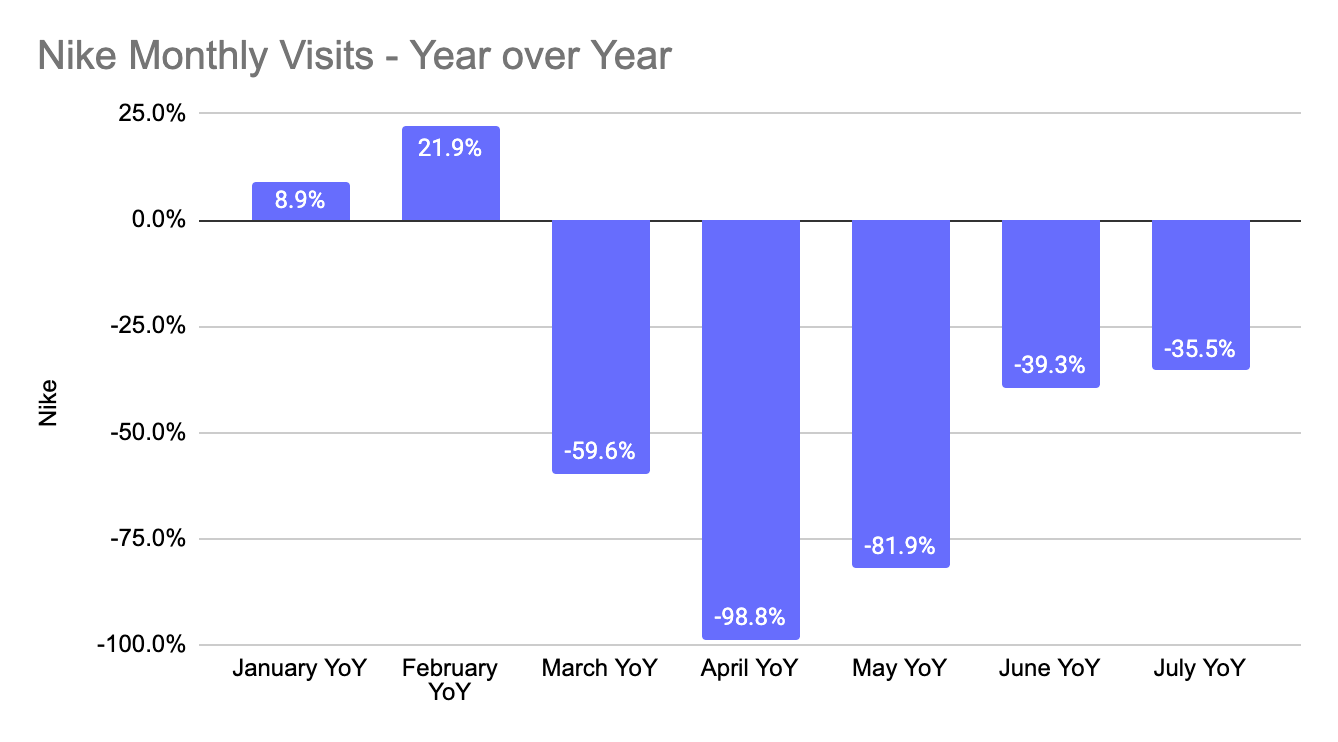

Nike’s move to own its offline presence is something we’ve been discussing since late 2019, and it didn’t stop making sense since then. The brand is among the most innovative in the way it approaches its in store experience and that perspective went a long way in driving visits in 2019 that were 10.1% higher than 2018. And 2020 kicked off in much the same manner, with visits up 8.9% and 21.9% year over year in January and February respectively.

Yes, the pandemic did hurt visits. Since bottoming out in April, visits were still down 35.5% in July. But the numbers are returning, and even more, Nike is showing the presence of mind to keep a steady course even amidst a massive short term change. As competition thins out, this is the type of focus and forward thinking that could set the retailer up for even greater success in years to come.

Department Store Silver Linings

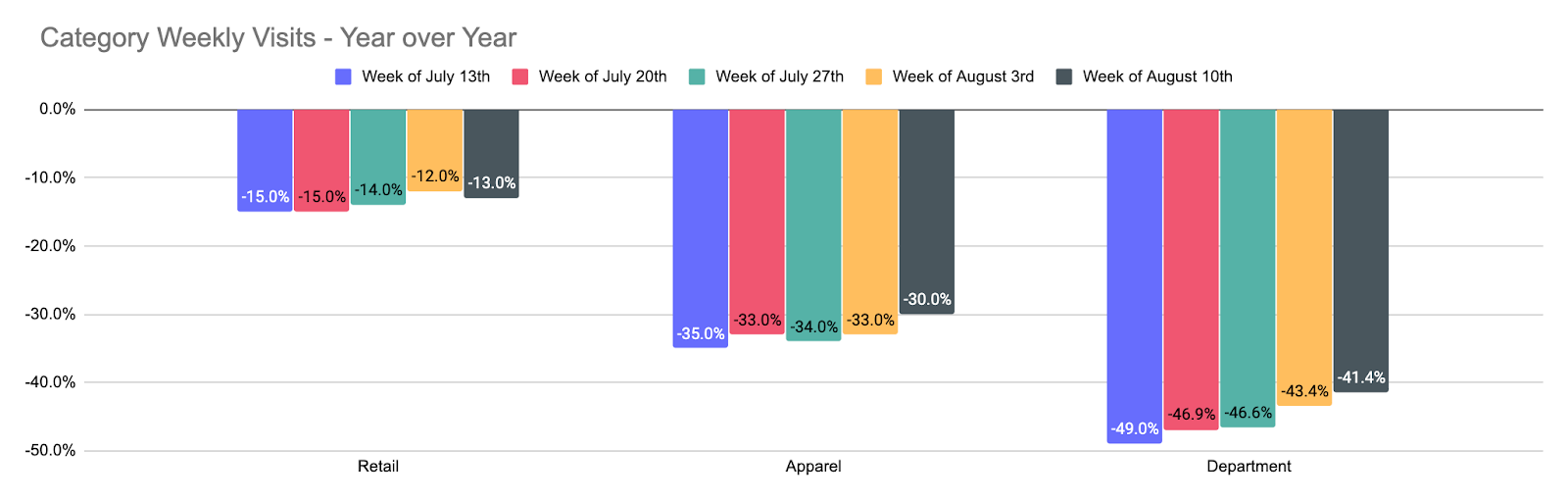

Negative narratives around department stores and their struggles to keep up with the times are certainly legitimate and carry very fair criticisms. However, it is possible that the “easy target” they present also obscures their strength. Department stores were hit especially hard in the pandemic, and while their recovery lags behind the wider retail and apparel sectors, they are indeed recovering.

And an opportunity could be presenting itself. The value of the department store lies in bringing together a large variety of items and brands under one roof, that also critically have a brand of their own. So, while there are brands that are struggling, the overall weakness presents an opportunity for other variations of this concept to succeed. Whether it be a Neighborhood Goods model that emphasizes DTC brands, a Kohl’s style approach that focuses its attention to outdoor centers or even a revival for some of the traditional brands as they optimize their retail footprint – a future for the space is clearly there.

Walmart’s Key Asset?

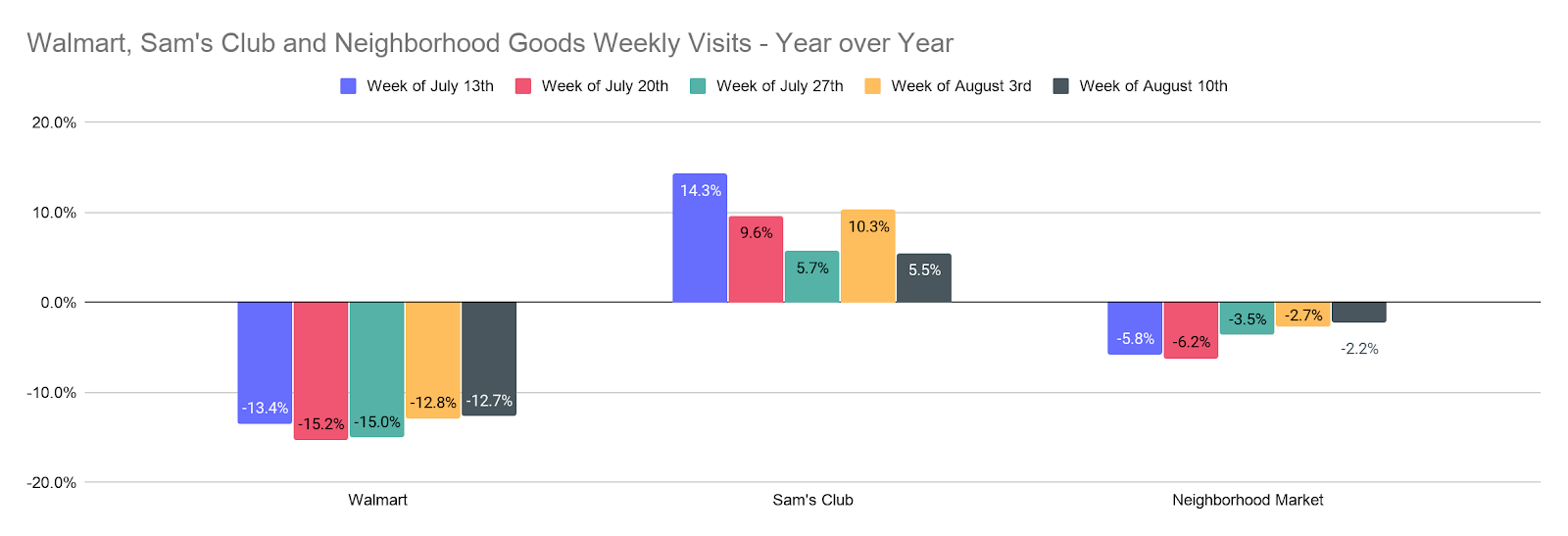

When Walmart announced that transactions dropped 14% while average basket size increased 27%, many were shocked. Yet, the increase in mission driven shopping, something that drove an increase of 4.5% in visit duration to Walmart Supercenters in August year over year, had been in the data for months. As was the decline in overall transactions, where visits were actually down just under 11% in May, June and July compared to the same three months in 2019.

But the really interesting element comes into play if this trend continues. Sam’s Club has seen ongoing growth even during the pandemic with monthly visits up an average of 5.4% year over year through the first seven months of 2020. And while Neighborhood Goods stores are seeing year-over-year visit declines, much of that is being driven by a large number of closures in 2019 making its latest weekly data all the more impressive. While weekly visits were down 8.9% the week beginning June 29th, they were down just 2.2% the week of August 10th.

So, if Walmart can maintain this new trend of maximized basket size, the returns for the brand could be huge. And this says nothing of key initiatives like its pushes into health and pharmacy or more digitally harmonized options. But, even if patterns return to normal, it’s clear that Walmart’s visits will return as well. The only takeaway – Walmart’s strength is so unique that it is able to adapt to almost any circumstance.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.