It was hardly the golden age for department stores before the rise of COVID-19, but the pandemic raised significant questions regarding the future of these stores. So we took a look at two of the most popular department stores across four different states, Kohl’s and Macy’s, to see how both of their nationwide and state recoveries were going.

Regional Impacts

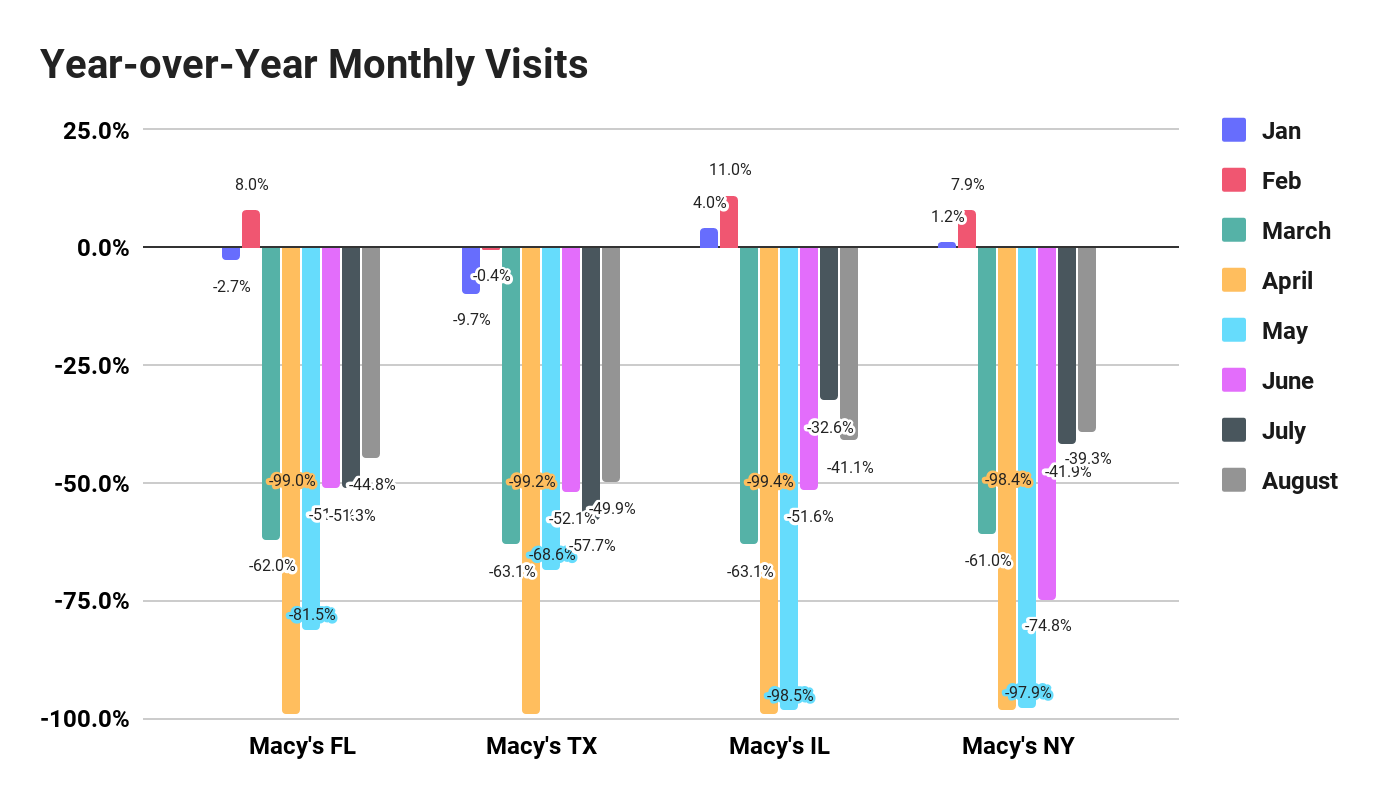

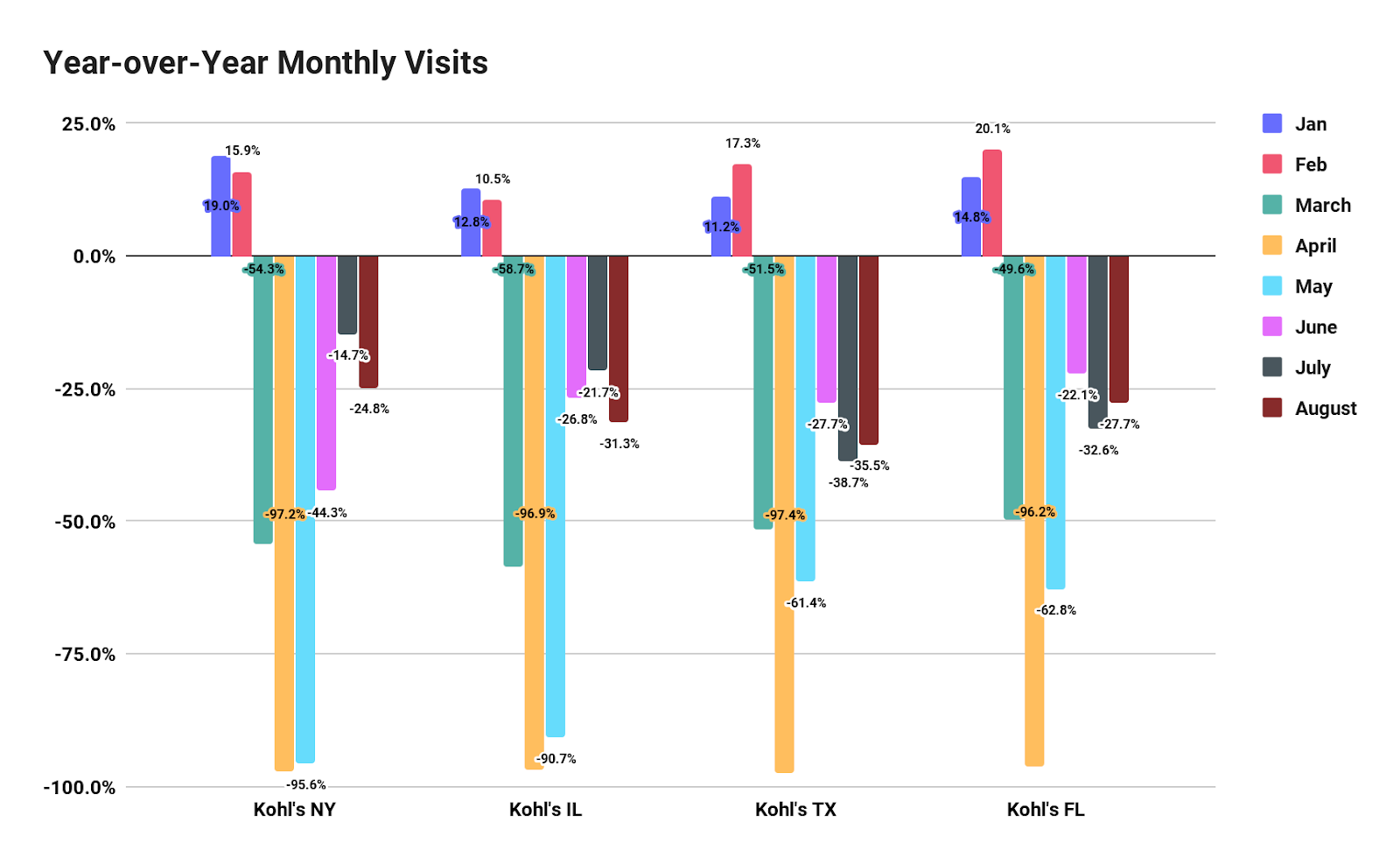

As we look at performance across different states, we do see an overall trend of recovery – though local jumps in COVID cases did hurt growth in those regions.

When looking at Texas, Florida and New York specifically, Macy’s locations generated visits that were closest to 2019 levels in July and August – the best they’ve been since February, pre-COVID. Macy’s NY locations saw visits that were 39.3% down, while Texas and Florida saw traffic that was 49.9% and 44.8% down, respectively in August. And these numbers are especially impressive considering the jump in cases both Texas and Florida saw in July.

The recovery for Kohl’s has been even more impressive even though traffic for most states fell further away from 2019 levels for the month of August, which was largely due to the comparison to 2019’s stellar back-to-school season. For example, Kohl’s locations in NY drew visits during July that were just 14.7% down from 2019, but that declined to 24.8% down in August.

Visits for Florida seem to be recovering the quickest, as traffic for all locations was just 22.7% down year over year in August after a difficult July when COVID cases returned en masse in Florida.

Weekly Recovery

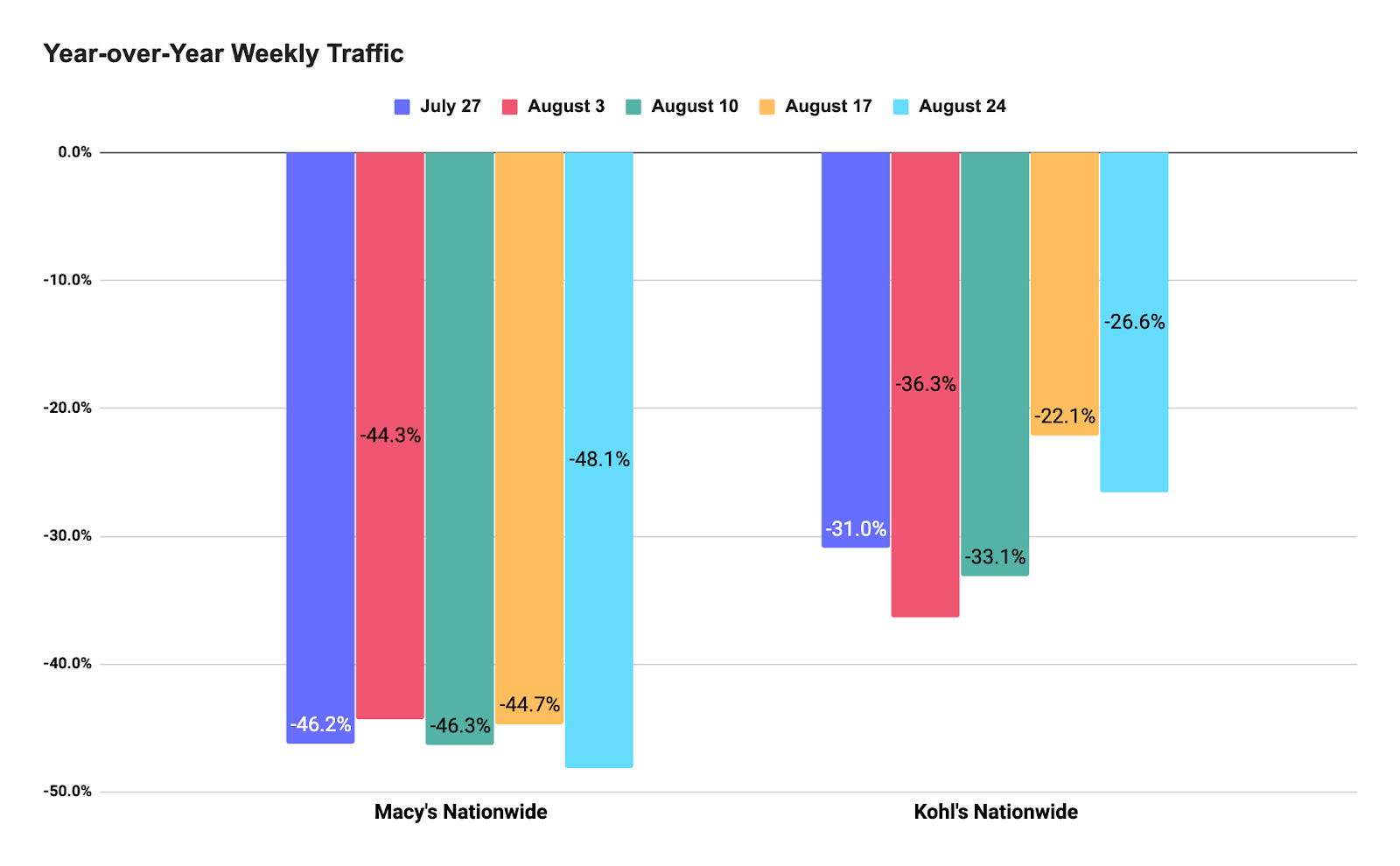

But looking at weekly visit rates year over year does draw a clear distinction between the performance of both brands. While Kohl’s is seeing a steady rate of growth each week towards 2019 levels, Macy’s has had a more mixed performance. Interestingly, with Macy’s announcing the testing of multiple outdoor center formats, the brand could be looking to replicate some of Kohl’s approaches. The outdoor orientation does look to be helping Kohl’s which saw nationwide traffic down just 26.6% for the week of August 24th.

It’s obvious that geographic location of retailers certainly affects the overall retail recovery, but even the states with a large number of COVID cases are recovering quickly – a clear and positive indication. Nonetheless, it is equally clear that department stores were hit especially hard in the pandemic, and while their recovery lags behind the wider retail and apparel sectors, they are indeed recovering. While the traditional “department store” concept might be losing some of its appeal, these stores have a unique position to rebrand and evolve into the future.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.